Top 10 Best Investment Options In 2025 For Guaranteed Growth

In 2025, achieving financial stability requires smart investing. With economic shifts, rising inflation, and evolving markets, choosing the right investment avenues is more important than ever. Whether you’re a beginner or a seasoned investor, this list highlights the top 10 best investment options in 2025 that offer both safety and strong growth potential.

1. Systematic Investment Plans (SIP) in Mutual Funds

In today’s fast-paced financial environment, Systematic Investment Plans (SIPs) have emerged as one of the most disciplined and effective ways to invest in mutual funds. For individuals seeking long-term wealth creation without the stress of timing the market, SIPs offer a consistent, flexible, and smart investment route.

✅ What is SIP?

A Systematic Investment Plan (SIP) allows an investor to invest a fixed amount in a mutual fund scheme at regular intervals — typically monthly or quarterly. Unlike lump sum investments, SIPs help you average out your purchase cost over time, thanks to a principle known as rupee cost averaging. This strategy makes SIPs particularly appealing during market volatility.

💡 Why Choose SIP in 2025?

In 2025, the financial market is characterized by growing investor participation, digital accessibility, and increased awareness about wealth creation. SIPs align perfectly with the needs of the modern investor:

- Low entry barrier – Start investing with as little as ₹500 per month

- No need to time the market – You invest in both highs and lows, averaging your costs

- Compound growth – SIPs benefit from the power of compounding, helping your wealth multiply steadily

- Digital convenience – Automated investments through apps and platforms make SIPs hassle-free

📈 Types of Mutual Funds for SIP

There are various categories of mutual funds available for SIPs, catering to different risk appetites and goals:

- Equity Mutual Funds – Best for long-term growth, though slightly riskier. Ideal for 5+ year investments.

- Debt Mutual Funds – Suitable for conservative investors, offering stable returns with lower risk.

- Hybrid Funds – A mix of equity and debt, offering a balanced approach.

- ELSS (Equity Linked Savings Scheme) – Offers tax benefits under Section 80C and is ideal for salaried individuals looking to save taxes.

💰 Benefits of SIP Investment

- Disciplined savings: Encourages regular saving habits without lump-sum pressure.

- Flexible investing: You can increase, decrease, pause, or stop your SIP anytime.

- Diversification: Mutual funds diversify across stocks, sectors, and markets, minimizing risks.

- Goal-based planning: SIPs help in achieving specific goals like education, marriage, or retirement.

🔢 Example of SIP Growth (Illustrative)

If you invest ₹5,000 per month in a SIP for 10 years at an average annual return of 12%, your investment will grow to over ₹11.6 lakhs, out of which ₹6 lakhs is your contribution, and the rest is profit through compounding.

| Monthly SIP | Duration | Estimated Return (12%) | Total Value |

|---|---|---|---|

| ₹5,000 | 10 years | ₹11.6 lakhs | ₹6 lakhs invested + ₹5.6 lakhs return |

(Note: Returns are market-linked and not guaranteed.)

📅 Best Time to Start SIP? Now!

The best part of SIP is: you don’t need to wait. The earlier you start, the more time your money gets to grow. SIPs are especially suited for young professionals, salaried employees, and anyone with a steady income.

📲 How to Start SIP in 2025?

Starting a SIP is easier than ever:

- Choose a mutual fund platform (Groww, Zerodha Coin, Paytm Money, etc.)

- Complete your KYC online

- Select a fund based on your risk profile

- Set your SIP amount and date

- Enable auto-debit from your bank account

2. Public Provident Fund (PPF)

The Public Provident Fund (PPF) continues to be one of the most trusted and safest long-term investment options for Indian investors in 2025. Backed by the Government of India, PPF offers a perfect mix of guaranteed returns, tax savings, and capital protection, making it ideal for conservative and risk-averse individuals.

🏦 What is PPF?

PPF is a long-term savings scheme introduced by the Indian government to promote regular savings among citizens. It comes with a 15-year lock-in period and earns a fixed interest rate that is reviewed quarterly by the Ministry of Finance. As of early 2025, the PPF interest rate stands at approximately 7.1% per annum (compounded annually).

📋 Key Features of PPF

- Tenure: 15 years (extendable in 5-year blocks after maturity)

- Minimum Investment: ₹500 per year

- Maximum Investment: ₹1.5 lakh per financial year

- Tax Benefits: Tax deduction under Section 80C, and interest + maturity amount are tax-free

- Interest: Compounded annually and credited on March 31 every year

🔐 Safety and Stability

PPF is a sovereign-backed investment, meaning your money is as safe as a government deposit. Unlike market-linked investments such as mutual funds or equities, PPF offers guaranteed returns without any market risks. It’s especially suitable for individuals looking to create a secure retirement corpus or save for their children’s future.

💡 Benefits of Investing in PPF

- Triple Tax Exemption (EEE Status)

PPF falls under the Exempt-Exempt-Exempt category:- Contribution qualifies for deduction under Section 80C (up to ₹1.5 lakh)

- Interest earned is tax-free

- Maturity proceeds are tax-free

- Compound Growth

The annual compounding of interest ensures your savings grow faster, especially if you start early and remain consistent. - Loan and Withdrawal Facility

- You can take a loan against PPF from the 3rd to the 6th financial year.

- Partial withdrawals are allowed from the 7th financial year onwards, subject to conditions.

- Ideal for Long-Term Goals

Planning for retirement, children’s education, or marriage? PPF is an excellent tool for goal-based investing with peace of mind.

🧮 Example of PPF Returns

If you invest ₹1.5 lakh per year for 15 years at an interest rate of 7.1%, your total investment of ₹22.5 lakhs can grow to approximately ₹40.7 lakhs on maturity — completely tax-free!

| Year | Annual Investment | Total Corpus (Approx.) |

|---|---|---|

| 15 | ₹1.5 lakh | ₹40.7 lakhs |

(Note: Returns are based on current interest rates and may change.)

📝 Who Should Invest in PPF?

- Salaried professionals looking for tax-saving options

- Self-employed individuals seeking secure long-term investments

- Parents building an education or marriage fund for their children

- Retirees wanting a low-risk interest-bearing option

🛠️ How to Open a PPF Account?

PPF accounts can be opened easily at:

- Public/private banks (SBI, HDFC, ICICI, etc.)

- India Post Offices

- Online banking portals (for existing account holders)

You’ll need basic documents like:

- PAN Card

- Aadhaar Card

- Passport-size photo

- Bank passbook or cheque

📌 Tips for Maximizing PPF Benefits

- Invest early in the financial year (preferably in April) to maximize yearly compounding.

- Invest the full ₹1.5 lakh if possible, to gain full tax benefits and higher returns.

- Use PPF as a foundation for your retirement portfolio along with EPF/NPS.

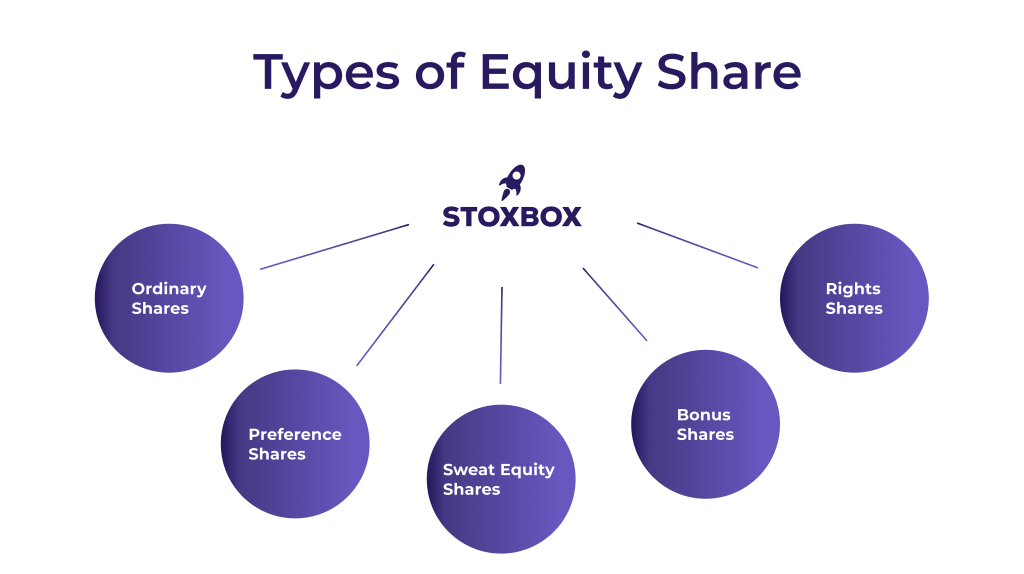

3. Stocks and Equity Shares

For high-risk appetite investors, the stock market offers unmatched growth. With the rise of digital trading apps, investing in top-performing Indian stocks has become easier and more accessible in 2025.

Why invest?

- Potential for high returns

- Dividend income + capital appreciation

- Great for long-term wealth building

📊 What Are Equity Shares?

Equity shares, or stocks, are units of ownership in a publicly listed company. When you buy shares of a company, you become a part-owner (shareholder) and are entitled to:

- A share in the company’s profits (dividends)

- Voting rights (in some cases)

- Capital appreciation (when stock prices rise)

Stocks are traded on recognized stock exchanges like NSE (National Stock Exchange) and BSE (Bombay Stock Exchange).

📈 Benefits of Investing in Stocks

- High Growth Potential

Equities have historically beaten inflation and delivered superior returns over long-term periods. - Liquidity

Stocks are highly liquid — you can buy/sell them easily during trading hours. - Dividend Income

Many companies share their profits with shareholders in the form of dividends. - Ownership and Transparency

As a shareholder, you have voting rights and access to public financial reports. - Wide Choice of Sectors

You can invest in banks, tech, pharma, energy, FMCG, and other high-growth sectors.

4. Real Estate

🏡 What is Real Estate Investment?

Real estate investment involves purchasing physical property—residential, commercial, or land—with the objective of earning income or achieving capital appreciation over time. There are also indirect ways to invest in real estate, such as Real Estate Investment Trusts (REITs), which are becoming increasingly popular in India.

🏙️ Types of Real Estate Investments

- Residential Property

- Apartments, villas, and houses bought for resale or rental income.

- High demand in urban and semi-urban areas due to population growth.

- Commercial Property

- Office spaces, retail shops, and warehouses.

- Generally more expensive but offer higher rental yields than residential units.

- Land or Plots

- Undeveloped land in growing areas can offer high appreciation over time.

- REITs (Real Estate Investment Trusts)

- Suitable for small investors.

- Offers dividend income and liquidity through stock exchanges.

💰 Why Invest in Real Estate in 2025?

The Indian real estate market is showing strong signs of revival post-pandemic. Government reforms, improved infrastructure, and increased urbanization are contributing to steady growth in both residential and commercial sectors. Key reasons to invest now include:

- Appreciation potential in tier 1 and tier 2 cities

- Stable rental income from residential/commercial properties

- Government incentives like PMAY (Pradhan Mantri Awas Yojana), RERA compliance, and GST benefits

- Rise of REITs providing easier access to real estate with small capital

📈 Benefits of Real Estate Investment

- Tangible Asset

Unlike stocks or mutual funds, real estate is a physical asset that you can see and manage. - Rental Income

A properly located property can generate monthly rental income, offering financial stability. - Value Appreciation

Over the long term, property prices tend to increase, especially in growing localities. - Tax Advantages

- Tax deductions on home loan interest under Section 24

- Deductions on principal repayment under Section 80C

- Depreciation benefits for commercial properties

- Hedge Against Inflation

Property values and rent typically rise with inflation, preserving your purchasing power.

⚠️ Risks and Considerations

- High Entry Cost: Requires significant capital for purchase, registration, and maintenance.

- Low Liquidity: Unlike stocks or mutual funds, it may take weeks or months to sell property.

- Market Fluctuations: Prices can stagnate or fall based on location, demand, or economic conditions.

- Legal and Regulatory Issues: Must ensure proper documentation, approvals, and RERA compliance.

5. Fixed Deposits (FDs)

Despite newer investment tools, fixed deposits are still relevant in 2025, especially for low-risk investors. Many banks offer interest rates up to 7.5% per annum, and FDs are now more flexible with online management.

💰 What is a Fixed Deposit?

A Fixed Deposit is a financial instrument provided by banks and non-banking financial companies (NBFCs) where you can invest a lump sum of money for a fixed tenure at a predetermined interest rate. At the end of the tenure, you receive your original investment along with the accrued interest.

FDs offer guaranteed returns, unaffected by market fluctuations, making them an ideal investment for short- to medium-term financial goals.

Why invest?

- Stable, guaranteed returns

- Short to medium-term horizon

- Low risk and easy liquidity

✅ Benefits of Investing in Fixed Deposits

- Guaranteed Returns

The interest rate is fixed at the time of investment, ensuring predictable earnings. - Capital Safety

FDs are among the safest investment options, especially when placed with government-backed or reputed banks. - Flexible Tenures

You can choose tenures ranging from 7 days to 10 years depending on your financial needs. - Loan Facility

Many banks allow you to take a loan or overdraft against your FD, up to 90% of its value. - Senior Citizen Advantage

Senior citizens get additional interest rates and are eligible for tax-saving FDs under specific schemes. - Tax-Saving Options

5-year tax-saving FDs qualify for deduction under Section 80C (up to ₹1.5 lakh annually).

6. National Pension Scheme (NPS)

NPS is perfect for long-term retirement planning. It offers both equity and debt exposure, and allows you to build a sizable retirement corpus with tax benefits under 80CCD.

🧾 What is NPS?

The National Pension Scheme is a voluntary, defined-contribution retirement savings plan regulated by the Pension Fund Regulatory and Development Authority (PFRDA). Under NPS, subscribers invest regularly in a mix of equity, corporate debt, government bonds, and alternative assets, based on the selected asset allocation.

At retirement (age 60), investors can withdraw up to 60% of the corpus tax-free, while 40% must be used to buy an annuity to receive a regular monthly pension.

Why invest?

- Low management charges

- Partial tax exemption at maturity

- Annuity + lump sum payout options

📈 Key Features of NPS

- Low management cost (around 0.01% annually)

- Flexible asset allocation: Equity (up to 75%), Corporate Bonds, Government Securities

- Choice of fund managers (HDFC, SBI, LIC, ICICI, UTI, etc.)

- Auto and Active investment choices to suit risk appetite

- Online account access through NSDL or Karvy

7. Gold Investments (Digital & Physical)

Gold has always been a hedge against inflation. In 2025, digital gold, sovereign gold bonds (SGBs), and gold ETFs are gaining popularity for being secure and easy to trade.

🏅 What is Gold Investment?

Gold investment refers to the process of purchasing gold in various forms, such as coins, bars, jewelry, digital gold, or through Gold ETFs (Exchange-Traded Funds), to generate profits either from capital appreciation or by earning income from gold-backed financial products.

Gold is widely viewed as a tangible asset with long-term value, historically retaining purchasing power even during times of economic uncertainty.

Why invest?

- Hedge against market volatility

- SGBs offer interest + gold price appreciation

- Liquidity through digital platforms

8. REITs (Real Estate Investment Trusts)

REITs are a great alternative to buying property directly. They let you invest in commercial real estate and earn dividends.

Why invest?

- Low capital requirement

- Regular income through dividends

- Exposure to real estate without ownership hassles

📈 Types of REITs

- Equity REITs:

- These REITs own and operate income-generating real estate, such as office buildings, shopping malls, and residential complexes.

- Investors benefit from the rental income and property value appreciation.

- Mortgage REITs (mREITs):

- These REITs invest in real estate mortgages or mortgage-backed securities (MBS).

- mREITs make money by earning the difference between the cost of borrowing and the interest they receive from the mortgages they hold.

- Hybrid REITs:

- A combination of both equity and mortgage REITs, offering investors exposure to both real estate properties and mortgage assets.

- Public Non-Listed REITs:

- These are REITs that are registered with the SEC but are not traded on stock exchanges.

- They can provide a higher yield but are less liquid than publicly traded REITs.

9. Cryptocurrency (With Caution)

Crypto assets are still volatile, but regulated platforms and stablecoins have made them more appealing in 2025. While not for everyone, some investors allocate a small part of their portfolio to crypto for diversification.

💡 What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (such as the dollar or euro), cryptocurrencies operate on blockchain technology, which is a decentralized and distributed ledger across a network of computers. This means cryptocurrencies are not controlled by any central authority, such as a government or bank, making them resistant to inflation and government interference.

The most well-known cryptocurrencies include:

- Bitcoin (BTC): The first and most valuable cryptocurrency, often considered a store of value.

- Ethereum (ETH): A platform that allows developers to build decentralized applications and execute smart contracts.

- Binance Coin (BNB), Ripple (XRP), Cardano (ADA), and many other altcoins have gained significant attention in the market.

Why invest?

- High growth potential

- Decentralized and global

- Suitable for tech-savvy investors

🧮 The Risks of Cryptocurrency Investment

While the rewards of cryptocurrency investment can be high, the risks are equally significant. It’s crucial to approach these investments with caution and awareness of the dangers involved.

- Volatility: Cryptocurrency prices are highly volatile. A 10–20% price swing in a single day is not uncommon. For example, Bitcoin’s price can go from $40,000 to $30,000 in a matter of hours and back up again, which can be disorienting for unprepared investors. While the potential for large returns exists, this volatility can also lead to substantial losses.

- Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies. Countries like China have imposed strict bans on crypto trading, while others, like the United States and India, are working on creating frameworks for taxation and regulation. Regulatory changes can affect cryptocurrency prices and availability, potentially leading to market crashes.

- Security Risks: Cryptocurrency investments are only as secure as the storage methods you choose. Hacks and fraudulent schemes are common in the crypto world. For example, exchanges like Mt. Gox have been hacked in the past, resulting in millions of dollars in losses. Investing in hardware wallets (cold storage) rather than leaving coins on exchanges (hot wallets) can minimize risk.

- Lack of Consumer Protections: Unlike traditional investments like stocks or bonds, cryptocurrencies lack the regulatory oversight that protects consumers. If you lose access to your crypto wallet, for instance, there is often no way to recover your funds. Additionally, fraudulent schemes like Ponzi schemes and pump-and-dump scams are prevalent in the crypto market.

- Market Manipulation: The crypto market, particularly in smaller altcoins, can be susceptible to market manipulation by large holders (often referred to as “whales”). A large investor can manipulate the market by buying or selling massive amounts of a specific cryptocurrency, which can artificially inflate or deflate its price.

10. ULIPs (Unit Linked Insurance Plans)

ULIPs offer the dual benefit of investment + life insurance. They are best suited for long-term investors looking for both protection and wealth creation.

Why invest?

- Tax-free returns under Section 10(10D)

- Life cover included

- Flexible fund switching

💡 What is a ULIP?

A Unit Linked Insurance Plan (ULIP) is a product offered by life insurance companies, where the policyholder pays a premium, and the money is then invested in various market-linked instruments (like equity, debt, or hybrid funds) based on the policyholder’s risk tolerance and investment preferences. A portion of the premium is allocated to life insurance coverage, while the remainder is invested in units of a selected fund, such as equity or debt funds.

The value of the investment is subject to market performance, and the funds grow or decline in value based on the performance of the underlying assets. This gives the policyholder the potential to build wealth over time while also receiving life cover.

Also Read: What Are the Best Investment Plans for High Returns?

Conclusion

Choosing the right investment in 2025 depends on your risk appetite, time horizon, and financial goals. A balanced portfolio combining fixed returns, market-linked assets, and tax-saving tools can help you achieve guaranteed and sustainable growth. Always research or consult a financial advisor before making investment decisions.