Mastering The Crypto Market: The Ultimate Investment Strategy

Cryptocurrency investment is no longer a niche interest for tech enthusiasts; it has evolved into a global phenomenon. Whether you’re new to the crypto space or an experienced investor, mastering the market is crucial to achieving success. The cryptocurrency market is volatile, fast-paced, and full of potential, but it also comes with its own set of risks. In this article, we will explore the ultimate investment strategy for navigating the cryptocurrency landscape, providing you with practical steps and insights to make informed decisions and maximize your returns.

Key Takeaways

- Research is Key: Always do your own research before investing in any cryptocurrency.

- Diversify Your Portfolio: Spread your investments across different cryptocurrencies to minimize risk.

- Risk Management is Essential: Use tools like stop-loss orders and position sizing to protect your capital.

- Stay Informed: Keep up with the latest news and developments in the cryptocurrency space.

- Be Prepared for Volatility: The crypto market is volatile; manage your emotions and stick to your strategy.

Understanding Cryptocurrency and Its Market

Before diving into strategies, it’s important to first understand what cryptocurrency is and how its market operates.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security, making it difficult to counterfeit or double-spend. The most well-known cryptocurrencies include Bitcoin (BTC), Ethereum (ETH), and thousands of others like Binance Coin (BNB), Solana (SOL), and Cardano (ADA). Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology. A blockchain is a distributed ledger that records all transactions across a network, ensuring transparency and security.

How Does the Crypto Market Work?

The cryptocurrency market operates 24/7, unlike traditional stock markets that have set trading hours. This means opportunities can arise at any time. The market is also decentralized, meaning there is no central authority or governing body overseeing it. Instead, prices are influenced by a combination of supply and demand, news, regulations, and market sentiment.

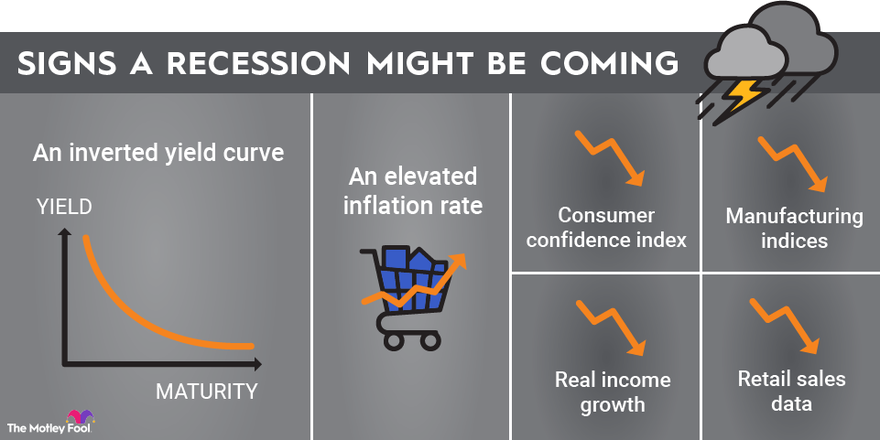

Why is the Crypto Market Volatile?

Cryptocurrency prices are notoriously volatile. Several factors contribute to this volatility, including speculation, market news, technological advancements, regulatory changes, and macroeconomic events. The relatively low liquidity of some cryptocurrencies, combined with a strong retail investor presence, can lead to sharp price movements, both up and down.

The Ultimate Crypto Investment Strategy

Now that we have a foundation, let’s dive into the investment strategies that can help you navigate the crypto market effectively.

Do Your Own Research (DYOR)

One of the most important principles in cryptocurrency investment is Do Your Own Research (DYOR). The crypto space is rife with speculation, rumors, and hype. Therefore, it’s crucial to independently assess any investment opportunities.

How to Research Cryptocurrencies

- Whitepapers: Every reputable cryptocurrency has a whitepaper, a document that outlines the project’s mission, technology, use cases, and future roadmap. Study the whitepaper to understand the underlying technology and goals of the project.

- Community Engagement: Join communities on platforms like Reddit, Twitter, Telegram, or Discord to get insights into the project’s development and its community sentiment. A strong, engaged community is often a good sign of a cryptocurrency’s potential.

- Technology and Use Case: Assess the blockchain’s technology and its real-world use case. Is the project solving a genuine problem? Does it have a competitive edge in the market?

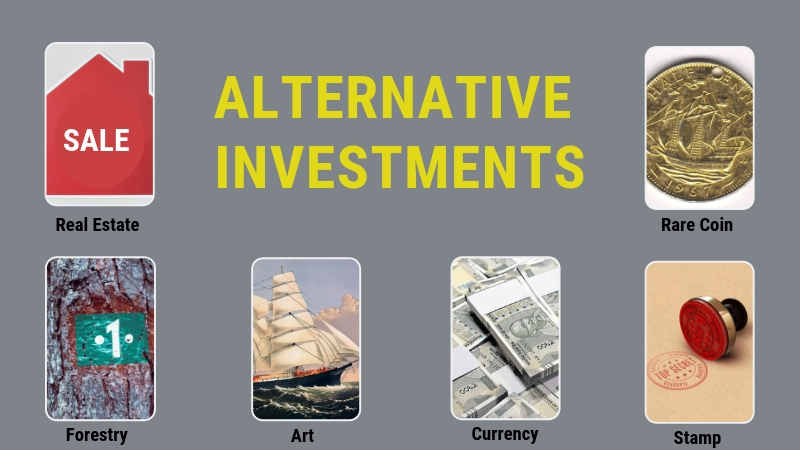

Diversify Your Portfolio

In any investment, diversification is key to reducing risk, and cryptocurrency is no exception. While Bitcoin and Ethereum are considered the “blue chips” of the market, there are thousands of altcoins with unique value propositions.

How to Diversify in Crypto

- Large-Cap Cryptos: These are established cryptocurrencies like Bitcoin, Ethereum, and Binance Coin. They tend to be less volatile than smaller coins but still offer good growth potential.

- Mid and Small-Cap Cryptos: Investing in mid and small-cap coins can offer significant returns, but they come with higher risk. It’s essential to carefully research these projects before investing.

- Stablecoins: Stablecoins like USDT, USDC, and DAI are pegged to the value of fiat currencies like the US dollar, which can help protect your portfolio from the volatility of other cryptocurrencies. They can be used as a hedge in times of market uncertainty.

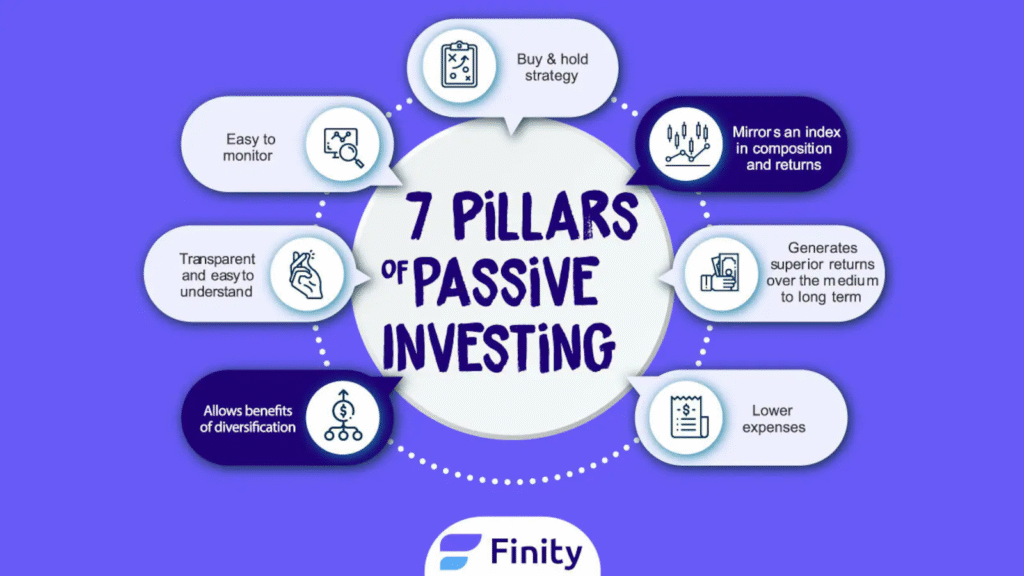

Long-Term vs. Short-Term Investment

There are two primary strategies for cryptocurrency investment: long-term and short-term. Both have their advantages, and the right choice depends on your goals, risk tolerance, and market outlook.

Long-Term Investment (HODLing)

If you believe in the long-term potential of cryptocurrency, you may choose to hold your investments for several years. This strategy, often referred to as HODLing (Hold On for Dear Life), relies on the expectation that the value of cryptocurrencies will rise over time as adoption grows and technology improves.

- Advantages: Less time-consuming, lower stress, potential for significant long-term gains.

- Disadvantages: Exposure to short-term market volatility, the potential for regulatory changes affecting your investments.

Short-Term Trading

Short-term trading involves buying and selling cryptocurrencies frequently to capitalize on price movements. This can be done through day trading, swing trading, or scalping. While the potential for profit is high, short-term trading requires extensive market knowledge, technical analysis, and the ability to make quick decisions.

- Advantages: Potential for quick profits, high engagement with the market.

- Disadvantages: High risk, requires more time and expertise, emotional stress due to market fluctuations.

Risk Management

Given the volatile nature of the cryptocurrency market, risk management is essential. Without proper risk management, it’s easy to make impulsive decisions that can result in significant losses. Here are some strategies to manage risk:

Position Sizing

Never invest more than you can afford to lose. Diversifying your investments across different cryptocurrencies, and even different asset classes, can also help mitigate risk.

Stop-Loss Orders

A stop-loss order automatically sells your cryptocurrency when the price drops below a certain threshold. This helps limit losses and protect your capital during market downturns.

Take-Profit Orders

Just as stop-loss orders help protect you from significant losses, take-profit orders allow you to lock in profits when your cryptocurrency reaches a specific price target.

Stay Informed and Adapt

Cryptocurrency is a rapidly evolving space, with new projects, regulations, and technologies emerging regularly. Staying informed is essential to making educated investment decisions.

Sources of Information

- News Websites: Websites like CoinDesk, CoinTelegraph, and The Block provide up-to-date news on the crypto industry.

- Social Media: Platforms like Twitter, Reddit, and Telegram offer valuable insights and discussions on various crypto projects.

- Technical Analysis: Learn technical analysis to understand price charts and market trends. Tools like TradingView can help you make data-driven decisions.

Consider Regulatory Risks

Cryptocurrencies are often subject to government regulations, which can affect their price and accessibility. Governments across the world are grappling with how to regulate cryptocurrency, and new regulations are continually being proposed and implemented.

How to Navigate Regulatory Risks

- Research Regulations: Stay updated on the regulatory environment in your country and globally. Some countries have embraced crypto, while others have imposed strict regulations or outright bans.

- Use Reputable Exchanges: Ensure you use regulated and secure exchanges that comply with local laws. Avoid platforms that seem suspicious or lack transparency.

Be Prepared for Volatility

The crypto market is known for its extreme volatility. Prices can swing wildly in a matter of hours, and even the most established coins like Bitcoin can experience significant dips.

How to Handle Volatility

- Avoid Emotional Trading: Don’t panic during market dips. Stick to your strategy and remember that volatility can lead to long-term opportunities.

- Take Breaks: If the market’s movements are causing stress, take a step back. Sometimes, the best decision is to do nothing and wait for the market to settle.

Advanced Strategies for Cryptocurrency Investment

As you progress in your crypto investment journey, it’s important to explore more advanced strategies that can further enhance your portfolio’s performance. These strategies take into account not only market trends but also how you can optimize your investments by integrating both traditional financial wisdom and blockchain-specific insights.

Staking and Yield Farming

Staking and yield farming are two ways of earning passive income from your cryptocurrency holdings. These strategies can be incredibly rewarding but require a deep understanding of the mechanics of decentralized finance (DeFi) platforms.

Staking

Staking involves locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return, you earn rewards, usually in the form of the same cryptocurrency you staked. Proof-of-Stake (PoS) and Delegated Proof-of-Stake (DPoS) are the two most common consensus mechanisms that utilize staking.

- How to Stake: To stake your crypto, you first need to find a PoS-based blockchain or staking platform (like Ethereum 2.0, Cardano, or Polkadot). Then, you lock up your coins in a wallet and earn rewards over time, generally calculated as a percentage of your stake.

- Risks: Staking is not risk-free. Staked coins can be locked for a period, and if there’s a network failure or hack, you may lose your stake.

Yield Farming

Yield farming involves lending your crypto assets to liquidity pools on decentralized exchanges (DEXs) or lending platforms. In return, you receive interest or a portion of the transaction fees. Yield farming has exploded in popularity due to its high returns, but it comes with its own set of risks.

- How Yield Farming Works: You provide liquidity (usually in pairs like ETH/USDT) to decentralized liquidity pools. In return, you receive a yield (usually a percentage of the fees or new tokens) from the platform. The more liquidity you provide, the greater your potential rewards.

- Risks: The most significant risk of yield farming is impermanent loss, which occurs when the price of the tokens in the liquidity pool changes. Also, smart contract vulnerabilities and platform risks can jeopardize your funds.

NFTs and Crypto-Assets

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership of a specific item or piece of content, such as art, music, or even virtual real estate. While NFTs have primarily been associated with collectibles and art, they are increasingly seen as investment opportunities in the crypto market.

Investing in NFTs

- Research the Project: Before investing in an NFT, research the project, its community, the creator’s reputation, and its potential for future appreciation. Famous NFTs like Bored Ape Yacht Club and CryptoPunks have seen significant price increases, but not every NFT will have this potential.

- Risks: The NFT market can be speculative and volatile, with some assets losing their value over time. Additionally, many NFTs are highly illiquid, meaning it could be hard to sell them at your desired price point.

Virtual Real Estate and Metaverse

Another growing area of investment is virtual real estate within virtual worlds or the metaverse. As more companies and individuals invest in virtual spaces, owning virtual land in platforms like Decentraland or The Sandbox can provide significant returns in the future.

- How to Invest: Virtual land can be purchased and held as an asset in the hope of appreciation. Some investors are buying land to build virtual stores, host events, or rent out spaces, similar to how real estate is handled in the physical world.

- Risks: The metaverse and virtual real estate are still evolving markets. Regulatory uncertainty, technological changes, and shifts in market interest could impact the value of these assets.

Tax Strategy and Compliance

One often-overlooked aspect of cryptocurrency investing is understanding the tax implications. Cryptocurrency is treated differently depending on the jurisdiction, but most governments regard crypto investments as taxable events, either as capital gains or income.

Tracking Cryptocurrency Transactions

- Record Keeping: Keep detailed records of all your crypto transactions, including trades, purchases, and sales. This will help you calculate your gains and losses and ensure you’re compliant with tax laws.

- Software for Tax Filing: Use tools like CoinTracking, Koinly, or TaxBit to automatically track and report your crypto transactions. These platforms integrate with exchanges and wallets to simplify tax reporting.

Tax Strategies for Cryptocurrencies

- Long-Term Holding: In many countries, holding cryptocurrency for over a year can result in favorable long-term capital gains tax rates. This makes HODLing an attractive strategy for tax optimization.

- Tax-Loss Harvesting: If you’ve experienced losses in certain crypto assets, you can sell them to offset gains in other investments. This can reduce your overall tax liability for the year.

Emotional Intelligence and Crypto Investment

The cryptocurrency market’s extreme volatility can invoke powerful emotional reactions, from euphoria during bull runs to fear and panic during sharp corrections. Emotional intelligence (EQ) is one of the most critical traits for a successful investor. Understanding how to manage your emotions can greatly improve your investment decisions.

Avoiding FOMO and FUD

Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) are two emotional triggers that can cloud your judgment and lead to impulsive decisions.

- FOMO: FOMO often strikes when a cryptocurrency is experiencing rapid price growth. It leads investors to jump into the market out of fear that they’ll miss a significant opportunity. The problem with FOMO is that you often buy at the peak, only to experience a correction shortly afterward.

- FUD: On the other hand, FUD is triggered when negative news or rumors spread, causing you to sell in panic. Many investors make the mistake of selling during market dips, missing the opportunity to buy at a lower price and capitalize on the eventual rebound.

How to Control Your Emotions

- Have a Plan: Develop a well-defined investment strategy with clear entry and exit points. Stick to your plan, even if the market experiences sharp fluctuations.

- Avoid Overtrading: Overtrading based on emotions can lead to significant losses. Limit your trades and avoid reacting to every market movement.

- Take Breaks: It’s okay to step away from the market to clear your mind. Sometimes, a pause can help you regain perspective and make more rational decisions.

Timing the Market with Technical and Fundamental Analysis

While the cryptocurrency market can be highly unpredictable, many investors use technical analysis (TA) and fundamental analysis (FA) to make educated predictions and determine the optimal entry and exit points for their investments.

Technical Analysis (TA)

TA involves analyzing price charts and historical data to identify trends and patterns. Traders use indicators such as Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands to predict short-term price movements.

- Benefits: Technical analysis is useful for short-term traders, as it allows them to capitalize on price swings based on historical trends.

- Limitations: While TA can provide valuable insights, it is not foolproof. The crypto market can be influenced by factors that are outside the scope of technical analysis, such as regulatory news or macroeconomic events.

Fundamental Analysis (FA)

Fundamental analysis involves evaluating the underlying value of a cryptocurrency based on factors such as its use case, adoption rate, team, and technology. A strong project with real-world utility and a solid development team has the potential for long-term growth.

- Benefits: FA is valuable for long-term investors who want to assess the true value of a cryptocurrency and its potential for mainstream adoption.

- Limitations: FA can be more subjective, and assessing a project’s future potential can be challenging due to the rapidly evolving nature of the industry.

Conclusion: Embracing the Future of Crypto Investment

The crypto market continues to evolve at an unprecedented rate. The volatility, while daunting to some, presents opportunities for those who approach it with a clear strategy, diversified assets, and a solid understanding of risk management. Whether you’re a long-term investor or a short-term trader, adapting to the changing environment and staying informed is crucial.

Cryptocurrency investment is not for the faint of heart. It requires a blend of research, patience, and emotional intelligence. But for those who take the time to master the market, the rewards can be significant. The ultimate crypto investment strategy involves diversification, a focus on risk management, and an ability to adapt to new technologies, regulations, and market shifts.

By following the advice in this guide, you can lay the groundwork for becoming a successful investor in the crypto space. Stay patient, stay informed, and most importantly, invest responsibly.

Also Read :-Top Real Estate Investment Opportunities for 2025

Conclusion

Mastering the crypto market requires a deep understanding of the assets you’re investing in, the risks involved, and the strategies for maximizing returns. By researching, diversifying, managing risk, and staying informed, you can navigate the volatile landscape of cryptocurrencies with confidence.

Remember that the cryptocurrency market is still young and evolving, and while the potential for significant returns exists, so does the potential for substantial losses. Be patient, adapt to changes, and invest wisely.

FAQs

- What is the best cryptocurrency to invest in right now?

The “best” cryptocurrency depends on your investment strategy and risk tolerance. Bitcoin and Ethereum are considered safe bets, but other coins like Solana, Cardano, and Polkadot have strong growth potential. Research and diversification are key. - How much should I invest in cryptocurrency?

It’s generally recommended not to invest more than 5-10% of your total portfolio in cryptocurrencies, especially if you’re new to the space. Only invest money that you can afford to lose. - Should I buy Bitcoin or altcoins?

Bitcoin is considered the most stable cryptocurrency, while altcoins can offer higher risk and higher reward. A balanced portfolio of both can help manage risk. - How do I protect my cryptocurrency investments?

Use secure wallets, enable two-factor authentication on exchanges, and avoid storing large amounts of crypto on exchanges. Cold wallets (hardware wallets) are more secure than hot wallets (software wallets). - How do I know when to sell my cryptocurrency?

Use stop-loss and take-profit orders to set exit points for your investments. Additionally, if a project you’re invested in no longer aligns with your goals or the market sentiment shifts, it may be time to reassess. - Is cryptocurrency a good long-term investment?

Many investors view cryptocurrency as a long-term investment due to the potential for mainstream adoption and technological advancements. However, it’s important to stay informed and manage your risk. - What are the tax implications of cryptocurrency investing?

Tax laws surrounding cryptocurrency vary by country. In many jurisdictions, cryptocurrency gains are taxed as capital gains. It’s important to keep records of your transactions and consult a tax professional for guidance.