Is Refinancing Your Loan The Right Move For You In 2025?

In 2025, as interest rates fluctuate and financial landscapes evolve, homeowners and borrowers are increasingly considering refinancing as a strategic move to optimize their financial situations. But is refinancing the right choice for you? This comprehensive guide delves into the nuances of loan refinancing, helping you make an informed decision.

Key Takeaways

- Evaluate Costs: Consider all associated costs, including closing fees and potential prepayment penalties.

- Assess Loan Terms: Ensure the new loan terms align with your financial objectives.

- Monitor Market Trends: Stay informed about interest rate movements to refinance at the optimal time.

- Consult Professionals: Seek advice from financial advisors to make an informed decision.

- Plan for the Long Term: Ensure that refinancing supports your long-term financial goals and stability.

Understanding Loan Refinancing

Loan refinancing is the process of taking out a new loan to replace an existing one, usually to secure better terms, reduce interest costs, or improve financial flexibility. It’s a common financial strategy used by borrowers to optimize their debt management.

How It Works

When you refinance a loan, you’re essentially paying off your original loan with a new one, ideally under more favorable terms. This can apply to various types of loans, including:

- Mortgage loans

- Auto loans

- Personal loans

- Student loans

- Business loans

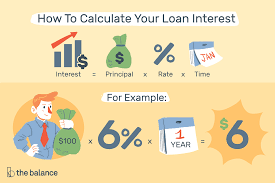

For example, if you currently have a mortgage with a 6.5% interest rate, and you qualify for a new loan at 5%, refinancing could lower your monthly payments and save you thousands in interest over the life of the loan.

Common Reasons to Refinance

- Lower Interest Rate

The most common reason to refinance is to take advantage of lower interest rates. This reduces monthly payments and the total amount paid over time. - Shorten Loan Term

Moving from a 30-year mortgage to a 15-year loan, for example, can help you pay off your debt faster and with less interest—though this typically increases your monthly payments. - Convert Between Fixed and Variable Rates

Some borrowers refinance to switch from an adjustable-rate loan to a fixed-rate loan, or vice versa, depending on interest rate trends and financial risk tolerance. - Access Equity (Cash-Out Refinance)

Homeowners may refinance to tap into home equity for large expenses, such as home improvements, education, or debt consolidation. - Debt Consolidation

Refinancing can consolidate multiple loans (like credit card debt and personal loans) into one payment, often at a lower interest rate. - Improve Cash Flow

Refinancing to extend the loan term may reduce monthly payments, freeing up cash for other expenses or investments.

When Is Refinancing a Good Idea?

Refinancing may be beneficial when:

- Interest rates are lower than when you took your original loan.

- Your credit score has improved, making you eligible for better terms.

- You plan to stay in the home or keep the asset long enough to break even on the refinancing costs.

- You want to switch from an adjustable-rate loan to a fixed-rate for long-term stability.

When to Avoid Refinancing

Refinancing might not be ideal if:

- The closing costs outweigh the benefits.

- You’re planning to move or sell the asset soon.

- Your credit score has declined.

- The new loan offers unfavorable terms, like high fees or prepayment penalties.

The Refinancing Process (Step-by-Step)

Refinancing a loan involves several stages that can be time-consuming but offer long-term financial benefits if done correctly. Here’s a detailed step-by-step guide to help you understand the refinancing process:

1. Assess Your Current Loan

Before beginning the refinancing process, it’s crucial to have a clear understanding of your current loan:

- Review Loan Terms: Take a close look at the terms of your existing loan, including your interest rate, monthly payments, loan balance, and remaining term. This helps you determine how much you stand to gain by refinancing.

- Payoff Amount: Find out the exact amount you still owe. This is crucial because refinancing essentially means paying off your existing loan with a new one, and you need to know whether refinancing will cover your current loan balance.

- Check for Prepayment Penalties: Some loans, particularly mortgages, may come with prepayment penalties if you pay off the loan early. These fees can affect the overall benefits of refinancing, so it’s important to factor them into your decision.

- Is Refinancing the Right Move?: Consider your reasons for refinancing—whether it’s to secure a lower interest rate, shorten the loan term, or access equity. Evaluate if refinancing aligns with your long-term financial goals.

2. Shop for Lenders

Once you understand your current loan, it’s time to start shopping for lenders. Not all lenders offer the same rates, terms, or fees, so it’s essential to compare:

- Banks and Credit Unions: Traditional banks and credit unions are often good places to start, especially if you have a strong relationship with them. They may offer competitive rates and terms to existing customers.

- Online Lenders: Online lenders typically offer quicker processes and often have more flexible requirements. However, rates can vary, and customer service may not be as personal as with traditional institutions.

- Compare Rates: Get quotes from multiple lenders to compare interest rates, loan terms, and fees. The lowest rate may not always be the best deal if the lender has high fees or other unfavorable terms.

- Check for Special Programs: Some lenders may offer refinancing programs tailored to specific types of borrowers, such as those with bad credit or first-time homebuyers. Don’t overlook these specialized programs if they apply to your situation.

3. Apply for Refinancin

Once you’ve chosen the best lender, it’s time to submit your refinancing application. You will need to provide several documents for the lender to evaluate your financial situation:

- Income Proof: Provide documentation that shows your income, such as pay stubs, tax returns, or bank statements. Lenders use this to determine your ability to repay the loan.

- Credit History: The lender will assess your credit score and history to determine your eligibility and the interest rate they’ll offer. A higher score usually results in better terms.

- Identification and Residency: You’ll need to provide proof of identity, such as a government-issued ID, and proof of residence, such as utility bills or a lease agreement.

- Existing Loan Details: Submit the details of your current loan (including your balance and account number), as the lender will use this to pay off the existing debt.

Be ready for a hard inquiry on your credit report during this stage, which may slightly affect your score in the short term.

4. Get a Loan Estimate

After you apply, the lender will provide you with a Loan Estimate. This is a detailed document that outlines the terms of the new loan, including:

- Interest Rate (APR): The APR (annual percentage rate) includes the interest rate and any additional costs. This is the true cost of the loan over its term.

- Monthly Payments: The Loan Estimate will specify your new monthly payment amount, factoring in the loan principal and interest. Make sure this amount fits your budget.

- Closing Costs: Review the list of closing costs, which may include appraisal fees, title insurance, origination fees, and more. These costs are typically between 2% and 5% of the loan amount, so be sure to account for them in your decision.

- Loan Term: Verify the length of the loan, whether it’s 15 years, 30 years, or another term. Adjusting the loan term can impact your monthly payments and overall interest paid.

- Other Fees: Look for additional fees or charges like prepayment penalties or administrative fees. These can add up and make refinancing less beneficial.

5. Underwriting and Approval

Once you’ve reviewed the loan estimate, the next step is underwriting. During this stage, the lender assesses your financial situation in detail to determine whether you qualify for refinancing.

- Financial Review: The lender will verify your financial information, such as income, debts, credit score, and loan-to-value ratio (in the case of home loans). This helps them determine your risk profile and whether you qualify for the new loan.

- Appraisal (for Mortgage Refinancing): If you’re refinancing a mortgage, the lender may require an appraisal of your property to determine its current value. The appraisal will impact your ability to refinance and the terms you receive.

- Approval Process: If you meet the lender’s criteria, you’ll receive final loan approval. If there are any issues (e.g., a lower-than-expected appraisal or debt issues), the lender may offer a revised loan or request additional documentation.

6. Closing

After receiving loan approval, you move on to closing, where the new loan is finalized, and the old loan is paid off.

- Sign Documents: You’ll sign a series of legal documents that outline the terms of the new loan, including your repayment obligations. Be sure to read everything carefully before signing.

- Pay Closing Costs: At closing, you’ll need to pay any applicable closing costs. Some lenders allow you to roll these costs into the loan balance, but this may increase your overall loan amount.

- Pay Off the Old Loan: The lender will use the funds from the new loan to pay off the existing loan in full. This completes the refinancing process.

- Start New Payments: After closing, your new loan terms will kick in. Begin making payments according to the new schedule, which may be lower or higher, depending on the refinancing terms.

Benefits of Refinancing in 2025

1. Lower Interest Rates

With the Federal Reserve’s recent rate cuts, many borrowers are finding opportunities to refinance at more favorable rates. For instance, homeowners with mortgage rates around 6% to 7% might consider refinancing to capitalize on potential savings .

2. Debt Consolidation

Refinancing offers the chance to consolidate multiple debts into a single loan, simplifying repayments and potentially reducing overall interest costs .

3. Access to Home Equity

A cash-out refinance allows homeowners to borrow against their property’s equity, providing funds for home improvements, education, or other significant expenses .

4. Improved Loan Terms

Refinancing can lead to better loan terms, such as eliminating prepayment penalties or obtaining more flexible repayment options .

Drawbacks of Refinancing

1. Closing Costs

Refinancing isn’t without its expenses. Closing costs can range from 2% to 5% of the loan amount, encompassing fees like origination, appraisal, and title insurance .

2. Extended Loan Term

While refinancing can lower monthly payments, it might also extend the loan term, leading to higher total interest payments over time .

3. Impact on Credit Score

The refinancing process involves a hard inquiry on your credit report, which can cause a temporary dip in your credit score .

4. Potential for Higher Monthly Payments

Opting for a shorter loan term with a lower interest rate can increase monthly payments, which might strain your budget .

5. Risk of Overborrowing

Cash-out refinancing can lead to increased debt if the borrowed funds are not used judiciously, potentially jeopardizing financial stability .

Key Considerations Before Refinancing

Refinancing can offer substantial financial benefits—but it’s not always the right choice for everyone. Before deciding to refinance your loan, it’s essential to evaluate a range of personal, financial, and market factors. Here’s what you should carefully consider:

1. Your Refinancing Goal

Before you dive into the refinancing process, it’s important to have a clear understanding of your financial goals. Refinancing can be a powerful tool, but only if it aligns with your objectives. Here are some common refinancing goals to consider:

Lower Your Interest Rate

One of the primary reasons people refinance is to lower their interest rate. If interest rates have dropped since you originally took out your loan, refinancing can allow you to take advantage of those lower rates and reduce your overall borrowing costs.

- Why Lower Interest Rates Matter: A lower interest rate means that a smaller portion of your monthly payments goes toward paying interest, and more of it goes toward the principal balance of your loan. Over time, this can result in significant savings.

- Best For: Borrowers who currently have a high interest rate or who qualify for a lower rate due to an improved credit score or a shift in market conditions.

Reduce Monthly Payments

Another reason to refinance is to reduce your monthly payments, which can free up cash for other expenses or investments. You can achieve this in two main ways:

- Securing a Lower Interest Rate: As mentioned, this lowers the amount of interest you pay over the life of the loan and can reduce your monthly payment.

- Extending the Loan Term: Refinancing to a longer loan term (for example, switching from a 15-year mortgage to a 30-year mortgage) can lower your monthly payment. However, this may result in paying more interest over the life of the loan.

- Why Reduce Monthly Payments?: Lower monthly payments can ease financial strain, especially if you’re facing temporary financial hardship or need more flexibility in your budget.

- Best For: Borrowers who need short-term financial relief or want to reduce monthly obligations for other financial priorities.

Shorten Your Loan Term

If you’re looking to pay off your loan faster and save money in the long run, refinancing to a shorter loan term may be the right choice. A shorter loan term (for example, moving from a 30-year mortgage to a 15-year mortgage) comes with several benefits:

- Interest Savings: Although your monthly payments may increase, you’ll pay less interest over the life of the loan because you’re paying off the principal faster.

- Accelerated Debt Payoff: By reducing the term, you commit to becoming debt-free sooner, which can be particularly appealing if you’re working toward financial independence or retiring early.

- Best For: Borrowers who have stable financial situations, higher incomes, or want to pay off their loan sooner to save on interest costs.

Tap Into Equity Through a Cash-Out Refinance

A cash-out refinance allows you to access the equity in your property by refinancing for more than you owe on your current loan. The difference between the new loan amount and the old loan is given to you as cash, which can be used for various purposes, such as:

- Home Improvements: Many homeowners use the cash to renovate or upgrade their property, which can increase the value of their home.

- Debt Consolidation: You may use the funds to consolidate high-interest debt, such as credit card balances, into a more manageable and potentially lower-interest loan.

- Education or Investment: Some borrowers use the extra funds for educational expenses or investment opportunities.

- Why Tap Into Equity?: This is often a good choice when interest rates are low and the value of your home has increased significantly. It can also help reduce the interest paid on high-interest debts.

- Best For: Homeowners who have built up significant equity in their property and need funds for large expenses or debt consolidation.

Consolidate High-Interest Debt

Refinancing can also be an excellent strategy for debt consolidation, particularly if you have high-interest credit cards or loans. By refinancing to a lower-interest loan, you can pay off multiple higher-interest debts with a single, more manageable monthly payment.

- How It Works: If you refinance a mortgage or personal loan, you can use the funds to pay off credit card debt or other loans, leaving you with only one loan to manage.

- Why Consolidate Debt?: Debt consolidation can simplify your finances by reducing the number of monthly payments you have to track and potentially lowering the overall interest rate. It can also make it easier to pay down your debt more quickly.

- Best For: Borrowers who have multiple high-interest loans and want to streamline their finances while reducing interest costs.

Summary: Aligning Your Refinancing Goal with Your Financial Situation

Understanding your refinancing goal is essential for choosing the right approach. Whether you’re looking to lower your interest rate, reduce monthly payments, pay off your loan faster, tap into equity, or consolidate debt, refinancing offers a variety of solutions.

- Best Time to Refinance: Refinancing is typically most beneficial when interest rates are lower than when you originally took out your loan, your credit score has improved, or your financial situation has changed in a way that supports your goals.

Before proceeding with refinancing, evaluate your long-term financial objectives and select the refinancing option that best aligns with those goals. Having a clear refinancing strategy will ensure that you’re making the right decision for your financial future.

2. Break-Even Point

Refinancing comes with costs—typically 2% to 5% of the loan amount. Your break-even point is the moment when the savings from your new loan outweigh the costs of refinancing. Use this simple formula:

Break-Even Point (in months) = Total Closing Costs ÷ Monthly Savings

Example:

If closing costs are $4,000 and you save $200/month:

$4,000 ÷ $200 = 20 months

If you plan to stay in the home (or hold the loan) longer than 20 months, refinancing might make financial sense.

3. Current Interest Rates vs. Your Rat

Compare today’s rates to your current loan’s interest rate. Even a 0.5%–1% reduction can lead to meaningful long-term savings, especially on large loans like mortgages.

Pro Tip: Keep an eye on the Federal Reserve announcements and economic trends, as they directly influence loan interest rates.

4. Loan Term and Payment Flexibility

Refinancing lets you adjust your loan term:

- Shorter Term: Higher monthly payments, but lower total interest and faster payoff.

- Longer Term: Lower monthly payments, but more interest paid over time.

Choose based on your cash flow, long-term goals, and ability to manage payments.

5. Closing Costs and Fee

Refinancing isn’t free. Costs may include:

- Application fees

- Appraisal and inspection fees

- Title search and insurance

- Attorney or notary fees

- Loan origination fee

Ask for a Loan Estimate from your lender to see all costs up front. Also, check if you can roll the costs into the new loan to avoid out-of-pocket expenses—though this may slightly increase your loan balance.

6. Your Credit Score

Lenders offer the best refinancing rates to borrowers with strong credit. Before applying:

- Check your credit score

- Dispute errors on your credit report

- Pay down high-interest debts

A score above 700 typically qualifies for better terms, while a score under 620 may result in higher rates or loan denial.

7. Debt-to-Income Ratio (DTI)

DTI compares your monthly debt payments to your income. A DTI under 43% is often preferred by lenders. A lower DTI not only boosts your chances of approval but may also get you better terms.

8. Home Equity (for Mortgage Refinancing

For mortgage refinancing, equity matters:

- Conventional refinance: Typically requires 20% equity.

- Cash-out refinance: Most lenders let you borrow up to 80% of your home’s appraised value.

- FHA/VA loans: May allow refinancing with less equity or more flexible terms.

An appraisal may be required, so keep your home in good condition to maximize value.

9. Prepayment Penalties

Some loans, especially older ones or certain private loans, come with prepayment penalties. This is a fee charged for paying off your loan early. Check your existing loan terms to see if this applies and factor it into your cost-benefit analysis.

10. How Long You Plan to Keep the Loan or Asset

If you’re planning to move, sell, or pay off the loan in the near future, refinancing may not be worthwhile—especially if you won’t reach your break-even point before that time.

11. Type of Loan You’re Refinancing

Different loans come with different refinancing processes:

- Mortgages: More complex; involve appraisals and title work.

- Auto Loans: Easier; fewer fees and less paperwork.

- Student Loans: Can save money but may forfeit government benefits like income-driven repayment plans or forgiveness.

Make sure you understand the trade-offs before refinancing federally-backed or subsidized loans.

12. Lender Reputation and Transparency

Not all lenders are created equal. Research reviews, fees, and customer service. Choose a reputable lender who:

- Offers clear terms

- Is transparent about fees

- Doesn’t use high-pressure tactics

Ask for a Good Faith Estimate or Loan Estimate to compare offers from multiple lenders.

Also Read:- What Is a Good Loan Interest Rate In 2025?

Conclusion

Refinancing can be a powerful financial tool in 2025, offering opportunities to reduce interest rates, consolidate debt, and access home equity. However, it’s crucial to weigh the benefits against the potential drawbacks, such as closing costs and the impact on your credit score. By carefully considering your financial situation and consulting with financial advisors, you can determine if refinancing aligns with your long-term goals.

FAQs

1. What is the ideal credit score for refinancing?

A credit score of 700 or higher is typically considered favorable for securing the best refinancing rates.

2. Can I refinance if I have a bad credit score?

While challenging, refinancing is possible with a lower credit score, though it may come with higher interest rates.

3. How often can I refinance my loan?

There’s no limit to how often you can refinance, but it’s essential to consider the costs and benefits each time.

4. Is refinancing available for all types of loans?

Refinancing options are available for various loans, including mortgages, auto loans, and student loans.

5. Can I refinance with my current lender?

Yes, many lenders offer refinancing options to existing customers, sometimes with better terms.

6. What documents are required for refinancing?

Common documents include proof of income, credit reports, property appraisal, and identification.

7. Will refinancing affect my tax deductions?

Refinancing can impact mortgage interest deductions; consult a tax professional to understand the implications.