How Do You Choose the Best Car Insurance Company?

Car insurance is an essential aspect of owning and operating a vehicle. Not only is it required by law in most countries, but it also offers protection and peace of mind in the event of accidents, theft, or natural disasters. However, with so many car insurance providers out there, choosing the best company can feel overwhelming. How do you navigate this sea of options to find the best policy for your needs?

In this comprehensive guide, we’ll explore the essential factors you need to consider when selecting a car insurance provider. From understanding different types of coverage to evaluating customer service, this article will provide you with the knowledge to make an informed decision. We’ll also answer some frequently asked questions (FAQs) about car insurance and provide a conclusion with key takeaways.

Key Takeaways

- Understand the types of coverage available and select the one that best fits your needs.

- Consider the financial stability and customer service reputation of potential insurers.

- Compare prices, coverage options, and available discounts to find the best value.

- Tailor your choice to your personal situation, including your driving habits and vehicle type.

- Always read the fine print before committing to a policy.

Advanced Considerations When Choosing the Best Car Insurance Company

While the basics—such as understanding types of coverage, comparing prices, and assessing the insurer’s reputation—are vital to making an informed choice, there are other advanced factors that can heavily influence the overall quality of your insurance experience. Here are a few more nuanced considerations:

- Evaluate the Claims Satisfaction History

It’s one thing to read about the financial stability of a company, but how well do they handle claims when their customers need them most? The process of making a claim can be one of the most stressful aspects of insurance, and many customers rate insurance providers based on how smooth the claims process is. Research the company’s claims satisfaction ratings from independent organizations like J.D. Power and Consumer Reports, which regularly publish data on customer experiences with claims.

Look for companies that have high claims satisfaction ratings, as this can be a strong indicator that the company is reliable and responsive when you need them the most.

- Consider Adding Optional Coverage for Added Protection

Beyond the standard coverage options, many car insurance providers offer various add-ons or endorsements that you may want to consider for additional protection. Some common optional coverages include:

- Rental Car Reimbursement: If your vehicle is damaged and requires repairs, this coverage can help pay for a rental car while your car is being fixed.

- Gap Insurance: If you have a lease or loan on your vehicle, this coverage ensures that you won’t be left with a large unpaid balance if your car is totaled in an accident. Gap insurance covers the difference between the car’s actual value and the balance on your loan or lease.

- Custom Parts and Equipment Coverage: If you’ve made modifications to your vehicle, such as installing a custom stereo system or aftermarket parts, this coverage ensures that you’re protected if these items are damaged in an accident.

- New Car Replacement: Some insurers offer policies that replace your car with a new model (instead of paying for its depreciated value) if it’s totaled within a certain time frame (usually the first few years of ownership).

These add-ons may increase your premium but could be worth the investment depending on your driving habits, vehicle type, and how much risk you’re willing to take on.

- Look Into Usage-Based Insurance (UBI) for Potential Savings

Usage-based insurance, or telematics insurance, is a modern offering by many car insurance companies. This type of policy allows your insurer to track your driving habits via a device installed in your car or a mobile app. It records metrics such as speed, braking habits, miles driven, and even the time of day you drive.

For drivers who demonstrate safe driving behaviors, UBI can result in significant savings. Some insurers even offer immediate discounts for signing up for a telematics program. However, this option is not for everyone, especially if you’re concerned about privacy or if you drive less safely. Always check the terms and conditions of UBI programs, including how your data will be used, before opting for this type of coverage.

- Consider the Insurer’s Reputation for Innovation

In the rapidly changing world of technology, many car insurance companies have adopted innovative solutions that make life easier for policyholders. These include mobile apps for managing claims and paying bills, digital tools for estimating repair costs, and even AI-driven customer service support for answering questions quickly.

If you’re tech-savvy and value a seamless digital experience, look for companies that offer these innovations. They can make managing your insurance much more convenient and may even allow you to get better deals by using online tools to shop and customize your policy.

- Ask About Policy Customization

While some car insurance companies offer “one-size-fits-all” policies, others allow you to tailor your coverage based on your personal needs. This can include adjusting your deductible, adding specific endorsements, or choosing the types of coverage you want.

Some companies provide a level of flexibility that lets you adjust your coverage as your needs change. For example, if you’re a driver who doesn’t frequently use your car or you’re going on a long vacation, you might want to temporarily reduce coverage or even put your policy on hold for a short period.

Common Car Insurance Myths to Avoid

Many misconceptions surround the process of choosing and buying car insurance. Being aware of these myths can help you avoid pitfalls and make a more informed decision:

- Myth: The Cheapest Car Insurance is the Best

While cost is an important factor, the cheapest insurance policy isn’t always the best option. As mentioned earlier, opting for minimal coverage or an insurer with poor customer service might cost you more in the long run. It’s crucial to balance cost with the level of service, claims satisfaction, and coverage. - Myth: All Car Insurance Companies Offer the Same Coverage

Not all car insurance policies are created equal. Some companies offer more extensive coverage options than others, or their policies might include benefits like accident forgiveness, which allows your first accident to not affect your rates. Be sure to compare policies side by side to ensure you’re getting the best coverage for your needs. - Myth: Your Credit Score Doesn’t Affect Your Car Insurance Premium

In many regions, your credit score can play a significant role in determining your premium. Insurers believe that people with better credit are less likely to file claims, so they often offer lower rates to those with higher credit scores. Be sure to check your credit score and improve it if possible, as this could lower your premiums. - Myth: Once You Choose an Insurer, You’re Stuck with Them

As mentioned before, you are free to change your car insurance provider at any time, even after you’ve signed a policy. If you’re dissatisfied with your insurer or find a better deal, switching is often a quick and painless process. Just ensure that you have continuous coverage and that you’re aware of any cancellation fees from your current provider. - Myth: Older Cars Don’t Need Full Coverage

It’s often assumed that once your car ages, it’s no longer worth insuring with full coverage. While older cars may have a lower market value, they can still benefit from full coverage, especially if the cost to repair or replace the car would still be high. Additionally, comprehensive and collision coverage can protect you from risks like theft, vandalism, or natural disasters.

Real-Life Examples of Good Car Insurance Choices

| Driver Profile | Vehicle Type | Insurance Needs | Insurance Features Selected | Why This Choice Worked Well |

|---|---|---|---|---|

| Sarah – Young Graduate | 2015 Honda Civic | Comprehensive protection for a new driver | – Full coverage (liability, collision, comprehensive) – Good student discount – Low deductible – High claims satisfaction provider | Affordable premium with student discounts and strong claims support, ideal for an inexperienced driver |

| Michael – Sports Car Owner | 2023 Porsche 911 | Premium protection for a high-value vehicle | – Full coverage with high limits – Gap insurance – Custom parts coverage – Premium insurer specializing in luxury vehicles | Ensured peace of mind with tailored protection for an expensive, high-risk vehicle |

| Lisa – Family Driver | 2017 Toyota Sienna | Safe, affordable coverage for family use | – Liability + comprehensive – Roadside assistance – Safe driving discount (telematics) – Bundle with home insurance | Balanced cost and safety; usage-based discount and emergency services were family-friendly |

| Carlos – Rideshare Driver | 2020 Toyota Prius | Commercial and personal use protection | – Hybrid policy (personal + rideshare) – High mileage coverage – Roadside assistance – Rental reimbursement | Ensured proper coverage while driving for Uber/Lyft and personal use |

| Emily – Retiree | 2012 Ford Fusion | Low mileage, budget-friendly policy | – Liability only – Low-mileage discount – Safe driver discount | Minimal driving meant less coverage needed; low premiums kept it cost-effective |

| Raj – Urban Commuter | 2018 Hyundai Elantra | Affordable full coverage in high-traffic city area | – Full coverage – Accident forgiveness – Uninsured motorist protection – Theft coverage | Protected against common urban risks: accidents, theft, and uninsured drivers |

| Olivia – College Student | 2016 Subaru Impreza | Parental policy extension with campus coverage | – Coverage under parents’ policy – Student away from home discount – Comprehensive + collision | Reduced costs while maintaining full coverage at college, including parked vehicle protection |

To help illustrate the process of choosing the right car insurance, let’s consider a few real-life examples:

- Example 1: Sarah’s First Car

Sarah is a recent college graduate who just bought her first car: a 2015 Honda Civic. Since she doesn’t have a lot of experience driving, she wants comprehensive coverage to protect her in case of an accident. Sarah opts for a well-known insurer with good ratings for customer service and claims satisfaction. She also takes advantage of the insurer’s good student discount, reducing her premium. By carefully comparing prices and considering her personal needs, Sarah finds a policy that offers both affordability and the necessary protection. - Example 2: Michael’s High-End Sports Car

Michael drives a 2023 Porsche 911, which is a high-performance vehicle. Because the car is expensive to repair and replace, Michael chooses full coverage with comprehensive and collision options. He also adds gap insurance, as his car is financed. Michael knows that he needs a provider that specializes in high-end vehicles and offers flexible coverage. He also asks for a customized policy that includes the option to insure high-value accessories, such as aftermarket wheels and a custom stereo system. After comparing providers, he settles on an insurer known for its premium service to high-net-worth individuals. - Example 3: Lisa’s Family Minivan

Lisa has a 2017 Toyota Sienna minivan, which she uses to transport her children. Because she doesn’t want to break the bank but needs coverage for both liability and family protection, Lisa opts for an insurer that offers low premiums and added discounts for safe drivers. She uses an app to track her driving habits, allowing her to benefit from a usage-based discount. Lisa also adds roadside assistance to her policy, as her family takes frequent road trips.

Final Thoughts: Making the Best Decision for Your Car Insurance Needs

Choosing the best car insurance company is a highly individualized decision based on your needs, budget, and preferences. It’s important to consider factors like coverage options, premiums, customer service, and claims satisfaction to ensure you’re making an informed choice. By researching multiple providers, comparing policies, and understanding the fine print, you can find the policy that offers the best protection for your unique situation.

Remember, car insurance is not just a legal requirement but also a way to safeguard your financial well-being in the event of an accident. Take the time to shop around and select the company that provides the best combination of price, coverage, and service.

Factors to Consider When Choosing the Best Car Insurance Company

- Understand the Different Types of Car Insurance Coverage

Before you even begin shopping for car insurance, it’s essential to understand the different types of coverage available. Car insurance policies typically consist of several different types of coverage, including:

- Liability Coverage: This covers bodily injury and property damage to others in an accident where you are at fault.

- Collision Coverage: This pays for repairs to your own vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: This covers damage to your car that isn’t the result of a collision, such as theft, vandalism, or damage from natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers if you’re injured in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have enough insurance (or any at all).

- Roadside Assistance: This covers services like towing, flat tire changes, and jump-starts if you break down.

Understanding the types of coverage that best fit your needs will help you determine which insurance provider offers the right combination of options.

- Evaluate the Company’s Financial Stability

Choosing an insurance company with strong financial health is crucial. After all, you want to ensure that the company will be able to pay out your claims when you need it most. Rating agencies such as A.M. Best, Standard & Poor’s, and Moody’s evaluate the financial strength of insurance companies. Look for companies with high ratings to ensure they are financially stable and reliable.

- Customer Service and Claims Process

The quality of customer service is an often overlooked yet critical factor when selecting an insurance company. A provider’s customer service will impact your overall experience, from the ease of purchasing a policy to how efficiently they handle claims.

Check the insurance company’s reputation for customer service by reading online reviews and checking for any complaints filed with organizations like the Better Business Bureau (BBB). An insurance company that makes the claims process easy and provides good customer support is worth considering.

- Price and Coverage Options

While price should never be the sole factor in choosing car insurance, it’s an important consideration. You want to get the best value for your premium. Some companies might offer the cheapest rates but provide limited coverage, while others might be more expensive but offer better value through more comprehensive coverage options.

When comparing prices, be sure to assess the extent of coverage provided. Make sure you’re not sacrificing essential coverage for a lower price, as this could leave you financially vulnerable in the event of an accident.

- Discounts and Special Offers

Many car insurance companies offer discounts for various reasons, such as:

- Good driving record: If you have a clean driving history, many providers will offer discounts.

- Multi-policy discounts: Bundling your car insurance with other policies (like home or life insurance) can lead to significant savings.

- Vehicle safety features: If your car has anti-theft devices or advanced safety features, such as airbags or automatic braking systems, you may be eligible for discounts.

- Good student discounts: Many insurers offer discounts for young drivers who maintain good grades in school.

- Low mileage discounts: If you don’t drive a lot, you might qualify for a discount.

When comparing insurance quotes, ask the providers about the discounts they offer and factor them into your decision-making process.

- Consider Your Personal Situation

Your individual circumstances will play a significant role in determining which car insurance company is the best fit for you. For example:

- Driving habits: If you frequently drive long distances, you may need more comprehensive coverage. If you’re primarily using your vehicle for short commutes, you might be able to get by with a more basic policy.

- Location: Some insurers specialize in specific regions or states. Check if there are providers in your area that offer better rates or coverage options suited to your needs.

- Age and driving experience: Younger drivers or those with limited experience behind the wheel may face higher premiums due to the perceived risk. Some companies offer policies designed specifically for new drivers.

- Vehicle type: The make and model of your vehicle will influence your premium. Some cars are more expensive to insure due to repair costs, safety ratings, and theft risk.

By evaluating your unique situation, you can select an insurance provider that tailors its services to your needs.

- Look for User-Friendly Technology

In today’s digital age, many car insurance companies offer online tools and apps that make managing your policy easier. These tools can help you pay premiums, file claims, and even track your driving behavior. Some insurers use telematics, or “black box” technology, to monitor your driving habits and offer discounts for safe driving.

Look for a provider that offers these convenient features, as they can help simplify the insurance process and save you time.

- Check for Legal Compliance and Licensing

Make sure the car insurance company is properly licensed to operate in your state or country. Insurance regulations vary from place to place, and working with an insurer that is not compliant with local laws can lead to complications down the road.

- Research and Compare Different Providers

Once you’ve narrowed down your list of potential insurers, it’s time to compare quotes from several companies. Many online tools allow you to compare policies side by side, so you can easily see which one offers the best value.

You can also consult with an independent insurance agent, who can provide personalized advice based on your needs and help you navigate the available options.

- Read the Fine Print

Before committing to any insurance policy, take the time to carefully read the terms and conditions. Understand the exclusions, coverage limits, and deductibles, and make sure there are no surprises when you file a claim. Look for policies that offer transparent terms and conditions, with clear details about what’s covered and what isn’t.

Also Read:-What Does Travel Insurance Typically Cover?

Conclusion

Choosing the best car insurance company involves evaluating multiple factors, including coverage options, customer service, price, and the company’s reputation. By carefully considering your needs, comparing quotes, and understanding your options, you can select a policy that offers the protection you need at a price that works for you.

FAQs

- What is the minimum car insurance required by law? The minimum car insurance requirements vary by state or country. Typically, they include liability coverage for bodily injury and property damage. Some areas also require additional coverage, such as personal injury protection (PIP) or uninsured motorist coverage.

- How can I lower my car insurance premium? You can lower your premium by maintaining a clean driving record, increasing your deductible, bundling policies, or taking advantage of discounts offered by your insurer.

- Should I get full coverage or liability insurance only? Full coverage is ideal for new or expensive cars, as it covers both your vehicle and others in an accident. Liability insurance is typically sufficient for older cars that have a lower market value.

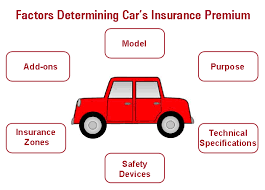

- What factors influence car insurance premiums? Factors such as your age, driving record, location, type of vehicle, and credit score can all impact your car insurance premium.

- Can I change car insurance providers anytime? Yes, you can switch car insurance providers at any time. However, make sure to review the cancellation terms with your current insurer, and consider timing the switch to avoid a lapse in coverage.

- What should I do if I have an accident? If you are involved in an accident, report it to your insurance company as soon as possible. Document the scene, exchange information with the other driver, and file a police report if necessary.

- Is it worth adding extra coverage like roadside assistance? Roadside assistance can be helpful if you’re prone to car trouble, but if you rarely drive long distances or have an emergency fund to cover minor repairs, you may decide it’s not worth the extra cost.