Is Passive Investing the Best Strategy for Long-Term Wealth Building?

When it comes to investing, many individuals are searching for a strategy that aligns with their long-term financial goals. Passive investing has gained widespread popularity in recent years, touted as a reliable and low-effort way to grow wealth over time. But is it truly the best strategy for building long-term wealth?

In this article, we’ll dive into the concept of passive investing, explore its benefits and risks, and determine whether it is the ideal approach for investors looking to build wealth over the long term.

Key Takeaways

- Low-Cost Strategy: Passive investing involves low fees and expenses, making it a cost-effective way to build wealth.

- Diversification: Passive investing offers built-in diversification, reducing the risk of losses from individual stocks.

- Long-Term Focus: This strategy is best suited for long-term investors who are willing to ride out market volatility.

- Tax Efficiency: Passive investors often face fewer tax consequences due to less frequent trading.

- Consistent Returns: While not immune to market downturns, passive investing historically delivers steady, long-term returns.

What Is Passive Investing?

At its core, passive investing refers to a strategy where investors aim to build wealth by making long-term investments in assets that require minimal ongoing management. Instead of trying to “beat the market” through active stock picking or frequent trades, passive investors typically invest in index funds, exchange-traded funds (ETFs), or other diversified portfolios that mirror the performance of broader market indexes like the S&P 500 or the NASDAQ.

The goal of passive investing is not to outperform the market in the short term but to achieve consistent returns over time with minimal effort and cost.

The Foundation of Passive Investing

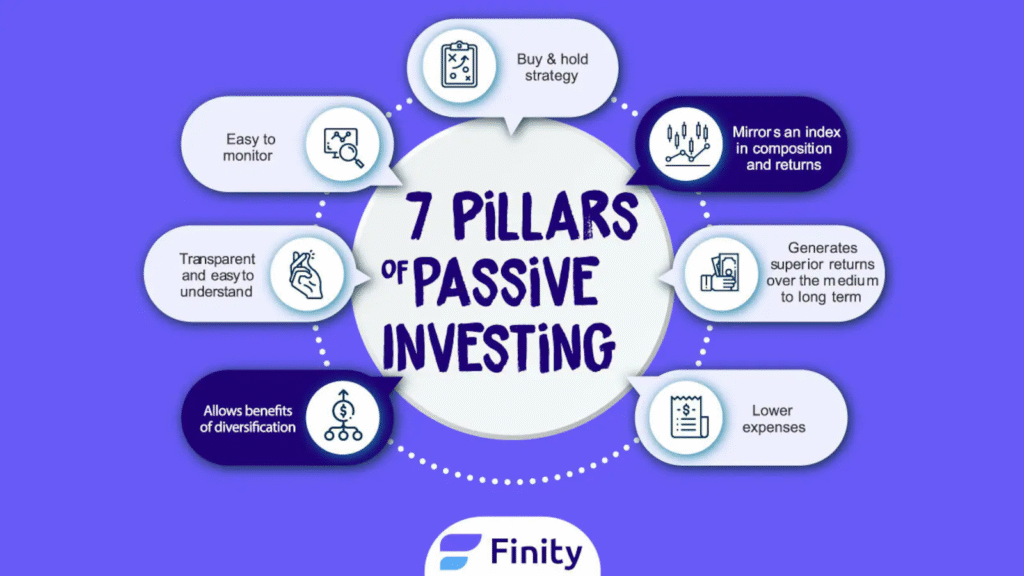

Passive investing relies on the following principles:

- Diversification: Instead of selecting individual stocks, passive investors typically invest in a wide range of assets, reducing risk by spreading their investments across various sectors and industries.

- Low-Cost: Passive investments, especially index funds and ETFs, often come with lower fees compared to actively managed funds. The absence of costly research and frequent trading helps investors retain more of their returns.

- Long-Term Approach: Passive investing is grounded in the belief that over the long run, markets tend to rise. This philosophy encourages investors to hold onto their investments, even in times of market volatility.

The Advantages of Passive Investing

1. Lower Fees and Expenses

One of the primary benefits of passive investing is its low cost. Active funds typically charge higher fees due to the research and management required to pick stocks and adjust the portfolio regularly. On the other hand, passive funds track an index and require minimal management, resulting in lower annual management fees.

For example, the average expense ratio for an S&P 500 index fund might be around 0.03%, compared to an actively managed fund that could charge 1% or more. Over time, this difference in fees can have a significant impact on your long-term returns.

2. Reduced Risk through Diversification

Passive investing offers instant diversification. An index fund that tracks the S&P 500, for example, spreads investments across 500 different companies, reducing the risk associated with any single stock. This makes it much less likely for your entire portfolio to suffer a significant loss due to one poor-performing stock.

Since passive investing focuses on broad-market indices, it helps protect you from the volatility of individual stocks, making it an attractive option for investors who are risk-averse.

3. Consistent Performance Over Time

Passive investing has proven to be a reliable strategy for long-term wealth accumulation. Historically, broad-market indices like the S&P 500 have shown steady growth, albeit with periods of volatility. Passive investors can expect to participate in the overall growth of the market, rather than trying to time the market or pick the next big winner.

For instance, the S&P 500 has delivered an average annual return of around 10% over the long term. While the market does experience short-term fluctuations, history shows that investing in broad indices has provided solid returns over decades.

4. Minimal Time and Effort Required

Unlike active investing, which requires ongoing research, monitoring, and decision-making, passive investing is a hands-off approach. Once you’ve selected an index fund or ETF that aligns with your investment goals, there’s very little you need to do beyond periodic check-ins.

This makes passive investing ideal for people who want to build wealth without having to dedicate significant time to managing their investments. It’s also an attractive option for investors who may not have the expertise or desire to engage in active trading.

5. Tax Efficiency

Since passive investors buy and hold their investments for long periods, they typically face fewer capital gains taxes than those who engage in frequent buying and selling. In active investing, regular trading results in taxable events that can eat into your returns.

By contrast, passive investing generally minimizes these taxable events, making it a more tax-efficient strategy, especially for those in higher tax brackets.

The Disadvantages of Passive Investing

1. Lack of Flexibility

One of the main criticisms of passive investing is its lack of flexibility. Since passive investors are essentially mirroring the performance of an index, they cannot adjust their portfolio to respond to specific market conditions or take advantage of short-term opportunities.

For example, if a sector or industry is struggling, a passive investor cannot avoid those stocks unless the index itself removes them. This lack of control can be a downside for those looking for more active management of their investments.

2. Potential for Lower Returns During Bull Markets

While passive investing provides consistent market returns, it can sometimes underperform during specific periods, particularly during bull markets. Actively managed funds or individual stock picks may outperform the broader market if fund managers or investors are able to capitalize on growth sectors or high-performing stocks.

In contrast, passive investors are tied to the overall market, which means they may miss out on the outsized returns that individual stocks or sector-specific funds can achieve.

3. Market Risk and Volatility

Although passive investing minimizes the risk of individual stocks, it is still subject to market risk. If the broader market experiences a downturn, passive investors will also experience losses. While the market historically rebounds over the long term, it’s important to remember that downturns can be painful for investors in the short term.

Moreover, passive investing does not protect against extreme volatility, and some investors may not have the stomach for the ups and downs that can come with holding onto a broadly diversified portfolio.

4. No Guarantee of Positive Returns

1. Market Volatility

Financial markets are highly volatile, and prices can fluctuate significantly due to changes in economic conditions, geopolitical events, and investor sentiment. Even well-diversified portfolios can experience downturns during periods of high volatility, leading to negative returns.

2. Economic Factors

Inflation, interest rates, and economic recessions can all negatively impact the performance of investments. For instance, during an economic downturn, businesses may experience lower profits, affecting stock prices, or interest rates may rise, leading to lower bond prices.

3. Company Performance

Investments in individual stocks or bonds are subject to the performance of the underlying companies or issuers. A company’s poor financial performance, management issues, or changes in the industry can result in a loss of investment.

4. No Control Over External Factors

Investors have little control over broader market conditions or the performance of individual investments. While diversification can help mitigate risks, it doesn’t eliminate the possibility of negative returns, especially during market-wide downturns.

5. Speculative Investments

Some investments, such as cryptocurrencies or speculative stocks, carry higher risks due to their volatility and unpredictable nature. These investments may offer the potential for high returns, but they also come with the risk of losing all or a significant portion of the invested capital.

6. Long-Term vs. Short-Term Performance

While some investments may provide positive returns over the long term, there may be periods of negative returns in the short term. For example, the stock market may experience bear markets or corrections, where prices decline significantly for an extended period before rebounding.

7. Market Timing Challenges

Even experienced investors struggle with accurately predicting market movements, making market timing a risky strategy. A poorly timed investment can lead to significant losses, as buying during market peaks or selling during troughs often results in negative returns.

Comparing Passive Investing to Active Investing

| Aspect | Passive Investing | Active Investing |

|---|---|---|

| Definition | Involves buying and holding assets to mirror a market index with minimal buying and selling. | Involves selecting individual stocks or assets with the goal of outperforming the market. |

| Management Style | Hands-off, minimal management. | Hands-on, involves constant monitoring and decision-making. |

| Goal | To match market returns over the long term. | To outperform the market and generate higher returns. |

| Risk | Lower risk due to diversification in a broad market index. | Higher risk, as it focuses on specific stocks or sectors, which can be more volatile. |

| Fees | Lower fees, typically due to fewer transactions and no active management. | Higher fees due to research, frequent trading, and management. |

| Investment Approach | Long-term, buy-and-hold approach. | Short-term or long-term, depending on market conditions and analysis. |

| Time Commitment | Low; minimal time spent researching or adjusting investments. | High; requires continuous research, market analysis, and decision-making. |

| Suitability | Ideal for long-term investors looking for steady growth with less involvement. | Suitable for experienced investors or those seeking higher returns with a tolerance for risk. |

| Diversification | High; invests in a broad index or sector, reducing the risk of individual asset failure. | Lower; the portfolio is more concentrated, focusing on selected stocks or sectors. |

| Tax Efficiency | More tax-efficient, as fewer transactions occur. | Less tax-efficient due to frequent buying and selling, leading to higher taxable events. |

| Historical Performance | Historically consistent with long-term market growth, though may underperform in bull markets. | Potential for higher returns in bull markets, but inconsistent performance overall. |

| Market Timing | Does not attempt to time the market, simply mirrors it. | Actively attempts to time the market by buying and selling based on market forecasts. |

| Examples of Funds | Index funds, ETFs, Target-date funds. | Actively managed mutual funds, hedge funds, individual stock picking. |

| Investor Control | Limited control over individual stock choices. | Full control over stock selection and portfolio composition. |

| Volatility Impact | Less impacted by short-term market volatility due to long-term strategy. | More susceptible to short-term market fluctuations and volatility. |

| Potential for Outperformance | Generally does not outperform the market; just aims to match it. | Higher potential for outperforming the market, though not guaranteed. |

| Requires Expertise | No need for deep expertise in individual stocks. | Requires substantial knowledge and expertise in stock picking and market analysis. |

Active Investing: The Contrarian Approach

Active investing is the opposite of passive investing. In this strategy, investors or fund managers actively select stocks or assets based on research, analysis, and predictions. The goal is to outperform the market by picking high-growth stocks or by timing the market.

While this strategy can lead to high returns during bull markets, it’s also more expensive and risky. Active investors must pay higher fees for research, trading costs, and management. Additionally, they are subject to human error, and not all active managers consistently outperform their benchmarks.

Which is Better?

Passive investing may be better suited for most long-term investors due to its lower fees, reduced risk, and ease of management. However, active investing may appeal to those with a higher risk tolerance or investors who believe they have the knowledge to outperform the market.

In general, for the average investor looking for a low-maintenance and cost-effective way to build wealth over time, passive investing tends to be the better strategy.

Also Read :-What Is the Best Travel Insurance for Visiting the USA in 2025?

Conclusion

Passive investing offers a straightforward, cost-effective, and low-maintenance strategy for long-term wealth building. While it may not provide the excitement of trying to pick individual stocks or the potential for short-term gains, its consistent returns, diversification, and minimal management requirements make it an ideal choice for most investors looking to build wealth over time.

However, passive investing is not without its drawbacks. It may underperform during bull markets, and it cannot provide the flexibility and control that some active investors may seek. Ultimately, whether passive investing is the best strategy for you depends on your financial goals, risk tolerance, and time horizon.

7 Frequently Asked Questions About Passive Investing

1. What is the difference between passive and active investing?

- Passive investing involves buying assets like index funds or ETFs and holding them for the long term. Active investing involves selecting stocks or other assets based on research, with the goal of outperforming the market.

2. How much money should I invest passively?

- There is no one-size-fits-all answer, but passive investing is suitable for anyone looking for long-term growth. It’s important to assess your financial goals and risk tolerance. A common recommendation is to allocate at least a portion of your portfolio to passive investments.

3. Is passive investing safer than active investing?

- Passive investing is generally safer because it spreads risk across many assets and avoids the volatility of individual stock picking. However, both strategies are subject to market risk.

4. Can I use passive investing in my retirement account?

- Yes, many retirement accounts like IRAs and 401(k)s offer passive investment options such as index funds and ETFs.

5. Can passive investing outperform active investing?

- Historically, passive investing has often outperformed active investing, especially when considering the lower fees and broad diversification.

6. Are there any tax advantages to passive investing?

- Yes, passive investing tends to be more tax-efficient because it involves fewer taxable events (such as selling investments) compared to active trading.

7. How do I get started with passive investing?

- You can start by selecting low-cost index funds or ETFs that align with your financial goals. Many online brokers make it easy to start with a small investment.