What Do You Need To Qualify For A Business Loan?

Starting or expanding a business often requires additional capital. For many entrepreneurs, a business loan can provide the necessary financial support to fund their goals. However, securing a business loan isn’t always as simple as applying and waiting for approval. Lenders, whether traditional banks or alternative sources, have specific requirements to evaluate your business’s financial health, stability, and ability to repay the loan.

Understanding what you need to qualify for a business loan can make the application process smoother and increase your chances of success. In this article, we’ll dive into the key qualifications needed to obtain a business loan and provide useful insights to help you prepare.

Key Takeaways

- Know your credit score: Both personal and business credit scores are crucial when applying for a loan.

- Prepare financial documents: Be ready to provide tax returns, profit and loss statements, and balance sheets.

- Business plan: A well-thought-out business plan demonstrates to lenders that you have a strategy for using the loan to grow your business.

- Cash flow is key: Ensure your business has a steady and positive cash flow to increase approval chances.

- Consider your collateral: If necessary, be prepared to offer assets as collateral to secure the loan.

1. Understanding Business Loans

| Loan Type | Description | Best For | Repayment Terms | Interest Rates |

|---|---|---|---|---|

| Term Loan | A lump-sum loan paid back with fixed monthly payments over a set period. | Established businesses with specific capital needs (e.g., equipment, expansion) | Typically 1-5 years with fixed payments | 6%-30% depending on credit and risk |

| SBA Loan | Loans backed by the Small Business Administration offering lower interest rates. | Small businesses looking for long-term, low-interest financing | Long-term (up to 25 years) with flexible terms | 5%-8% typically |

| Line of Credit | A flexible revolving credit line that businesses can draw from as needed. | Businesses needing short-term capital or fluctuating cash flow | Revolving, monthly or annual payments | 7%-25% depending on credit score |

| Invoice Financing | Borrowing against unpaid invoices to bridge cash flow gaps. | Businesses with outstanding invoices but poor immediate cash flow | Short-term (30-90 days) repayment | 1%-5% of invoice value + fees |

| Equipment Financing | Loans specifically for purchasing equipment, with the equipment itself as collateral. | Businesses needing to purchase or upgrade equipment | 1-5 years (fixed or flexible) | 6%-20% depending on loan amount |

| Merchant Cash Advance | A lump-sum payment in exchange for a portion of future sales or credit card transactions. | Businesses with strong daily credit card or sales transactions | Daily or weekly repayments based on sales | 20%-50% or more (high-risk lenders) |

| Microloan | Small loans often provided by non-profit organizations or the government. | Startups or small businesses needing small amounts of capital | 3-7 years, typically fixed terms | 8%-13% |

| Business Credit Card | A revolving line of credit for everyday business expenses, offering cash back or rewards. | Businesses needing short-term funding for operational costs | Revolving, monthly minimum payments required | 12%-24% (varies with credit score) |

| Crowdfunding | Raising capital from a large number of people via online platforms. | Startups or small businesses with innovative products or services | Depends on the platform’s terms | Fees (5%-12%) |

| Short-Term Loan | A quick loan option with a short repayment period. | Businesses needing immediate funds for urgent needs | Typically 3-18 months | 10%-40% |

Before we explore the requirements for a business loan, it’s important to first understand the different types of business loans available. Common options include:

- Term Loans: A lump sum amount with a fixed repayment period.

- Lines of Credit: Flexible credit that allows you to borrow up to a certain limit as needed.

- SBA Loans: Loans backed by the Small Business Administration, offering lower interest rates and longer repayment terms.

- Equipment Financing: Loans specifically designed to purchase equipment.

- Invoice Financing: Borrowing against your outstanding invoices for immediate cash flow.

Each type of loan has unique eligibility criteria and requirements, so it’s important to align your loan type with your business needs.

2. Key Qualifications for a Business Loan

While each lender may have slightly different criteria, most business loans require the following:

a. Strong Credit Score

Your credit score is one of the first things lenders will check when reviewing your application. It demonstrates your reliability in repaying debts.

For small businesses, a personal credit score often plays a large role, especially if your business is relatively new and lacks a solid credit history. Most lenders look for a score of 680 or higher, although some might approve loans with lower scores if you have other strong financial indicators.

- Personal Credit Score: If you’re a sole proprietor or have limited business credit, your personal credit score may be the primary factor.

- Business Credit Score: Established businesses should work to build and maintain a strong business credit score (similar to personal credit but focused on your company’s history).

b. Business Plan

Lenders want to know that your business is viable and that you have a solid strategy for growth. A well-written business plan will help convince the lender that you’re capable of using the loan effectively.

Your business plan should include:

- Executive Summary: An overview of your business and goals.

- Market Analysis: A look at the industry, competitors, and target audience.

- Financial Projections: A detailed forecast of future earnings and expenses.

- Use of Funds: A clear explanation of how you plan to use the loan, whether for expansion, equipment, or working capital.

c. Time in Business

Lenders want to see a stable, established business before granting a loan. Generally, you’ll need to have been in business for at least one to two years. However, this can vary depending on the loan type and lender.

For newer businesses, alternative lenders, such as online lending platforms or microloans, may offer options with more flexible terms.

d. Revenue and Cash Flow

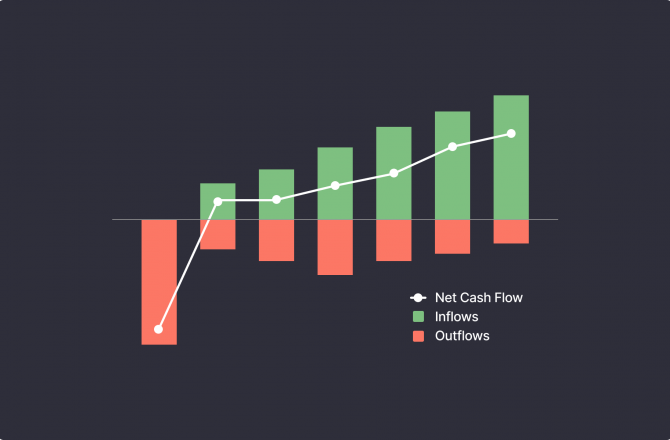

Lenders want to see a steady cash flow to ensure your business can repay the loan. Typically, lenders look for annual revenue of at least $100,000 or more. Your business should also show consistent, positive cash flow over the last 6 to 12 months.

Key financial metrics include:

- Profit and Loss Statements (P&L): Shows your business’s financial health, including income and expenses.

- Cash Flow Statement: Provides insight into your business’s liquidity and how well it can meet short-term obligations.

- Balance Sheet: A snapshot of your company’s assets, liabilities, and equity.

e. Collateral

Some types of business loans may require collateral, which is an asset used to secure the loan. If you default on the loan, the lender can seize the collateral to recover the outstanding amount.

Common types of collateral include:

- Real estate or property

- Inventory

- Equipment

- Accounts receivable

Not all loans require collateral, but it’s more common with larger loan amounts or loans from traditional banks.

f. Debt-to-Income Ratio

This ratio compares your business’s total monthly debt payments to its income. A lower debt-to-income ratio is preferable, as it indicates your business is not overly leveraged and can handle new debt.

Lenders generally look for a debt-to-income ratio of 40% or lower, though this can vary.

Preparing for the Loan Application

To improve your chances of approval, here are a few steps you should take before applying:

- Review Your Credit Score: Check your credit score and report. If there are any errors or issues, work to resolve them before applying for a loan.

- Prepare Financial Documents: Gather up-to-date financial documents, including tax returns, financial statements, and bank statements, to demonstrate your business’s financial health.

- Research Lenders: Different lenders have varying qualification requirements. Compare interest rates, terms, and fees to find the best match for your business.

- Consider Your Loan Amount and Terms: Understand exactly how much money you need, the repayment terms that work for your business, and the purpose of the loan. This will help you select the appropriate loan product.

Also Read :-What Are the Hidden Costs of a Car Loan?

Conclusion

Securing a business loan can be a game-changer for your company’s growth and success, but qualifying for one requires careful preparation. Lenders will evaluate your credit score, financial health, business plan, time in business, and ability to repay the loan before approving your application.

By understanding these key requirements and preparing your business for the loan application process, you can increase your chances of securing the financing you need.

FAQs

1. What is the minimum credit score required for a business loan?

The minimum credit score for a business loan depends on the lender and loan type. Typically, a score of 680 or higher is recommended, but alternative lenders may accept lower scores.

2. Can I get a business loan with bad credit?

Yes, it’s possible to secure a business loan with bad credit, especially with alternative lenders. However, you may face higher interest rates or stricter terms.

3. How long does it take to get approved for a business loan?

Approval times can vary based on the lender and loan type. Traditional loans may take weeks, while alternative lenders often approve loans within a few days.

4. Do I need to provide collateral for a business loan?

Collateral requirements depend on the loan type and lender. Secured loans often require collateral, but unsecured loans do not.

5. Can I get a business loan if I am a startup?

Yes, startups can qualify for business loans, but they may face more stringent requirements. SBA loans, microloans, and alternative lenders often have more lenient terms for new businesses.

6. How much revenue do I need to qualify for a business loan?

Most lenders prefer businesses that generate at least $100,000 in annual revenue. However, this can vary depending on the loan type and lender.

7. Can I use a business loan for personal expenses?

No, business loans should only be used for business-related expenses, such as equipment, expansion, or working capital. Using the funds for personal expenses could lead to legal and financial consequences.