What Is A Student Loan And How Does It Work?

Introduction

Higher education is a powerful tool that opens doors to better job opportunities, higher income potential, and personal growth. However, the cost of obtaining a degree has risen significantly over the years. For many students and families, paying out-of-pocket for tuition, books, housing, and other expenses is simply not feasible. This is where student loans come into play.

Student loans are a form of financial aid designed to help students cover the costs of higher education. Unlike scholarships or grants, loans must be repaid with interest. While student loans can provide necessary financial support, they also come with long-term responsibilities and potential financial risks.

In this article, we’ll explore what student loans are, how they work, the different types, how to apply, and how to manage repayment. We’ll also answer common questions and conclude with key takeaways to help you make informed decisions.

✅ Key Takeaways

- Student loans help cover college costs but must be repaid with interest.

- Federal loans offer better protections, fixed rates, and forgiveness programs.

- Private loans have fewer protections and are credit-based.

- Repayment options include income-driven plans, deferment, and consolidation.

- Responsible borrowing and financial planning are essential for long-term success.

1. What Is a Student Loan?

A student loan is money borrowed to pay for education expenses, which must be paid back over time, usually with interest. Student loans are available through:

- Federal governments

- State governments

- Banks and credit unions (private lenders)

- Educational institutions

Student loans are often essential for students who do not qualify for enough grants or scholarships to cover the full cost of their education. In most cases, students begin repaying the loan after completing their education or leaving school.

2. Types of Student Loans

There are two main categories of student loans:

A. Federal Student Loans (U.S. Context)

These loans are provided by the government and have more flexible repayment terms and lower interest rates.

1. Direct Subsidized Loans

- For undergraduate students with financial need.

- The government pays the interest while the student is in school and during deferment.

2. Direct Unsubsidized Loans

- Available to both undergraduate and graduate students.

- Not based on financial need; interest accrues during all periods.

3. Direct PLUS Loans

- For graduate or professional students and parents of dependent undergraduates.

- Credit check is required.

4. Direct Consolidation Loans

- Allows you to combine multiple federal loans into one loan with a single monthly payment.

B. Private Student Loans

Offered by banks, credit unions, and private lenders. Features vary by lender.

- May require a credit check or a co-signer.

- Interest rates may be fixed or variable.

- Less flexibility in repayment options compared to federal loans.

3. How Do Student Loans Work?

A. Application Process

- Federal Loans (U.S.): Apply by submitting the Free Application for Federal Student Aid (FAFSA).

- Private Loans: Apply directly through the lender’s website or bank.

B. Disbursement of Funds

Once approved, the lender sends the loan amount directly to your school to cover tuition and fees. If any funds remain, they are given to the student for living expenses.

C. Interest Accrual

- Subsidized Loans: Interest does not accrue while you’re in school or during deferment.

- Unsubsidized and Private Loans: Interest begins accruing as soon as the loan is disbursed.

D. Repayment

- Repayment usually begins 6 months after graduation or if you drop below half-time enrollment.

- Private loans may have different grace periods or require payment while still in school.

4. Student Loan Interest Rates and Fees

A. Federal Loans

- Set annually by Congress.

- Fixed interest rate.

- Origination fee may apply (e.g., ~1% of loan).

B. Private Loans

- Based on credit score, income, and co-signer.

- May be fixed or variable rates.

- No standard fees, but may include processing fees or penalties.

5. Repayment Plans

A. Standard Repayment Plan

- Fixed monthly payments over 10 years.

- Minimizes total interest paid.

B. Graduated Repayment Plan

- Payments start low and increase every two years.

- Ideal for students who expect income growth.

C. Extended Repayment Plan

- Allows up to 25 years for repayment.

- Available for loans over a certain amount.

D. Income-Driven Repayment Plans

- Adjusts monthly payment based on income and family size.

- Types include:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

- May qualify for forgiveness after 20-25 years.

6. Loan Forgiveness and Discharge Options

A. Public Service Loan Forgiveness (PSLF)

- Available after 120 qualifying monthly payments while working full-time in public service.

B. Teacher Loan Forgiveness

- Forgives up to $17,500 for qualifying teachers after 5 years of service in low-income schools.

C. Disability Discharge

- Total and permanent disability may result in discharge of federal loans.

D. Death Discharge

- Loans are discharged if the borrower dies (federal loans only).

7. Student Loan Pros and Cons

1. Access to Education

Student loans provide access to higher education for individuals who might otherwise be unable to afford it. This funding allows students to pay for tuition, books, housing, and other education-related expenses. Without student loans, many students would not have the opportunity to attend college or university.

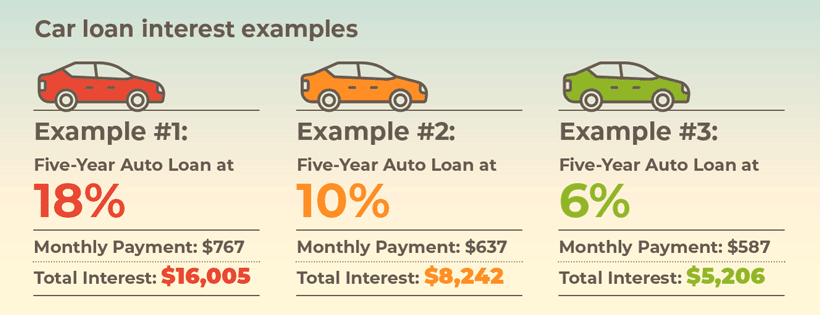

2. Lower Interest Rates (Federal Loans)

Federal student loans often have much lower interest rates compared to other forms of credit, such as personal loans or credit cards. For instance, as of recent years, the interest rate for federal loans for undergraduates is typically around 3.73%, which is relatively low and fixed.

3. Deferment Options

Federal student loans offer deferment options, which allow you to temporarily pause your loan payments. This can be helpful if you face financial hardships, are enrolled in school at least half-time, or have other qualifying circumstances such as military service or unemployment.

4. Flexible Repayment Plans

There are multiple repayment plans available for federal loans. These include standard repayment, graduated repayment (increasing payments over time), and income-driven repayment plans (which adjust payments based on income and family size). These flexible options allow borrowers to choose a plan that works best for their financial situation.

5. Loan Forgiveness Opportunities

Some student loans, particularly federal loans, offer forgiveness programs. Public Service Loan Forgiveness (PSLF) is one example, where borrowers working in certain public service jobs may have their remaining loan balance forgiven after making 120 qualifying payments. Additionally, teachers working in underserved areas may qualify for loan forgiveness.

6. Build Credit History

Making timely student loan payments can help build or improve your credit score, which can be useful when applying for credit cards, car loans, mortgages, or other financial products in the future.

7. No Collateral Required

Unlike many types of loans, student loans do not require collateral. You don’t have to put up property or assets as security, which reduces the financial risk for students when borrowing.

Cons of Student Loans

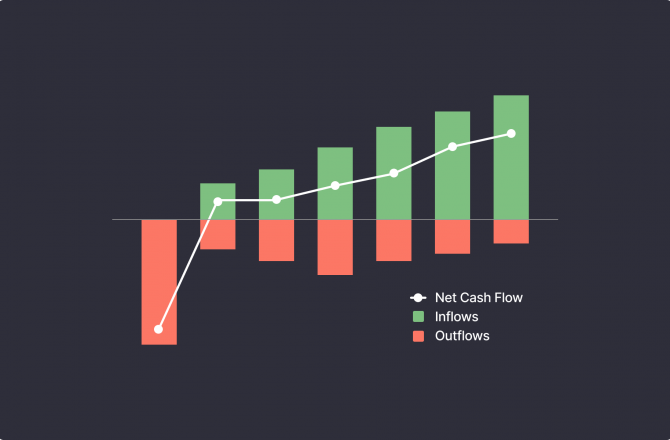

1. Debt Burden After Graduation

One of the biggest drawbacks of student loans is the debt that accumulates. After graduation, many students are left with tens of thousands of dollars in debt, which can take years to pay off. This debt can hinder long-term financial goals such as saving for retirement, buying a home, or starting a family.

2. Interest Accrual

Interest accrues on most student loans while you’re in school, during deferment, or forbearance periods. With unsubsidized loans, interest begins accruing immediately after disbursement, and it may compound over time, increasing the total amount you owe.

3. Potential Impact on Credit Score

If student loan payments are missed or go unpaid for an extended period, it can negatively impact your credit score. A poor credit score can make it difficult to get approved for mortgages, car loans, or even rental housing in the future. Defaulting on a loan can lead to serious consequences such as wage garnishment or tax refund interception.

4. Limited Bankruptcy Protection

Unlike many other types of debt, student loans are difficult to discharge in bankruptcy. While it is possible to discharge federal student loans in rare cases of extreme hardship, the process is difficult and often requires a legal proceeding called an “adversary proceeding.”

5. Limited Repayment Flexibility for Private Loans

While federal student loans offer various repayment options, private loans typically have fewer flexible options. If you have a private loan, you may be required to pay it back on a fixed schedule with little ability to adjust your payments if your financial situation changes. If you have trouble making payments, the lender may not offer forbearance or deferment options.

6. Higher Interest Rates for Private Loans

Private loans often have higher interest rates compared to federal loans. These rates depend on factors such as your credit score and financial history. Without a cosigner, you may face even higher rates, which means you could end up paying much more in interest over the life of the loan.

7. Potential for Over-Borrowing

Since student loans can be used to pay for living expenses and other costs beyond tuition, there is a temptation to borrow more than is necessary. Over-borrowing can lead to greater debt after graduation and an even harder time repaying the loan.

8. Tips for Managing Student Loans Wisely

| Tip | Description |

|---|---|

| 1. Borrow Only What You Need | Avoid borrowing more than necessary. Consider tuition, living expenses, books, and other essentials to keep debt manageable. |

| 2. Understand Your Loan Terms | Know the interest rates, repayment schedule, and any fees associated with your loans. This helps you plan your finances better. |

| 3. Make Payments While in School (If Possible) | If you can afford it, start making interest payments during school to avoid interest capitalization. This will reduce the total amount owed. |

| 4. Choose the Right Repayment Plan | Explore options like income-driven repayment plans or graduated repayment plans to ensure your monthly payments are manageable. |

| 5. Keep Track of Your Loans | Maintain a record of your loans, including the lender, loan amount, and interest rate. This will help you stay organized and avoid missing payments. |

| 6. Refinance or Consolidate Loans | Consider refinancing or consolidating your loans to lower interest rates or simplify payments, especially for private loans. |

| 7. Stay in Contact With Your Loan Servicer | If you’re struggling, reach out to your loan servicer. They can offer deferment, forbearance, or alternative payment plans. |

| 8. Explore Loan Forgiveness Programs | If you’re working in public service, teaching, or other qualifying fields, look into loan forgiveness programs to reduce your debt. |

| 9. Set Up Automatic Payments | Setting up auto-pay can help you avoid missed payments and sometimes even lower your interest rate. |

| 10. Monitor Your Credit Report | Regularly check your credit report to ensure that your student loan payments are being reported accurately and that your credit remains healthy. |

- Only borrow what you need.

- Understand the terms of each loan—interest rate, fees, and repayment schedule.

- Keep track of your loans using a spreadsheet or loan servicer portal.

- Make payments during school if possible to reduce interest.

- Explore all repayment plans before defaulting.

- Stay in contact with your loan servicer for updates and assistance.

Also Read :-What Is a Personal Loan And How Does It Work?

Conclusion

Student loans can be a helpful resource to fund your education, but they are a significant financial obligation. Understanding how they work—from application and disbursement to repayment and forgiveness—empowers you to borrow responsibly and manage your debt effectively.

Choosing the right type of loan, knowing your repayment options, and being proactive in managing your debt are key steps toward financial wellness during and after college.

FAQs

1. Can I get a student loan with bad credit?

Yes. Federal student loans do not require a credit check (except for PLUS loans). Private loans often require a co-signer if your credit is poor.

2. Do I need to repay student loans if I drop out?

Yes. Loan repayment begins after a grace period, even if you don’t complete your degree.

3. Can student loans be used for non-tuition expenses?

Yes. After tuition and fees are paid, the remaining funds can be used for books, housing, food, transportation, and other education-related costs.

4. Can I refinance my student loans?

Yes. Refinancing through a private lender can potentially lower your interest rate but may result in loss of federal loan protections.

5. Are student loans tax deductible?

In the U.S., you may deduct up to $2,500 of student loan interest on your taxes, subject to income limits.

6. What happens if I miss a payment?

Missing a payment can lead to delinquency and eventually default. Contact your servicer immediately to explore deferment, forbearance, or income-driven repayment.

7. Can student loans be forgiven for working in nonprofit organizations?

Yes. Under the PSLF program, you may qualify for forgiveness after 10 years of payments while working for a qualifying nonprofit.