What Is A Debt Consolidation Loan and How Can It Help You?

In today’s fast-paced world, it’s easy to accumulate various types of debt. From credit cards and student loans to medical bills and personal loans, managing multiple debts can be overwhelming. Many individuals find themselves juggling several payments each month, each with varying interest rates and due dates. As a result, it can be challenging to stay on top of everything, which can further strain your financial situation.

A solution that has helped countless people regain control of their finances is the debt consolidation loan. This financial tool combines multiple debts into one single loan, ideally with a lower interest rate, better repayment terms, and a more manageable monthly payment.

In this article, we’ll explore what a debt consolidation loan is, how it works, the benefits it offers, and who can benefit from it. Additionally, we’ll answer common questions surrounding debt consolidation and provide you with a clear path toward managing your debt more effectively.

Key Takeaways

- Debt consolidation loans combine multiple debts into one, simplifying payments and often lowering interest rates.

- They are particularly helpful for individuals with high-interest credit card debt, multiple loans, or poor credit scores.

- While they offer several advantages, such as predictable payments and reduced stress, they also come with risks, such as longer repayment periods and potential new debt.

- Always review the terms and conditions carefully, and commit to a debt-free lifestyle to make the most of this option.

What is a Debt Consolidation Loan?

A debt consolidation loan is a type of loan that allows you to combine multiple debts into one, thereby simplifying your debt management. With this loan, you can pay off existing high-interest debts (such as credit cards, personal loans, or medical bills) and replace them with a single loan that has a more favorable interest rate and payment structure.

The idea behind a debt consolidation loan is to reduce the number of creditors you deal with while lowering your overall interest payments, which makes it easier to manage your debt.

For example, if you have multiple credit card balances with high interest rates, a debt consolidation loan could offer a lower interest rate, allowing you to save money over time. Instead of paying various creditors each month, you would make one monthly payment to the lender offering the consolidation loan.

How Does a Debt Consolidation Loan Work?

A debt consolidation loan typically involves borrowing a lump sum of money to pay off your outstanding debts. You then repay the debt consolidation loan over a fixed period, usually with a fixed interest rate. Here’s how the process generally works:

- Apply for the Loan:

First, you need to apply for a debt consolidation loan with a lender (banks, credit unions, or online lenders). Lenders will evaluate your financial situation, including your credit score, income, and current debts, to determine if you qualify for the loan. - Receive the Loan Amount:

Once approved, the lender will provide you with the loan amount, which will be used to pay off your existing debts. This amount will be disbursed directly to your creditors, and you’ll no longer owe those individual debts. - Consolidate Your Debts:

After your debts are paid off, you’ll only have one loan to manage, with one interest rate and one monthly payment. - Repay the Loan:

You’ll now make regular payments on your debt consolidation loan over the agreed-upon term, which could range from a few months to several years. The goal is to ensure that the monthly payments fit within your budget while reducing your debt more efficiently than before.

Benefits of Debt Consolidation Loans

A debt consolidation loan offers several advantages for individuals struggling with multiple debts:

- Simplified Finances:

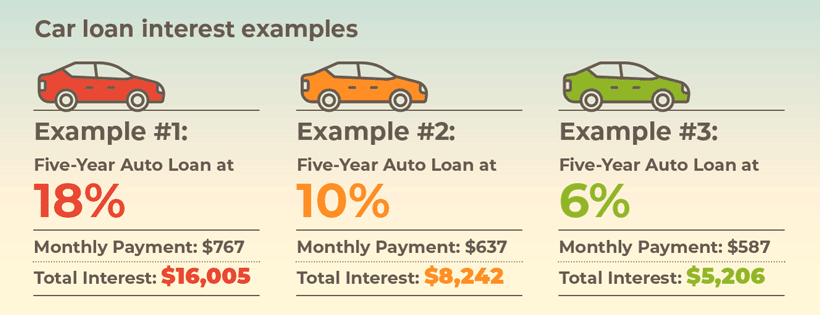

One of the most obvious benefits of debt consolidation is the simplification of your finances. Instead of dealing with multiple creditors, varying due dates, and fluctuating interest rates, you only need to manage one loan with a single monthly payment. - Lower Interest Rates:

By consolidating high-interest debts (like credit card balances), you can often secure a loan with a lower interest rate, reducing your overall debt burden. This can save you money in the long run and make it easier to pay off your debt. - Improved Credit Score:

Debt consolidation can help improve your credit score by reducing your overall credit utilization and lowering your outstanding debt. However, it’s essential to make consistent, on-time payments to see positive results. - Predictable Monthly Payments:

With a debt consolidation loan, you typically receive a fixed interest rate and a set loan term. This means your monthly payment will be predictable, which helps with budgeting and planning your finances. - Faster Debt Repayment:

Consolidating your debts might allow you to repay your debt faster if you’re able to secure a loan with a lower interest rate. The amount of interest you pay over the life of the loan can be significantly reduced, which means you can pay off your principal balance more quickly. - Reduced Stress:

Having to keep track of multiple debt payments can be stressful and overwhelming. A debt consolidation loan eliminates this burden, helping you regain control of your finances and reduce anxiety. - Potential for Lower Monthly Payments:

By extending the loan term (in some cases), you can lower your monthly payments, making it easier to stay on top of your payments, especially if your current financial situation makes it difficult to meet higher obligations.

Who Can Benefit from Debt Consolidation Loans?

Debt consolidation loans are ideal for individuals who are struggling to manage multiple debts. Here are some scenarios where a debt consolidation loan could be a good option:

- High Credit Card Debt: If you have accumulated significant credit card debt with high interest rates, consolidating it into a single loan with a lower interest rate could help you save money and get out of debt faster.

- Multiple Loans: If you have several loans with varying interest rates, a debt consolidation loan can streamline your payments and lower your overall interest burden.

- Poor Credit History: Individuals with a fair or average credit score may still qualify for a debt consolidation loan, especially if they have a stable income and a manageable debt-to-income ratio.

- Struggling to Keep Up with Payments: If you’re finding it difficult to keep up with multiple payments, consolidating your debts can help reduce the monthly payment amounts, giving you more breathing room in your budget.

- Looking for a Structured Repayment Plan: If you prefer a clear, structured repayment plan with fixed monthly payments and a set term, a debt consolidation loan could be an excellent option.

Things to Consider Before Taking Out a Debt Consolidation Loan

Before committing to a debt consolidation loan, it’s essential to carefully evaluate your situation and weigh the pros and cons:

- Eligibility: Lenders will typically require a certain credit score and financial history. If your credit score is low, you may not qualify for a favorable interest rate, making consolidation less beneficial.

- Fees and Costs: Some debt consolidation loans come with fees, such as origination fees or early repayment penalties. Make sure to factor these costs into your decision.

- Discipline: A debt consolidation loan won’t work if you continue accumulating new debt. You must commit to not taking on more credit card debt or loans while you pay off the consolidation loan.

- Loan Term: While a longer loan term can lower your monthly payment, it may increase the total interest paid over time. It’s important to balance the loan term with your ability to repay the debt without extending it too far.

Exploring Debt Consolidation Loans Further

While debt consolidation loans are an effective way to manage multiple debts, it’s crucial to understand both the broader benefits and potential drawbacks. Here, we delve deeper into how you can maximize the benefits of consolidation and what additional considerations you should take into account before taking this step.

Types of Debt Consolidation Loans

Not all debt consolidation loans are the same. Different types of loans are available, and your choice will depend on your individual needs and financial situation. Here are the most common types of debt consolidation loans:

- Unsecured Debt Consolidation Loan:

This is the most common type of debt consolidation loan. An unsecured loan means you don’t need to put up collateral to secure the loan. Lenders will base their decision on factors such as your credit score, income, and debt-to-income ratio. Since there is no collateral, these loans tend to have higher interest rates compared to secured loans. - Secured Debt Consolidation Loan:

A secured debt consolidation loan requires you to pledge an asset (e.g., your home or car) as collateral for the loan. If you fail to repay, the lender has the right to seize the asset. These loans often come with lower interest rates because they are less risky for the lender, but they also carry the risk of losing your property. - Home Equity Loan (or Line of Credit):

A home equity loan or home equity line of credit (HELOC) is a secured debt consolidation option that allows homeowners to tap into the equity in their homes to consolidate debt. This option often comes with lower interest rates because your home is used as collateral. However, as with any secured loan, there’s a risk of foreclosure if you cannot keep up with payments. - Balance Transfer Credit Card:

Some people opt for a balance transfer credit card to consolidate their credit card debt. This option usually comes with an introductory 0% APR for a set period (e.g., 12–18 months). During this period, you can pay down your debt without accruing interest, provided you meet the minimum payment requirements. However, after the introductory period ends, the interest rate may increase significantly, so it’s important to pay off the debt before this happens. - Debt Management Plans (DMPs):

While not exactly a loan, a debt management plan is a service offered by nonprofit credit counseling agencies. In a DMP, the agency negotiates with your creditors to lower interest rates and consolidate your debts into one monthly payment. However, DMPs typically take longer to pay off and may require closing your credit card accounts.

Pros of Debt Consolidation Loans

While we’ve touched on the benefits of debt consolidation loans, let’s expand on them to help you understand why it might be the best solution for you:

- One Monthly Payment:

Managing multiple debts often means dealing with several due dates, interest rates, and varying payment amounts. A debt consolidation loan consolidates all your debts into one monthly payment. This can significantly reduce the hassle and prevent late payments, which can damage your credit score. - Lower Interest Rates:

If you have high-interest credit card debt, a debt consolidation loan can be a game-changer. By consolidating your debts into a loan with a lower interest rate, you can save money over the long term. Many debt consolidation loans offer fixed interest rates, which means your rate will remain the same throughout the life of the loan. - Faster Debt Repayment:

Some people who consolidate their debts may have a lower interest rate, which helps them pay off their debt faster. Additionally, consolidating your debts can prevent you from continuously accumulating more debt, making it easier to focus on paying down your balance. - Reduced Financial Stress:

The mental strain of managing multiple debts, especially if you’re falling behind on payments, can be overwhelming. A debt consolidation loan simplifies your finances, reduces the number of creditors you deal with, and helps restore your peace of mind. It’s easier to make one manageable payment than to juggle various bills. - Improved Credit Score:

If you’re struggling with high credit utilization, a debt consolidation loan could improve your credit score by reducing the amount of outstanding debt. As you make consistent, on-time payments, your credit score should gradually improve.

Potential Drawbacks of Debt Consolidation Loans

While debt consolidation loans offer several benefits, there are also potential risks that you should consider before taking the plunge:

- Secured Loans Put Assets at Risk:

If you choose a secured debt consolidation loan (such as a home equity loan), you could lose your property if you fail to make payments. This is a significant risk, especially if the loan amount is high and you are already struggling to manage your finances. - It Can Take Longer to Pay Off Debt:

Depending on the loan term, you may extend the length of time it takes to pay off your debt. While lower monthly payments can ease your immediate financial burden, a longer loan term can result in paying more interest over time. - Consolidation Might Not Solve the Root Cause:

Debt consolidation is a tool for managing debt, not a long-term solution to a spending problem. If you don’t change your spending habits, there’s a risk of accumulating more debt, which could leave you in a worse financial position than before. - Fees and Costs:

Some debt consolidation loans come with fees, such as origination fees, processing fees, or annual fees. It’s essential to review the loan terms and understand any costs associated with the loan before committing. - Eligibility Requirements:

Not everyone qualifies for a debt consolidation loan. Lenders typically evaluate factors like your credit score, income, and the total amount of debt you’re consolidating. If you have poor credit, you may be offered a loan with a higher interest rate or may not qualify at all. - Not All Debts Can Be Consolidated:

Some debts, such as federal student loans, may not be eligible for consolidation through traditional debt consolidation loans. You may need to consider alternative solutions for specific types of debt.

How to Choose the Right Debt Consolidation Loan

To make the most of a debt consolidation loan, it’s crucial to shop around and choose the best loan for your situation. Here are some tips to help you choose the right loan:

- Compare Interest Rates:

One of the primary reasons for consolidating debt is to secure a lower interest rate. Compare different lenders to find a loan with the best rate for your credit profile. Be sure to check whether the rate is fixed or variable. - Review the Loan Terms:

Carefully review the loan’s terms and conditions, including the repayment period, monthly payment amount, and any fees. Make sure the loan fits within your budget and offers a manageable repayment plan. - Check for Fees:

Ensure that you understand any upfront or ongoing fees associated with the loan. Look for loans that have minimal fees to keep the cost of consolidation as low as possible. - Consider Your Credit Score:

Your credit score plays a significant role in determining your eligibility for a debt consolidation loan and the interest rate you’ll receive. If your score is low, consider working to improve it before applying for a loan. - Consider the Loan’s Impact on Your Credit:

Take into account how the loan will affect your credit score. Consolidating your debt can improve your credit score if you keep up with your payments, but missed payments will hurt your credit. Choose a loan that you can confidently manage.

Also Read :-Is a Federal Student Loan Better Than a Private Loan?

Conclusion

A debt consolidation loan can be a powerful tool to regain control of your finances by simplifying your payments, reducing interest rates, and helping you become debt-free faster. However, it’s essential to evaluate your financial situation carefully and ensure that you have the discipline to avoid taking on new debt. By choosing the right loan, managing it responsibly, and staying focused on paying it off, you can use a debt consolidation loan to put your financial future back on track.

7 Frequently Asked Questions (FAQs)

- How do I qualify for a debt consolidation loan?

To qualify, you generally need a decent credit score, a stable income, and manageable debt-to-income ratio. Lenders will assess your financial situation to determine eligibility. - Can I consolidate credit card debt with a debt consolidation loan?

Yes, credit card debt is one of the most common types of debt consolidated through this loan. Consolidating your credit card debt into a single loan with a lower interest rate can save you money. - How long does it take to get a debt consolidation loan?

The approval process can take anywhere from a few days to a couple of weeks, depending on the lender’s requirements and your financial situation. - Can I still use my credit cards after consolidating debt?

Yes, but it’s best to avoid using your credit cards while you’re repaying the debt consolidation loan. Continuing to rack up debt defeats the purpose of consolidating in the first place. - Will a debt consolidation loan hurt my credit score?

A debt consolidation loan can temporarily impact your credit score, especially if you’re applying for new credit. However, if you make timely payments, it could improve your credit score over time. - Can I consolidate my student loans with a debt consolidation loan?

Yes, federal student loans can be consolidated through a federal loan consolidation program. However, private student loans would need to be handled separately through private consolidation options. - What’s the difference between a debt consolidation loan and debt settlement?

Debt consolidation involves taking out a loan to pay off multiple debts, while debt settlement involves negotiating with creditors to reduce the total amount owed. Debt consolidation is usually a better option for those who want to pay off their full debt.