How Does A Loan Calculator Work And Why Should You Use One?

Introduction

In today’s fast-paced financial landscape, making informed decisions about loans is crucial. Whether you’re considering a personal loan, home loan, or auto loan, understanding the financial implications is essential. This is where a loan calculator becomes an invaluable tool. But how does it work, and why should you incorporate it into your financial planning? Let’s delve into these questions.

Key Takeaways

- Informed Decision-Making: Loan calculators provide clarity, helping you make educated choices about borrowing.

- Financial Control: They offer insights into your repayment obligations, promoting better financial management.

- Time and Effort Saving: With instant results, loan calculators eliminate the need for manual calculations and consultations.

- Customization: Tailor your loan scenarios to find the best fit for your financial situation.

- Comprehensive Understanding: Beyond monthly payments, gain a full picture of your loan’s total cost and repayment schedule.

Understanding Loan Calculators

A loan calculator is a powerful financial tool designed to help you estimate your loan payments and understand the overall cost of borrowing. Whether you’re planning to take out a personal loan, car loan, home mortgage, or business loan, this calculator allows you to plan smarter, borrow responsibly, and avoid financial surprises.

Let’s break it down step by step:

What Is a Loan Calculator?

A loan calculator is a digital tool (usually available online for free) that calculates your monthly payment (EMI), total interest payable, and the full repayment amount based on a few inputs:

- Loan amount (how much you’re borrowing)

- Interest rate (what the lender charges yearly)

- Loan tenure (how long you’ll take to repay)

Some calculators may also ask for:

- Processing fees

- Down payment

- Prepayment options

Why Is It Useful?

Using a loan calculator helps you:

- Know your monthly EMI in seconds

- Compare different loan options

- Avoid over-borrowing or over-committing

- Understand how interest builds over time

- Plan for early repayments to save money

How to Use a Loan Calculator

Most loan calculators have a simple interface with sliders or fields. You:

- Enter the loan amount

- Input or adjust the interest rate

- Set the loan duration

- Hit “Calculate” or see the results auto-populate

The calculator then shows:

- Monthly EMI

- Total interest

- Total repayment amount

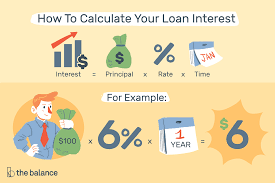

Example:

Types of Loan Calculators

There are various calculators for different financial needs:

- Personal Loan Calculator

- Home Loan Calculator

- Car Loan Calculator

- Business Loan Calculator

- EMI Calculator with Prepayment

- Loan Eligibility Calculator

Each is tailored to its respective loan type, offering unique inputs and outputs for more accuracy.

⚙️ What Happens Behind the Scenes?

🎬 In Film or Theater Production

Behind the scenes refers to everything that happens off-camera or off-stage:

- Scriptwriting, casting, rehearsals

- Set design, lighting, and sound engineering

- Makeup, costume design, and prop preparation

- Directors and producers making creative and logistical decisions

- Crew managing camera work, editing, and special effects

All of this coordination ensures the final product appears seamless to the audience.

💻 In Software or App Development

Behind the scenes includes:

- Planning and designing user experience (UX/UI)

- Coding (frontend and backend)

- Database management

- Security implementation

- Testing and debugging

- DevOps and continuous deployment

These processes make the app or website work reliably for users.

🧠 For AI Like Chat GPT

Here’s a simplified look at what happens behind the scenes when you ask a question:

- Input processing – Your message is tokenized (broken down into smaller units).

- Model inference – The model (like GPT-4o) uses its trained parameters to predict a response based on the context of your message.

- Post-processing – Formatting, grammar correction, and safety filters are applied.

- Response generation – You get a coherent, relevant answer.

🏢 In Business Operations

Behind the scenes involves:

- Supply chain management

- HR and employee management

- Finance and budgeting

- Customer support

- Marketing strategy

- Legal and compliance

All this happens invisibly to ensure the customer sees a smooth, professional experience.

Amortization Schedule

Many calculators also offer an amortization table, which shows a detailed month-by-month breakdown of your loan repayment, including:

- EMI amount

- Interest component

- Principal component

- Balance remaining

This helps you understand how much of each payment goes toward reducing your loan vs. paying interest.

Benefits of Using a Loan Calculator

- Budgeting: Know if the EMI fits within your monthly income.

- Comparison: Choose the best deal from different lenders.

- Transparency: No surprises when you see the final repayment cost.

- Saves Time: No need to consult an expert for basic estimates.

- Helps with Early Repayment Planning: See how prepayments reduce tenure and total interest.

What Loan Calculators Don’t Do

While they’re incredibly useful, loan calculators don’t:

- Account for fluctuating interest rates (in case of floating-rate loans)

- Include hidden charges like late payment fees, penalties, or insurance

- Reflect your credit score’s impact on final loan terms

- Consider inflation or opportunity cost

Always verify the final figures with your lender.

Final Thoughts

Understanding loan calculators is essential in today’s credit-driven world. They empower you to:

- Make informed borrowing decisions

- Avoid over-leverage

- Plan your finances with precision

Whether you’re a first-time borrower or a seasoned homeowner, using a loan calculator is your first step to smart financial planning.

How Does a Loan Calculator Work?

A loan calculator is a digital tool that helps borrowers estimate their monthly loan repayments (EMI), the total interest payable, and the overall cost of a loan over time. It uses a mathematical formula to perform quick calculations based on a few key inputs. Here’s a detailed breakdown of how it works:

Key Inputs Required

To calculate your loan EMI, a loan calculator typically asks for three main details:

- Loan Amount (Principal)

The total amount of money you want to borrow from a lender. - Interest Rate (Annual)

The yearly rate charged by the lender on the loan amount. - Loan Tenure

The time period (usually in months or years) over which you will repay the loan.

How It Works Behind the Scenes

How It Works Behind the Scenes: Loan Calculator Logic Explained

A loan calculator might seem like a simple tool on the surface, but behind the scenes, it uses a powerful mathematical model to deliver accurate and instant financial estimates. Here’s a detailed breakdown of what happens when you input your loan details:

🧮 The Core Calculation: EMI Formula

At the heart of a loan calculator lies the EMI (Equated Monthly Installment) formula, which calculates the fixed amount a borrower must pay each month.

➤ EMI Formula:

EMI=P×r×(1+r)n(1+r)n−1EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}EMI=(1+r)n−1P×r×(1+r)n

Where:

- P = Principal loan amount

- r = Monthly interest rate (Annual Interest Rate ÷ 12 ÷ 100)

- n = Total number of monthly installments (Loan Tenure in Months)

🔍 Step-by-Step Process Inside the Calculator

1. Input Collection

You provide the following details:

- Loan amount (Principal)

- Annual interest rate

- Loan tenure (in months or years)

2. Interest Conversion

The calculator:

- Converts the annual interest rate to a monthly rate: r=Annual Rate12×100r = \frac{\text{Annual Rate}}{12 \times 100}r=12×100Annual Rate

3. Tenure Normalization

- If tenure is given in years, it’s converted into months: n=Tenure in years×12n = \text{Tenure in years} \times 12n=Tenure in years×12

4. EMI Computation

Using the values of P, r, and n, the calculator plugs them into the EMI formula and computes the monthly payment.

📊 Additional Calculations

Most loan calculators also compute:

✅ Total Interest Payable

Total Interest=(EMI×n)−P\text{Total Interest} = (\text{EMI} \times n) – PTotal Interest=(EMI×n)−P

✅ Total Amount Payable

Total Repayment=EMI×n\text{Total Repayment} = \text{EMI} \times nTotal Repayment=EMI×n

These values help the borrower understand the long-term cost of the loan.

🧾 Optional: Amortization Schedule Logic

Advanced calculators also generate an amortization schedule, showing:

- How much of each EMI goes toward interest and how much reduces the principal

- The outstanding loan balance after each month

This involves iterating monthly over:

- New interest = Outstanding balance × monthly rate

- Principal repayment = EMI – interest

- Remaining balance = Outstanding – principal paid

🛠️ Optional Features Built In

- Prepayment impact: Recalculates EMI or tenure if you enter lump-sum prepayment.

- Fees and charges: Adds one-time charges to the total cost.

- Graph generation: Visualizes interest vs principal breakdown over time.

🔐 What It Doesn’t Do Automatically

- It does not access real-time lender data

- It won’t include tax benefits, unless manually entered

- It assumes a fixed interest rate, not accounting for floating rate changes unless stated

🧠 Example (Behind-the-Scenes Math)

You enter:

- Loan = ₹10,00,000

- Interest = 10% p.a.

- Tenure = 5 years

Conversion:

- Monthly rate = 10 ÷ 12 ÷ 100 = 0.00833

- Tenure = 60 months

Plug into formula: EMI=10,00,000×0.00833×(1+0.00833)60(1+0.00833)60−1≈₹21,247EMI = \frac{10,00,000 \times 0.00833 \times (1 + 0.00833)^{60}}{(1 + 0.00833)^{60} – 1} \approx ₹21,247EMI=(1+0.00833)60−110,00,000×0.00833×(1+0.00833)60≈₹21,247

You’ll see:

- EMI = ₹21,247

- Total interest = ₹2,74,820

- Total repayment = ₹12,74,820

Why Should You Use a Loan Calculator?

- Accurate Financial Planning: By understanding your monthly obligations, you can plan your budget effectively, ensuring you don’t overextend financially.

- Comparison of Loan Offers: Loan calculators allow you to input different interest rates and tenures, helping you compare various loan offers and choose the one that best fits your financial situation.

- Understanding Total Repayment: Beyond monthly payments, it’s essential to know the total amount you’ll repay over the loan’s lifetime. A loan calculator provides this insight, helping you assess the true cost of borrowing.

- Avoiding Financial Pitfalls: By visualizing your repayment schedule, you can identify potential financial strain points and make adjustments before committing to a loan.

- Time Efficiency: Instead of manually calculating EMIs or relying on bank representatives, loan calculators provide instant results, saving you time and effort.

Key Features of Loan Calculators

Loan calculators are practical, user-friendly tools that simplify financial decision-making. Whether you’re planning to take out a personal loan, home loan, auto loan, or business loan, these calculators help you understand your repayment obligations in advance. Here’s a breakdown of their most valuable features:

1. EMI Calculation

- Calculates your Equated Monthly Installment (EMI) based on loan amount, interest rate, and tenure.

- Provides instant, accurate results so you know how much you’ll be paying every month.

2. Total Interest & Repayment Summary

- Displays the total interest payable over the life of the loan.

- Shows the total repayment amount (principal + interest), helping you assess the true cost of borrowing.

3. Customizable Loan Tenure & Amount

- Allows you to adjust:

- Loan amount

- Repayment tenure (in months or years)

- Interest rate

- Great for comparing different loan scenarios.

4. Amortization Schedule

- Offers a detailed repayment schedule:

- Breaks down each EMI into principal and interest portions.

- Shows how your outstanding loan balance reduces over time.

5. Prepayment & Part-Payment Options

- Some advanced calculators let you:

- Add lump-sum prepayments

- View how prepayments affect your EMI or loan tenure

- Calculate interest savings from early payments

6. Real-Time Calculations

- Instant results based on real-time input adjustments.

- No need to wait or perform manual calculations.

7. User-Friendly Interface

- Easy to use, with sliders or simple input boxes.

- Often available on mobile apps and websites, making it accessible anytime.

8. Safe and Anonymous

- No personal information is usually required.

- Safe to use without affecting your credit score or financial record.

9. Comparison Across Lenders

- Lets you simulate offers from different banks or NBFCs.

- Helps you choose the most cost-effective and flexible loan.

10. Versatile for Different Loan Types

- Available for various types of loans:

- Home loan calculator

- Car loan calculator

- Personal loan calculator

- Education loan calculator

- Business loan calculator

11. Additional Fee Estimator

- Some calculators allow entry of processing fees or GST, giving a clearer cost breakdown.

Real-World Applications

Consider the example of a homebuyer looking to purchase a property worth ₹50 lakh. By using a loan calculator, they can input their desired loan amount, interest rate, and tenure to determine their monthly EMI. This empowers them to make informed decisions about their property purchase and loan application.

Also Read :-What Is a Student Loan and How Does It Work?

Conclusion

A loan calculator is more than just a tool; it’s a financial companion that aids in making informed borrowing decisions. By understanding its workings and benefits, you can navigate the complexities of loans with confidence, ensuring that your financial commitments align with your capabilities.

7 Frequently Asked Questions (FAQs)

- Can I use a loan calculator for different types of loans? Yes, loan calculators can be used for various loan types, including personal, home, and auto loans. Some calculators are specialized for specific loan types, offering more tailored results.

- How accurate are the results generated by a loan calculator? Loan calculators provide estimates based on the information you input. While they offer a close approximation, actual loan terms may vary based on lender policies and individual circumstances.

- Do loan calculators consider my credit score? Most basic loan calculators do not factor in your credit score. However, some advanced calculators might provide insights into how your credit score can affect your loan terms.

- Are there any hidden fees that a loan calculator doesn’t show? While loan calculators provide estimates based on the principal, interest rate, and tenure, they may not account for additional fees like processing charges or insurance premiums. It’s essential to consult with the lender for a comprehensive breakdown.

- Can I use a loan calculator to plan for early repayments? Yes, many loan calculators allow you to input additional payments or prepayments, helping you understand how early repayments can reduce your loan tenure and total interest paid.

- Is it safe to use online loan calculators? Most reputable financial institutions offer secure online loan calculators. Ensure you’re using a trusted website to protect your personal information.

- Do loan calculators consider inflation or changing interest rates? Standard loan calculators assume fixed interest rates and do not account for inflation. However, some advanced calculators might offer scenarios with variable rates.