How Can You Get Quick Loan Approval Without Hassle?

Getting a quick loan approval is often crucial for people facing emergencies, unexpected expenses, or those who need funds to seize opportunities. Whether it’s for medical bills, a home renovation, or business growth, knowing how to access quick loan approval without unnecessary delays can relieve a lot of financial stress.

This guide will provide you with a comprehensive approach to securing a loan quickly and without hassle, from understanding loan options to tips that will streamline the approval process. We’ll also discuss the key steps to follow to maximize your chances of fast approval, the most common reasons loans get delayed, and expert insights on handling the process smoothly.

Key Takeaways

- Preparation is key: Ensure all your documents are ready before applying for a loan to speed up the approval process.

- Credit score matters: A good credit score increases your chances of quick approval and better loan terms.

- Opt for online lenders: They provide fast processing times and easy access to loans without long wait times.

- Consider collateralized loans: If you need faster approval, secured loans are a viable option with more favorable terms.

Understanding the Need for Quick Loan Approval

When emergencies arise or opportunities present themselves unexpectedly, many people find themselves needing money fast. That’s where quick loan approval becomes essential. While traditional bank loans can take weeks to process, many online lenders now offer streamlined processes that can have you approved for a loan in as little as an hour.

But before diving into the process, it’s important to understand what “quick loan approval” means and how it differs from regular loan processes. Quick loan approval typically refers to lenders who promise fast responses and disbursements, sometimes within the same day or within a few hours. These loans are often ideal for:

- Emergency expenses (medical bills, urgent repairs, etc.)

- Personal purchases (buying a car, home repairs, etc.)

- Business funding (to cover unexpected business expenses)

- Consolidating debts (quick access to funds to pay off high-interest debts)

The desire for a quick, hassle-free loan approval is clear, but achieving it requires understanding how to optimize your application and choosing the right lender. Below is a breakdown of key actions you can take to increase your chances of getting fast loan approval.

1. Know What Type of Loan You Need

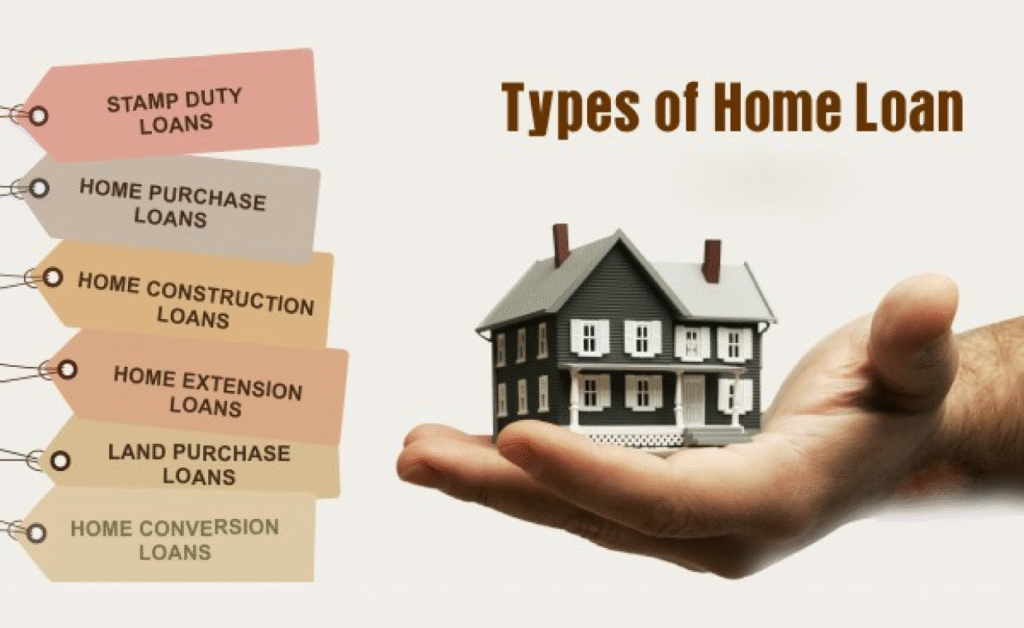

Choosing the right loan type is crucial for ensuring a quick approval process. Lenders typically offer different kinds of loans, each with its approval timelines. Here are the common types:

- Personal Loans: These are unsecured loans, meaning you don’t need to provide collateral. They are often used for debt consolidation, emergency expenses, or significant purchases.

- Payday Loans: Short-term loans for small amounts with quick approval, typically requiring repayment by your next paycheck. These loans often have high-interest rates and fees.

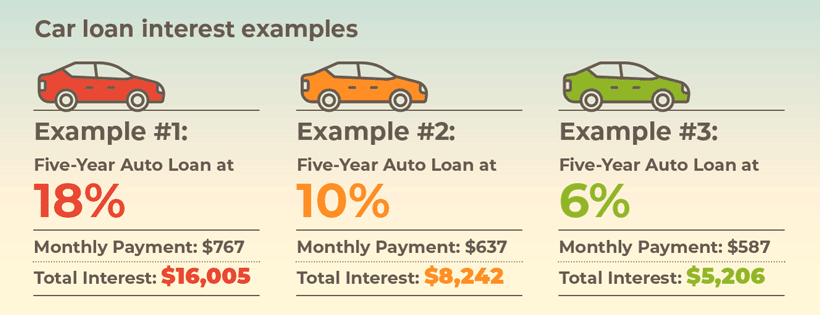

- Car Loans: If you’re buying a car, applying for a car loan could be faster. This loan is secured by the vehicle, making it less risky for lenders.

- Home Equity Loans or Lines of Credit: These loans allow you to borrow against the value of your home, and they usually offer quick approval since your house serves as collateral.

- Business Loans: For entrepreneurs and small business owners, quick approval loans can be used to cover business expenses, from inventory purchases to cash flow gaps.

Tip: Quick loans are typically unsecured personal loans, payday loans, or car loans, so it’s essential to choose the right type for your need. Personal loans from online lenders tend to be the fastest.

2. Check Your Credit Score Before Applying

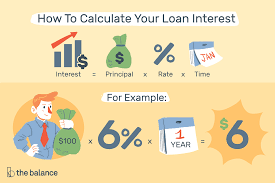

Your credit score is one of the primary factors that lenders use to determine whether or not they’ll approve your loan application. A higher credit score typically results in quicker approval and lower interest rates. However, if your score is on the lower end, you may face delays in getting approved.

Here’s how different credit score ranges typically affect loan approval:

- Excellent Credit (750 and above): Chances of quick approval are very high, and you’ll likely receive the best loan terms.

- Good Credit (700-749): You’re still likely to get approved quickly, though the loan terms might not be as favorable as with excellent credit.

- Fair Credit (650-699): Approval times may be slightly longer, and the interest rate could be higher.

- Poor Credit (below 650): Getting approved quickly becomes more difficult. You might need to apply for specialized loans such as payday loans, which can have a higher risk and cost.

Tip: Before applying for a loan, check your credit report to make sure there are no errors that might negatively impact your score. If your score is low, consider applying for loans designed for bad credit, but be aware of their higher interest rates.

3. Choose the Right Lender for Speed

Not all lenders are designed for fast approval. If you want a quick loan approval, selecting the right lender is essential. Traditional banks, for example, often have lengthy approval processes and may take weeks to respond to your application.

Here’s how different types of lenders compare:

- Online Lenders: These are often the fastest when it comes to loan approval. Many online lending platforms (such as SoFi, LendingClub, or Upstart) have streamlined, digital applications that provide quick responses—sometimes within minutes of submission.

- Credit Unions: While they may offer competitive rates, credit unions are typically slower than online lenders. However, they may be a good choice if you have a long-standing relationship with them.

- Peer-to-Peer (P2P) Lenders: These lenders connect borrowers to individual investors and often offer fast approval times, but the process may not be as automated as that of online lenders.

- Traditional Banks: Banks tend to have the slowest approval times, but some have digital applications that can speed up the process.

Tip: Opt for online lenders that specialize in quick approvals. They typically offer 24/7 access, faster processing times, and automated systems that expedite approval.

4. Gather Required Documents Ahead of Time

One of the main reasons loan applications get delayed is the lack of required documentation. To ensure quick loan approval, make sure you have all the necessary documents ready before you apply. Here’s a checklist:

- Identification: Proof of identity such as a passport, driver’s license, or state-issued ID.

- Proof of Income: Recent pay stubs, bank statements, or tax returns to verify your income.

- Employment Details: Employer name, position, and salary.

- Proof of Residence: Recent utility bills or lease agreements to show your current address.

- Social Security Number (SSN) or equivalent tax identification number.

Tip: Upload all documents as soon as you apply, especially for online lenders who process everything digitally. This will help prevent delays in the approval process.

5. Apply Online for Speed

Applying online is one of the fastest ways to get approved for a loan. Online lenders generally offer a seamless digital application process that can save you time. Moreover, these platforms tend to offer real-time updates on your application status, and in some cases, you can get approval within minutes.

Tip: Avoid applying in-person, as manual paperwork can lead to delays. Apply through secure online portals to streamline the process.

6. Consider Secured Loans for Faster Approval

If you’re not in a hurry and want to maximize your chances of quick approval, secured loans are a good option. These loans require collateral, such as your house, car, or other valuable assets. Since the lender has something to fall back on in case you default, secured loans tend to have a quicker approval process and more favorable terms.

For example:

- Home Equity Loans: If you own a home and need quick access to funds, a home equity loan can be a great option.

- Car Title Loans: You can use your vehicle as collateral for quick access to funds.

Tip: Though secured loans offer faster approval, ensure that you understand the risks involved—if you default, you could lose your collateral.

7. Apply During Business Hours

While online platforms are available 24/7, applying during business hours may speed up the process. When you apply on weekdays, lenders have a full team available to process your application. On weekends or holidays, processing times may be slower, even for online lenders.

Tip: Apply for your loan between 9 a.m. and 5 p.m. on weekdays to avoid delays in communication and approval.

8. Avoid Common Mistakes That Delay Approval

While there are plenty of ways to speed up the loan process, there are also some common mistakes that people make that can delay approval. Here are the main mistakes to avoid:

1. Incomplete or Inaccurate Application

The first and most common mistake is submitting an incomplete or inaccurate application. Lenders often need detailed information to assess your eligibility. If any part of your application is unclear or missing, it could delay your approval process, requiring you to resubmit documents and potentially slow things down.

Tip: Double-check your application for accuracy. Ensure all fields are filled out, your details are correct, and you’ve uploaded the necessary documents.

2. Applying for the Wrong Loan Type

Applying for a loan type that isn’t suited for your needs or your financial situation can delay approval. For example, if you apply for a personal loan when you need a payday loan, the approval process will be different, and it might take longer.

Tip: Carefully evaluate the loan options available and select the one that best meets your requirements for speed and terms.

3. Not Shopping Around for Lenders

Sometimes, people rush into applying with the first lender they find, without comparing their options. Not all lenders offer the same loan terms or approval speeds. Some might have more rigorous requirements than others, resulting in a slower process.

Tip: Take the time to compare multiple lenders to find the one with the fastest approval times, best interest rates, and easiest application process.

4. Failing to Consider Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is one of the key indicators that lenders use to assess your financial health. If you’re applying for a loan and already have significant debt relative to your income, it may slow down the approval process or lead to a rejection.

Tip: Before applying, evaluate your DTI ratio and ensure that it’s within an acceptable range. If you have too much debt, try to reduce it before applying for a loan.

9. Explore Specialized Quick Loan Options

There are specialized loans designed for people who need immediate funds and are willing to accept higher interest rates or shorter repayment terms. If speed is a priority over long-term repayment, these options might work for you.

Payday Loans

Payday loans are often the fastest type of loan you can get, with approval and disbursement often happening on the same day. However, they are high-risk loans, typically reserved for urgent needs, because of their short repayment terms and high interest rates. Payday loans can be useful for very short-term needs, but they come with a catch—the APR (annual percentage rate) can be extremely high.

Tip: Only consider payday loans when it’s an absolute emergency, and make sure you can pay it back on time to avoid fees and interest piling up.

Cash Advances

A cash advance from a credit card is another option for fast access to cash. While this doesn’t require an application or approval process, the downside is that credit card companies often charge high fees and interest rates for advances, which can increase your debt if not paid off quickly.

Tip: If you have a credit card with available credit, using a cash advance might be faster, but keep in mind the high costs associated with it.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms such as LendingClub and Prosper allow individuals to borrow money from other individuals (or investors) rather than financial institutions. These platforms often offer faster approval than traditional loans, and some can even have you funded within a few days. However, they can have stringent credit requirements.

Tip: P2P lending platforms might be worth considering if you have a solid credit history but need a quicker process than what traditional banks can offer.

10. Consider Lenders Who Offer Pre-Approval

If you want to get an estimate of whether you’ll be approved before applying for a loan, consider lenders that offer pre-approval. Pre-approval doesn’t guarantee final approval, but it gives you a good idea of the loan amount, interest rate, and terms you might be offered. This step can help you avoid unnecessary hard credit checks and multiple applications that might slow the process down.

Tip: Look for lenders who offer soft credit checks for pre-approval. Soft checks don’t impact your credit score, and they allow you to shop around without committing to a loan right away.

11. Consider the Loan’s Terms, Not Just Speed

While quick loan approval is important, it’s equally important to understand the loan terms before making a commitment. A loan might be approved quickly, but if the terms are unfavorable (e.g., high interest rates, hidden fees, or short repayment periods), it could become a financial burden down the road.

Tip: Always review the terms and conditions carefully before accepting any loan. Ensure the repayment terms are manageable, and the interest rates align with your financial situation.

12. How to Improve Loan Approval Chances for Different Scenarios

Depending on your specific situation, there are strategies you can apply to improve your chances of getting a quick loan approval:

For Bad Credit

- Look for lenders that specialize in bad credit loans.

- Consider secured loans, where you offer collateral to reduce risk for the lender.

- Be prepared to accept higher interest rates in exchange for quicker approval.

For Business Loans

- Prepare a solid business plan that clearly outlines how the loan will benefit your business.

- Provide financial statements showing that your business is stable enough to repay the loan.

- Ensure that all required documentation is ready, including proof of ownership, tax returns, and cash flow statements.

For Personal Loans

- Debt-to-income ratio (DTI) is crucial when applying for personal loans. Aim for a lower DTI ratio to improve your chances of approval.

- If you have good credit, you may qualify for an unsecured personal loan with a fast approval process.

Additional Strategies to Speed Up Loan Approval

To further speed up the loan approval process, consider the following strategies:

1. Be Transparent

When applying for a loan, always be transparent about your financial situation. Lenders appreciate honesty and may be more willing to work with you if you clearly explain your circumstances. If you’ve had issues in the past (e.g., missed payments or bankruptcies), let the lender know upfront and offer a plan for repayment.

2. Build Relationships with Lenders

Building a relationship with a lender over time can work in your favor when it comes to getting quick approvals. If you’ve had previous loans with a particular lender, or if you’re a member of a credit union, they may be more likely to approve you quickly in times of need.

3. Keep Your Finances Organized

A well-organized financial record can drastically speed up the loan process. If you keep track of your income, expenses, and debts, you’ll be able to submit your application with minimal delay. Some lenders may also require you to verify your bank transactions, so having everything organized and ready will make this process smoother.

4. Automate Repayments to Avoid Late Payments

One of the easiest ways to improve your chances of loan approval is to avoid late payments. Setting up automatic payments can ensure that you’re always on time, which positively affects your credit score and financial reputation.

13. Real-Life Examples of Quick Loan Approvals

Sometimes the best way to learn how to get quick loan approval is by looking at real-life scenarios. These examples show how individuals applied certain strategies to obtain fast funding when needed the most.

Example 1: Emergency Medical Loan

Sophia needed emergency surgery and had limited savings. The surgery was costly, and she needed funds quickly. Instead of relying on credit cards, which would have taken days for approval, she opted for an online personal loan.

Sophia’s credit score was 725, which helped her secure a loan with a reasonable interest rate. By completing the application on a Monday morning and providing all the necessary documents (proof of income, identification, and medical bills), she was approved within 30 minutes and received the loan funds by the end of the day.

Takeaway: Sophia’s ability to choose an online lender specializing in personal loans, along with her solid credit score, enabled her to access funds fast and at an affordable rate.

Example 2: Fast Loan for Business Expansion

Jason, a small business owner, needed to purchase inventory quickly in order to take advantage of a time-sensitive opportunity with a supplier. Instead of going to his bank, which typically took weeks to approve loans, Jason used a peer-to-peer lending platform.

Since he had a well-documented business plan and financial statements, Jason’s application was processed within hours. The loan was approved and funds were deposited into his business account the next day.

Takeaway: P2P lending can be a fast and flexible option for business owners, especially if they have clear financial records and a solid plan for using the loan proceeds.

Example 3: Car Loan for an Urgent Purchase

When Emma’s car broke down and repairs were too expensive, she needed a new vehicle fast. She applied for a secured car loan from an online lender, using her old vehicle as collateral.

Since the loan was secured, the approval was much faster than if she had applied for an unsecured loan. She was approved within an hour and had the funds to purchase a new car by the end of the day.

Takeaway: A secured loan, while requiring collateral, can be an excellent way to get quick approval for large purchases like cars.

14. Understanding the Risks of Fast Loan Approval

While obtaining a quick loan can be extremely convenient, it’s important to consider the risks associated with certain types of loans, especially if you’re looking for immediate funds. Below are some common risks to consider:

High-Interest Rates and Fees

Quick loans, especially payday loans and cash advances, can come with exorbitant interest rates and hidden fees. This can create financial stress in the long run, especially if the loan repayment period is short.

- Example: A payday loan with an APR of 400% may seem like a quick solution, but when you factor in interest and fees, the total cost of the loan can quickly become unmanageable.

Tip: Always read the fine print. Be cautious of loans that charge high-interest rates or penalty fees if you miss a payment.

Debt Cycle Risk

For people who struggle to repay their loan on time, the risk of falling into a debt cycle is real. This happens when borrowers repeatedly take out new loans to pay off old ones, often exacerbating their financial struggles due to high fees and interest charges.

- Example: Some payday loan borrowers, instead of repaying the loan on time, opt to “roll over” their debt, incurring new fees and interest each time.

Tip: Only borrow what you can afford to pay back on time. If you’re unsure of your ability to repay a loan, consider alternative options, like borrowing from family or friends, before opting for high-risk fast loans.

15. Alternatives to Quick Loan Approval

If you’re looking for faster financing options but want to avoid high-risk loans, consider these alternative options:

1. Personal Line of Credit

A personal line of credit is a revolving loan that works like a credit card. It allows you to borrow funds up to a specific limit and only pay interest on the amount you use. These lines are typically easier to qualify for than personal loans and can be a great way to have immediate access to funds without the hassle of reapplying each time you need money.

- Pros: Fast access to cash, lower interest rates than payday loans, and no need for collateral.

- Cons: Interest rates can still be relatively high compared to traditional loans, especially if you have poor credit.

Tip: If you have access to a personal line of credit, it’s often the best choice for fast, flexible financing.

2. Borrowing from Family or Friends

If you need a small loan quickly and don’t want to deal with banks or lenders, borrowing from family or friends can be a great option. It may not have the formalities or high interest rates of traditional loans.

- Pros: Typically no interest, minimal paperwork, and flexible repayment terms.

- Cons: Could strain personal relationships if not repaid on time.

Tip: If you decide to borrow from loved ones, create a repayment plan and stick to it to avoid misunderstandings.

3. Employer Payroll Advances

If you have a good relationship with your employer, you might be able to get a payroll advance or salary loan. Some companies offer employees the ability to borrow against their future wages in times of need.

- Pros: Often no interest or low fees.

- Cons: You’re effectively borrowing from your future paycheck, which can strain your budget when repayment is due.

Tip: Approach your employer professionally and explain your situation clearly to increase your chances of being approved for a payroll advance.

16. Special Considerations for Fast Loan Approval During Economic Uncertainty

During times of economic uncertainty, such as a recession or financial crisis, getting quick loan approval can be even more challenging. Lenders often tighten their lending criteria to reduce risk, and borrowers may face higher interest rates and stricter requirements. However, there are still ways to improve your chances of approval:

1. Look for Government-Backed Loans

Government-backed loans, such as SBA loans for businesses or federal student loans, often have favorable terms, including lower interest rates and longer repayment periods. These loans may take slightly longer to process than private loans but are generally easier to qualify for, even in uncertain economic times.

Tip: Research any government loan programs available in your area or country to see if they fit your needs.

2. Apply with a Co-Signer

If you have a low credit score or don’t meet other qualifications, applying for a loan with a co-signer can significantly improve your chances of approval. A co-signer is someone with a better credit score who agrees to be responsible for the loan if you default.

Tip: Make sure you have an honest conversation with your co-signer about the terms of the loan and the responsibility they’re taking on.

3. Lenders Offering Flexible Terms During Economic Challenges

Some lenders may offer special loan programs during challenging economic times to help people who have been impacted. Look for lenders with flexible terms designed to help individuals navigate financial hardship.

Tip: Check with local community banks or credit unions, as they might offer programs that are more accommodating to borrowers during tough economic conditions.

17. The Importance of Financial Planning for Future Loan Needs

Getting quick loan approval is often seen as a solution to immediate financial problems, but it’s important to remember that financial planning is key to reducing your reliance on loans in the future. By adopting better budgeting habits, saving for emergencies, and building a solid credit history, you can decrease the need for fast loans.

1. Build an Emergency Fund

Start setting aside money for unexpected expenses. Having an emergency fund means you won’t need to rely on loans when an urgent situation arises. Aim for saving 3-6 months of living expenses to cover unexpected costs.

2. Focus on Building and Maintaining Good Credit

Your credit score plays a crucial role in loan approval and interest rates. By keeping track of your spending, paying your bills on time, and reducing your debt, you can maintain a strong credit score that will improve your chances of receiving fast loan approval when needed.

Tip: Review your credit report regularly to check for any inaccuracies and dispute errors to keep your credit in good shape.

Also Read :-Is Online Insurance The Right Choice For You?

Conclusion

Getting quick loan approval without hassle requires careful planning and understanding the key factors that influence the process. From choosing the right loan type to applying with a trusted lender and ensuring your financial documents are in order, every step plays a crucial role in speeding up your approval time.

While quick approval loans are ideal for urgent financial needs, remember to choose a loan that fits your financial situation and ability to repay. Always consider the interest rates, terms, and potential risks before finalizing your decision.

FAQs

- How long does quick loan approval take?

- Most online lenders can approve loans within minutes to hours, while traditional lenders may take several days to a week.

- What’s the minimum credit score needed for quick loan approval?

- It depends on the lender and loan type. However, most online lenders will approve loans for people with credit scores of 650 or higher.

- Can I get a loan without proof of income?

- Some payday lenders may approve loans without proof of income, but most traditional or online lenders will require it for verification.

- How do I improve my chances of quick loan approval?

- Ensure your credit score is in good shape, provide all necessary documents, and apply with lenders who specialize in fast approvals.

- What types of loans have the fastest approval times?

- Personal loans, payday loans, and car loans from online lenders usually have the quickest approval times.

- Is it better to apply for a secured or unsecured loan for quick approval?

- Secured loans tend to offer faster approval due to the lower risk for the lender, but they require collateral.

- What are the risks of applying for payday loans for quick approval?

- Payday loans typically come with high-interest rates and fees, which can create financial strain if not repaid promptly.