What Should You Look for in a Reliable Currency Trading Broker?

Currency trading, or Forex trading, is one of the most popular and lucrative investment opportunities available today. However, it’s also one of the most complex, demanding, and risky financial markets. As a result, selecting the right currency trading broker is crucial to your success. A reliable broker is not just an intermediary; they are your partner in navigating the Forex market. In this article, we will explore the key factors you need to consider when choosing a currency trading broker and why they matter.

Key Takeaways

- Always prioritize brokers with reputable regulatory bodies to ensure security and fair practices.

- The trading platform should be intuitive, fast, and mobile-friendly.

- Compare spreads, commissions, and leverage options before committing to a broker.

- Ensure the broker offers sufficient educational resources and research tools.

- Customer support is vital for resolving issues and ensuring smooth trading experiences.

Regulation and Licensing

One of the first things you need to look for in a currency trading broker is whether they are regulated by a reputable financial authority. Regulatory bodies are responsible for enforcing strict standards of conduct for brokers to ensure fairness, transparency, and security for their clients.

Why Regulation Matters

A regulated broker must adhere to high standards, such as holding client funds in segregated accounts, providing transparent pricing, and offering fair leverage levels. These measures are designed to protect traders from fraud, market manipulation, and unethical practices.

Some of the top global regulatory bodies include:

- U.S. Commodity Futures Trading Commission (CFTC)

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

How to Verify Regulation

Always verify a broker’s regulatory status by checking the website of the regulatory body they claim to be registered with. Reputable brokers typically display their licensing details on their websites for easy access.

Trading Platform and Technology

The trading platform is the software used to execute trades, monitor price movements, and analyze the Forex market. It’s essential to choose a broker that offers a reliable, user-friendly, and feature-rich trading platform.

Popular Trading Platforms

- MetaTrader 4 (MT4): The most widely used platform among retail traders. It offers advanced charting tools, automated trading capabilities, and a large community of traders.

- MetaTrader 5 (MT5): A newer version with more timeframes, improved charting, and additional asset classes.

- cTrader: Known for its intuitive design, fast execution, and advanced charting tools.

Mobile Trading

In today’s fast-paced world, mobile trading is a must. A good broker should offer a mobile app that mirrors the functionality of their desktop platform so that you can trade from anywhere at any time.

Execution Speed

The broker’s technology should ensure fast order execution, especially if you’re involved in short-term trading strategies. Delays in order execution can result in slippage and losses.

Fees and Spreads

Trading costs directly affect your profitability in the Forex market. Currency trading brokers charge fees in the form of spreads (the difference between the buy and sell prices) and commissions. Understanding these costs is essential to determine whether a broker is offering competitive pricing.

Spreads vs. Commissions

- Spreads: These are the most common way brokers make money. The tighter the spread, the less you will pay to trade.

- Commissions: Some brokers charge a commission on each trade in addition to the spread. While this may seem like an added cost, it can be beneficial if the spreads are tight.

Other Costs

Look for hidden costs such as overnight financing (swap rates) and withdrawal fees. Understanding the full scope of fees can help you calculate your real trading costs and avoid surprises.

Leverage Options

Leverage allows traders to control a larger position than the amount of capital they have. While it can amplify gains, it can also increase the risk of significant losses. The amount of leverage a broker offers is crucial in determining how much risk you are willing to take on.

Leverage Regulation

Regulations often dictate the maximum leverage a broker can offer to protect retail traders. For instance, in the European Union, the maximum leverage is 30:1 for Forex pairs. U.S. brokers may offer leverage up to 50:1 for Forex.

Choosing the Right Leverage

Traders should select a broker that offers appropriate leverage based on their risk tolerance and trading strategy. Using excessive leverage can quickly lead to significant losses.

Customer Service and Support

In the world of currency trading, problems can arise at any time of day or night. That’s why responsive and professional customer support is essential.

24/7 Availability

Since the Forex market operates 24 hours a day, five days a week, a reliable broker should offer customer support during these hours. Ensure they provide multiple channels of communication, including live chat, phone support, and email.

Multilingual Support

If you’re not fluent in English, look for brokers that provide customer service in your native language. This will ensure that you can understand their policies and resolve any issues effectively.

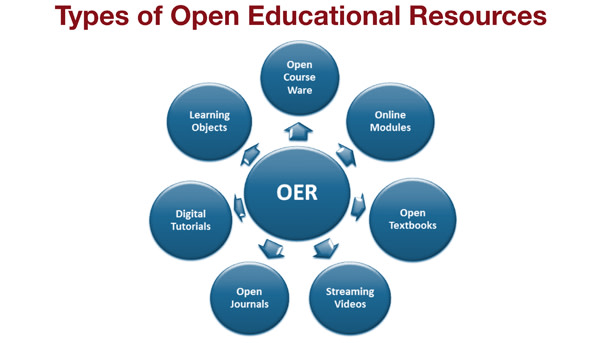

Educational Resources

A broker’s educational resources can be a great asset to both novice and experienced traders. Good brokers provide educational tools, webinars, tutorials, and market analysis that can help you improve your trading skills.

Types of Educational Resources

- Video Tutorials

- Trading Guides

- Webinars

- Market News and Analysis

Having access to these resources will allow you to stay updated with market trends and learn new strategies, increasing your chances of success in Forex trading.

Account Types and Deposit Requirements

| Account Type | Description | Minimum Deposit Requirement | Leverage | Target Audience | Other Features |

|---|---|---|---|---|---|

| Standard Account | This is the most common account type, offering competitive spreads and leverage options. | $100 – $500 | 1:50 to 1:500 | Suitable for both beginners and experienced traders | Offers access to major currency pairs, standard spreads, and no commission-based trading. |

| Micro Account | A low-entry account designed for new traders or those who want to trade smaller volumes. | $1 – $50 | 1:50 to 1:500 | Ideal for beginners and traders with low risk tolerance | Lower lot sizes, smaller pip movements, and limited leverage. |

| Mini Account | Designed for intermediate traders, this account type allows for slightly larger positions than micro accounts. | $50 – $250 | 1:50 to 1:500 | Suitable for traders who want more control than micro accounts | Offers flexible leverage and lower minimum position sizes than standard accounts. |

| VIP or Premium Account | A high-tier account designed for professional traders or those who trade large volumes. | $5,000 – $50,000 | 1:50 to 1:500 | Professional traders with high capital for larger trades | Access to advanced trading tools, tighter spreads, and VIP customer support. |

| Islamic Account | An account that complies with Sharia law, offering no swaps or interest on positions. | $100 – $500 | 1:50 to 1:500 | Traders who follow Islamic principles in trading | Offers swap-free trading, with adjusted spreads or commissions. |

| Cent Account | An account designed for low-risk trading and beginners, where traders can trade in cents rather than dollars. | $1 – $10 | 1:50 to 1:500 | Beginner traders looking for a low-risk entry point | Allows trading in cent lots, making it perfect for practicing without risking much capital. |

| Demo Account | A risk-free account for practice trading with virtual funds before going live. | Free (Virtual Funds) | N/A | Beginners looking to practice or experienced traders testing strategies | No real money involved, ideal for testing strategies and learning the platform. |

Different brokers offer different types of trading accounts, with varying deposit requirements, leverage options, and access to features. When choosing a broker, it’s important to select one that offers an account type suitable for your trading style and financial situation.

Types of Accounts

- Standard Accounts: These are the most common and usually require a lower minimum deposit.

- ECN Accounts: These accounts provide direct access to the market and typically have lower spreads but may charge a commission.

- VIP Accounts: These are premium accounts with higher deposit requirements and often come with benefits like lower spreads, priority customer service, and advanced trading tools.

Deposit and Withdrawal Methods

Look for brokers that offer a variety of deposit and withdrawal options, such as bank transfers, credit cards, and e-wallets. It’s essential to consider withdrawal processing times and any fees associated with withdrawals.

Reputation and Reviews

Before signing up with a currency trading broker, take time to research their reputation and read reviews from other traders. Check reputable online forums, social media channels, and review websites for real feedback from actual users.

Red Flags to Watch Out For

- Negative reviews about withdrawal delays

- Complaints of poor customer support

- Unregulated brokers or those with a history of scams

Choosing a broker with a strong reputation is critical for your success in the Forex market.

User Experience

Look for platforms that provide ease of use, reliability, and fast order execution. Slow or clunky platforms can negatively impact your trading experience, especially in a market as fast-paced as Forex. It’s also worth checking if the platform supports advanced features such as automated trading (via Expert Advisors on MT4/MT5), algorithmic trading, and robust charting tools.

Fees and Spreads

Another critical factor to consider is the cost of trading. Currency trading brokers charge fees in the form of spreads (the difference between the buy and sell price) or commissions. The fee structure can significantly impact your profitability, especially if you’re an active trader or plan to make numerous trades each day.

Spreads

Spreads are the most common cost structure in Forex trading. A lower spread means less cost to enter and exit a trade. However, be cautious of brokers offering extremely tight spreads, as this may indicate hidden fees or other trade restrictions. The average spread on major currency pairs like EUR/USD typically ranges between 1 to 2 pips (points in percentage).

Commission-Based Brokers

Some brokers charge a commission instead of (or in addition to) spreads. The commission is usually based on the size of the trade. This model is often preferred by more experienced traders who value transparency and are trading larger volumes.

Swap Fees

Another often-overlooked fee is the overnight swap or rollover fee, which is charged when you hold positions overnight. This fee varies based on the interest rate differential between the two currencies in the pair you’re trading.

Account Maintenance Fees

Some brokers charge account maintenance fees, inactivity fees, or withdrawal fees. These charges can add up, so it’s essential to be aware of them when comparing brokers.

Leverage and Margin Requirements

Leverage allows you to control a large position in the market with a relatively small amount of capital. However, while leverage can amplify profits, it also increases the potential for losses.

What is Leverage?

Leverage is typically expressed as a ratio, such as 100:1 or 500:1, meaning that for every $1 you have in your trading account, you can control $100 or $500 worth of currency.

Choosing the Right Leverage

Choosing the right leverage depends on your trading strategy, risk tolerance, and experience level. A reliable broker will offer various leverage options to suit different types of traders. While higher leverage can lead to higher potential returns, it also exposes you to greater risk.

It’s important to note that regulators often impose limits on leverage. For instance, in the European Union, the maximum leverage allowed for retail traders is 30:1 on major currency pairs. Always check your broker’s leverage options and understand how they affect your potential risk and reward.

5. Customer Support and Service

The quality of customer support is an often-overlooked factor when choosing a currency trading broker. A reliable broker should offer responsive, helpful customer support that can address any concerns or issues you encounter during trading.

What to Expect from Good Customer Support

- Availability: 24/7 support is essential in Forex trading, given the market operates 24 hours a day, five days a week.

- Multilingual Support: If you’re trading from a non-English-speaking region, look for brokers that offer customer service in your preferred language.

- Multiple Contact Methods: A good broker should offer various ways to get in touch, including live chat, email, phone, and social media.

- Quick Response Time: The Forex market is fast-paced, and your issues need to be resolved quickly, so look for brokers with a reputation for fast and efficient support.

6. Deposit and Withdrawal Methods

The ease of depositing and withdrawing funds from your trading account is a critical factor in choosing a reliable broker. Ensure the broker offers convenient and secure payment methods, such as credit/debit cards, bank transfers, and e-wallets like PayPal, Skrill, or Neteller.

Withdrawal Process

Be sure to read the broker’s terms and conditions regarding withdrawals. Some brokers have lengthy processing times or charge high withdrawal fees. Also, watch out for brokers who place unnecessary restrictions on withdrawals, which can be a red flag.

Deposit Fees

Most brokers offer free deposits, but some may charge fees for certain methods. Check whether there are fees associated with your chosen deposit method and whether the broker allows multiple deposit options to suit your needs.

7. Range of Currency Pairs and Other Assets

Forex traders often trade a variety of currency pairs, including major, minor, and exotic pairs. A good currency trading broker should offer a broad selection of currency pairs to give you ample opportunities for diversification.

Major Currency Pairs

The major currency pairs include EUR/USD, GBP/USD, USD/JPY, and AUD/USD. These pairs generally have the lowest spreads and the highest liquidity, making them the most favorable for most traders.

Exotic Pairs

Exotic currency pairs involve one major currency and one currency from an emerging or developing economy (e.g., USD/TRY, EUR/ZAR). While these pairs can offer high volatility and potentially higher returns, they also come with higher spreads and less liquidity.

Other Asset Classes

Some brokers also allow traders to diversify by offering commodities, indices, or even cryptocurrencies. This can be an advantage if you’re looking to trade in multiple markets from a single account.

8. Education and Research Tools

A reliable broker should also offer education and research resources to help you improve your trading skills and stay informed about the market. Good brokers provide access to:

- Webinars and Tutorials: These can help beginners learn the basics and advanced traders to refine their skills.

- Market Analysis: Regular updates and analysis of market trends, news, and currency pairs.

- Economic Calendar: A tool to keep track of upcoming economic events and their potential impact on the Forex market.

A broker with comprehensive educational resources can help you avoid costly mistakes and improve your overall trading strategy.

Also Read:- Are Low-Spread Forex Brokers Really Worth It?

Conclusion

Choosing a reliable currency trading broker is crucial to your success in the Forex market. A trustworthy broker offers strong regulatory oversight, competitive fees, user-friendly platforms, and robust customer support. Be sure to research and evaluate different brokers based on the factors discussed in this article, and don’t rush the decision-making process. A well-chosen broker can provide you with the tools, resources, and security you need to succeed in Forex trading.

FAQs

1. What is the best regulation to look for in a Forex broker?

Look for brokers regulated by reputable bodies like the FCA (UK), CFTC (US), ASIC (Australia), or CySEC (Cyprus). These regulators enforce strict standards to protect traders.

2. How much leverage should I use in Forex trading?

Leverage should be used cautiously. As a beginner, it’s wise to start with lower leverage, such as 30:1 or 50:1. Higher leverage increases both potential profits and risks.

3. What is the difference between ECN and Market Maker brokers?

ECN brokers connect traders directly to the market, offering raw spreads and transparency. Market Maker brokers set their own prices, which can be advantageous for beginners but may carry a risk of price manipulation.

4. Are Forex brokers’ fees the same everywhere?

No, fees and spreads vary from broker to broker. It’s important to compare costs before choosing a broker, especially if you plan to trade frequently.

5. Can I trade Forex on my phone?

Yes, most brokers offer mobile trading apps for iOS and Android that mirror the functionality of their desktop platforms.

6. How do I know if a Forex broker is trustworthy?

Check for regulatory licenses, read user reviews, and ensure the broker offers a secure trading platform with transparent pricing and solid customer support.

7. Can I start trading Forex with a small amount of capital?

Yes, many brokers offer micro or cent accounts that allow you to trade with as little as $1. However, your ability to make substantial profits will be limited with a small deposit.