What Are Alternative Investments And How Can They Diversify Your Portfolio?

In the world of finance, investment strategies are crucial for building wealth and securing financial stability. Traditional investment vehicles such as stocks, bonds, and savings accounts have long been the go-to options for most investors. However, there’s a growing shift toward alternative investments, which can offer greater diversification and the potential for higher returns. In this article, we will explore what alternative investments are, why they are important, and how they can diversify your portfolio.

Key Takeaways:

- Alternative investments include assets like real estate, commodities, hedge funds, and private equity that offer diversification beyond stocks and bonds.

- They provide high return potential but come with risks such as illiquidity, complexity, and high fees.

- Alternative investments can help reduce overall portfolio volatility and hedge against inflation.

- Investors should carefully consider their financial goals, risk tolerance, and time horizon before incorporating alternatives into their portfolios.

What Are Alternative Investments?

Alternative investments are assets that do not fall into the traditional categories of stocks, bonds, or cash. These investments typically offer the potential for higher returns but come with higher risk and may be less liquid than traditional investments. Alternative investments include a wide range of asset types, including real estate, commodities, hedge funds, private equity, venture capital, and even collectibles like art and wine.

Examples of Alternative Investments:

- Real Estate: This could involve direct investment in properties or through Real Estate Investment Trusts (REITs), which allow you to invest in real estate portfolios without owning the physical properties.

- Commodities: Commodities like gold, silver, oil, and agricultural products are considered alternative assets. They often serve as a hedge against inflation and are viewed as stores of value during economic uncertainty.

- Private Equity: This involves investing in private companies that are not publicly listed. Investors can provide funding for startups, buy out established companies, or invest in other private ventures.

- Hedge Funds: Hedge funds pool capital from accredited investors to make a variety of investments, often using advanced strategies like leverage, short-selling, and derivatives.

- Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and others have become popular alternative investments, though they are highly volatile and speculative.

- Collectibles: This category includes tangible items like art, rare wine, vintage cars, and even sports memorabilia. These items can appreciate over time but are also illiquid and require specialized knowledge.

- Peer-to-Peer Lending: P2P lending allows investors to lend money to individuals or businesses online, often providing higher returns compared to traditional savings accounts or bonds.

Why Consider Alternative Investments?

- Diversification: The most significant advantage of adding alternative investments to a portfolio is the ability to diversify. Since these assets often don’t move in sync with traditional stocks or bonds, they can provide stability when stock markets are volatile.

- Potential for Higher Returns: While higher risk is inherent in most alternative investments, they also come with the potential for higher returns, especially in areas like private equity, venture capital, and commodities.

- Hedge Against Inflation: Physical assets like real estate and commodities tend to maintain their value, or even appreciate, in times of inflation, making them an effective hedge against rising prices.

- Low Correlation with Traditional Markets

Key Characteristics of Alternative Investments:

- Non-Traditional: Unlike stocks or bonds, alternative investments are not listed on public exchanges, and they often require a more hands-on approach.

- Illiquidity: Many alternative investments have limited liquidity, meaning they can’t be easily converted to cash.

- High Risk and Reward: They tend to come with higher risks, but they also offer the possibility of higher returns.

- Diversification: Alternative investments can help diversify your portfolio, reducing the overall risk by including assets that do not move in tandem with traditional investments.

Types of Alternative Investments

There is a wide variety of alternative investments that investors can explore. Below are some of the most popular ones:

1. Real Estate

Real estate is one of the oldest and most trusted forms of alternative investment. Investors can choose to buy physical properties or invest through real estate investment trusts (REITs), which allow them to pool money for collective investment in real estate assets.

- Physical Real Estate: Directly purchasing residential or commercial properties to earn rental income or sell for profit.

- Real Estate Investment Trusts (REITs): Publicly traded companies that own, operate, or finance real estate that generates income.

2. Commodities

Commodities include natural resources such as oil, gold, silver, and agricultural products. These assets are often used to hedge against inflation and economic uncertainty.

- Precious Metals: Gold and silver are among the most popular commodities used in alternative investing.

- Energy: Oil, natural gas, and other energy resources can provide high returns, especially when the global demand shifts.

3. Private Equity

Private equity involves investing directly in companies that are not publicly traded. These investments usually involve purchasing a stake in a company and helping it grow before exiting the investment through a sale or IPO.

- Venture Capital: A form of private equity focused on funding startups and small businesses with high growth potential.

- Buyouts: Private equity firms often purchase established companies to restructure and improve their profitability.

4. Hedge Funds

Hedge funds pool money from investors to make a wide range of investments, typically aiming to provide high returns through complex strategies such as short selling, leverage, and derivatives trading.

- Strategy Variety: Hedge funds can employ diverse strategies including global macroeconomic trading, arbitrage, and long/short equity.

- High Fees: Hedge funds usually come with high management fees and performance fees.

5. Cryptocurrency

Cryptocurrencies like Bitcoin, Ethereum, and other digital currencies are a relatively new and volatile alternative investment. Despite their high volatility, cryptocurrencies have gained traction as a potential store of value and a hedge against traditional asset market fluctuations.

6. Collectibles

Investing in tangible goods like art, wine, rare coins, and even luxury items such as watches or cars can also be considered alternative investments. While these items may appreciate over time, they require expertise and often come with high transaction costs.

7. Peer-to-Peer Lending

P2P lending platforms allow individuals to lend money to others in exchange for interest payments. These platforms often cater to both personal loans and business loans and offer a potential for higher returns compared to traditional savings accounts or bonds.

How Can Alternative Investments Diversify Your Portfolio?

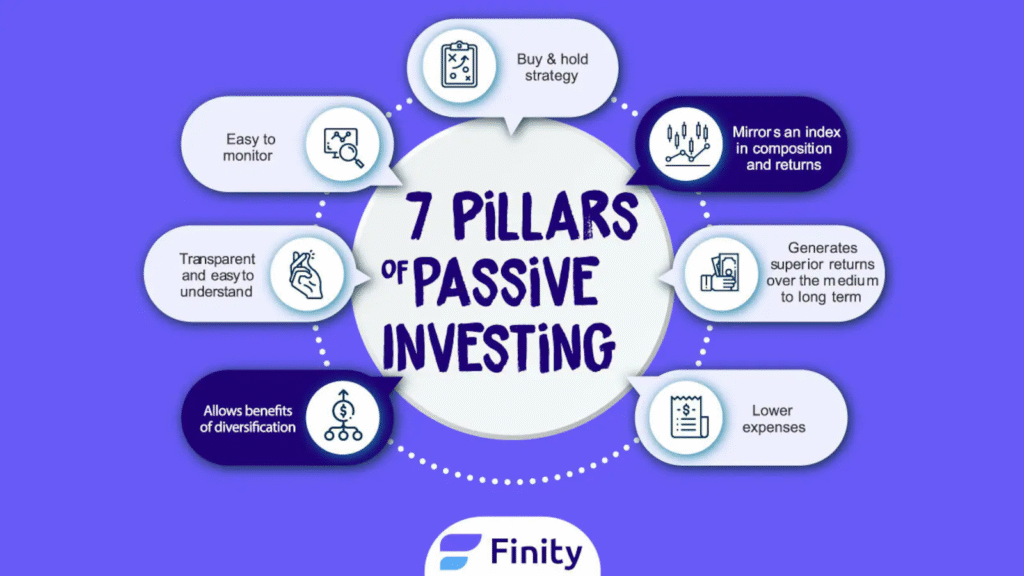

One of the key benefits of alternative investments is their ability to diversify an investment portfolio. Traditional investments like stocks and bonds are often correlated, meaning they tend to move in similar directions based on economic events. However, alternative investments usually behave differently, offering a way to protect and grow your wealth even when the stock market is underperforming.

1. Non-Correlation with Traditional Markets

Because alternative investments don’t always move in line with stock and bond markets, they can help reduce the overall risk in a portfolio. For instance, when the stock market is down, real estate or commodities might be performing better, helping offset losses from traditional assets.

2. Reducing Overall Volatility

Alternative investments can help smooth out volatility. While some alternative assets, like cryptocurrencies, can be quite volatile, others, such as private equity or real estate, can provide steady returns with less fluctuation than stocks or bonds.

3. Hedge Against Inflation

Inflation refers to the rise in the general price level of goods and services over time, eroding the purchasing power of money. As inflation increases, the value of money decreases, meaning it takes more money to buy the same goods or services. To protect against the negative effects of inflation, many investors turn to various hedge against inflation strategies, where certain assets or investment approaches are used to preserve or grow wealth in times of rising prices.

In this article, we’ll explore what it means to hedge against inflation, why it’s important, and some of the common strategies and assets that investors use to protect their portfolios.

What Is a Hedge Against Inflation?

A hedge against inflation refers to an investment or strategy that helps to preserve or increase the purchasing power of money during times of rising inflation. The goal of inflation-hedging is to ensure that the returns on investments outpace inflation, allowing investors to maintain or grow their real wealth (i.e., wealth adjusted for inflation).

For example, if inflation is 3% and your investment yields a 5% return, you effectively gain 2% in real purchasing power. On the other hand, if your investment returns only 2%, your real return would be negative, losing value against inflation.

Why Is a Hedge Against Inflation Important?

Inflation can have a significant impact on your financial well-being. As prices rise, your savings or fixed income investments might lose their value in real terms. For example:

- Fixed Income Impact: Bonds and savings accounts with fixed interest rates might provide the same nominal return, but in an inflationary environment, those returns will be worth less in real terms.

- Purchasing Power Erosion: Inflation reduces how much your money can buy, leading to higher living costs.

Therefore, protecting against inflation is crucial for long-term financial health. A proper hedge can help ensure that your investments maintain their value and continue to grow despite rising prices.

Common Inflation-Hedging Assets

There are several types of assets and investment strategies that are commonly used as a hedge against inflation. These assets tend to either rise in value with inflation or provide returns that outpace it.

1. Real Estate

Real estate, especially income-producing properties, is one of the most popular and effective hedges against inflation. The value of real estate often increases as inflation rises, due to higher demand and rising property values. Additionally, rental income from properties tends to rise with inflation, making real estate a strong choice for income generation during inflationary periods.

- Real Estate Investment Trusts (REITs): If you don’t want to buy physical property, REITs provide a way to invest in real estate without the hassle of managing properties directly.

2. Precious Metals (Gold & Silver)

Precious metals like gold and silver have historically been seen as a safe haven during periods of inflation. These assets tend to hold or increase in value as inflation erodes the purchasing power of fiat currencies (like the dollar). Investors often turn to gold as a store of value during uncertain economic times.

- Gold: Known as a traditional inflation hedge, gold tends to perform well during periods of high inflation.

- Silver: While more volatile than gold, silver can also act as a hedge against inflation, and it’s often more accessible for smaller investors.

3. Commodities

Commodities like oil, agricultural products, and natural resources are also considered excellent inflation hedges. These assets often rise in price when inflation is high because the cost of raw materials increases as the value of money declines.

- Oil: Oil prices tend to increase during inflationary periods as energy costs rise.

- Agricultural Commodities: Products like wheat, corn, and livestock often rise in price as inflationary pressures drive up production costs.

4. Inflation-Protected Securities

Government-issued bonds can also be designed to protect investors against inflation. These are called inflation-protected securities, and they adjust their value based on the inflation rate.

- TIPS (Treasury Inflation-Protected Securities): Issued by the U.S. government, TIPS are bonds that adjust their principal value based on the Consumer Price Index (CPI). As inflation rises, the principal value of TIPS increases, and interest payments are adjusted accordingly.

5. Stocks (Equities)

While stocks can be volatile in the short term, many companies have the ability to pass on higher costs to consumers in an inflationary environment. Companies in sectors like consumer goods, healthcare, and utilities often benefit from inflation by raising prices or maintaining demand for their products or services.

- Dividend Stocks: Stocks of companies that pay dividends can be especially attractive during inflationary periods, as they provide income streams that might grow over time.

6. Cryptocurrencies

Cryptocurrencies like Bitcoin have recently emerged as a potential hedge against inflation. Bitcoin, in particular, has a fixed supply, which contrasts with fiat currencies that can be printed at will by central banks. Some investors believe that Bitcoin’s scarcity makes it a store of value in times of inflation.

- Bitcoin: Often referred to as “digital gold,” Bitcoin has gained popularity as an alternative store of value.

- Ethereum: Although more volatile, Ethereum and other cryptocurrencies may provide diversification and hedge benefits for certain investors.

7. Foreign Currency

Investing in foreign currencies can also help hedge against inflation, especially if you’re concerned about your home country’s currency losing value. By holding assets in a currency that is expected to remain stable or appreciate against your domestic currency, you can offset the effects of inflation.

- Foreign Bonds: Bonds issued by foreign governments or corporations can provide exposure to currencies that may be less affected by inflation.

Inflation-Hedging Strategies for Investors

In addition to specific inflation-hedging assets, investors can also consider different strategies to protect their portfolios:

- Diversification: A well-diversified portfolio that includes both traditional and alternative assets like stocks, real estate, and commodities can help mitigate the impact of inflation on your wealth. Diversifying across asset classes and geographic regions ensures that you’re not overly reliant on one type of investment.

- Focus on Growth: Investing in growth stocks or sectors that can raise prices in an inflationary environment, such as technology, consumer staples, and healthcare, can help your portfolio outpace inflation.

- Rebalancing: Rebalancing your portfolio periodically ensures that your inflation-hedging assets remain aligned with your investment goals. As the economic environment changes, rebalancing allows you to adjust your holdings to take advantage of rising or falling inflation expectations.

Risks of Inflation-Hedging

While inflation-hedging assets can protect your wealth, they come with certain risks:

- Volatility: Some inflation-hedging assets, like commodities and cryptocurrencies, can be highly volatile and may not provide consistent returns.

- Liquidity: Certain inflation-hedging assets, like real estate or collectibles, can be less liquid, making it harder to access your money in a pinch.

- Timing: Accurately predicting inflation is challenging. Even assets like gold and real estate may not perform well if inflation doesn’t materialize as expected.

4. Access to High Return Potential

Alternative investments often offer higher return potential than traditional investments, especially in niche markets. For example, venture capital and private equity investments can yield significant profits if the businesses perform well, though they come with higher risk.

Risks Associated with Alternative Investments

While alternative investments offer numerous benefits, they also come with certain risks that investors should be aware of before diving in.

- Liquidity Risk: Many alternative investments, such as real estate or private equity, are illiquid, meaning they cannot be easily sold or converted to cash in the short term.

- Complexity and Knowledge Requirement: Some alternative investments, like hedge funds and private equity, require specialized knowledge to evaluate and invest successfully.

- Higher Fees: Many alternative investment vehicles, such as hedge funds and private equity, charge high management and performance fees that can eat into your returns.

- Regulatory Risk: Alternative investments are often less regulated than traditional investments, which can expose investors to additional risks.

- Market Risk: Certain alternatives, especially commodities and cryptocurrencies, can be volatile and subject to significant price swings.

Also Read :- What Are the Best Investment Opportunities in 2025?

Conclusion

Alternative investments provide a valuable opportunity to diversify a portfolio, reduce risk, and potentially achieve higher returns. By incorporating assets like real estate, private equity, commodities, and even cryptocurrencies, investors can hedge against market downturns and inflation. However, these investments also come with their own set of risks, including illiquidity and high fees, which should be carefully considered.

As with any investment strategy, it’s important to balance alternatives with traditional investments based on your risk tolerance, investment goals, and time horizon. Consultation with a financial advisor can help you make well-informed decisions about integrating alternative investments into your portfolio.

FAQs

1. What is the best alternative investment for beginners?

For beginners, real estate investment trusts (REITs) and commodities like gold are good starting points, as they provide exposure to alternative assets with relatively low complexity and risk.

2. Can alternative investments be a long-term strategy?

Yes, many alternative investments, such as private equity and real estate, are well-suited for long-term growth. However, the time horizon for returns may be longer than traditional investments.

3. Are alternative investments tax-efficient?

The tax efficiency of alternative investments depends on the specific asset. For example, real estate can offer tax benefits through depreciation, while hedge funds may be subject to higher taxes on gains.

4. How do I get started with alternative investments?

To get started, research and consider investing through accessible vehicles such as REITs, P2P lending platforms, or mutual funds focused on alternative assets. It’s also wise to consult with a financial advisor.

5. What percentage of my portfolio should be in alternative investments?

The ideal percentage of alternative investments in your portfolio depends on your risk tolerance and investment goals. A typical allocation might range from 5% to 20%, but it’s best to tailor this based on your personal situation.

6. Are alternative investments liquid?

Most alternative investments are less liquid than stocks or bonds. Some, like real estate and private equity, may require years to realize returns, while others, like hedge funds or collectibles, are also relatively illiquid.

7. What are the risks of alternative investments?

Risks include illiquidity, high fees, lack of regulation, and volatility. It’s essential to fully understand the asset before investing.