What Are the Key Factors That Determine Your Loan Eligibility?

When applying for a loan, whether it’s a personal loan, mortgage, auto loan, or business loan, your eligibility plays a critical role in the approval process. Understanding what factors influence your loan eligibility can help you prepare better and improve your chances of getting approved. Lenders use a combination of financial, personal, and credit-related factors to determine whether you qualify for a loan, and at what terms.

In this article, we will discuss the key factors that determine your loan eligibility, providing you with all the essential information you need before you apply. Additionally, we’ll answer some frequently asked questions (FAQs) to further clarify the loan eligibility process and offer a clear conclusion with key takeaways.

Key Takeaways

- Credit score is one of the most important factors in loan eligibility.

- Income and employment stability show lenders that you can repay the loan.

- Existing debt and your DTI ratio will affect your ability to qualify for new loans.

- Collateral can be used to secure a loan, especially for those with lower credit scores.

- Your age and residency status are important for certain loan types.

- Loan eligibility varies based on the type of loan and lender, so it’s essential to understand the specific requirements for the loan you’re applying for.

Factors That Determine Loan Eligibility

1. Credit Score

Your credit score is perhaps the most important factor when determining your loan eligibility. Lenders use your credit score to assess how risky it is to lend money to you. The higher your credit score, the better your chances of securing a loan at favorable terms.

- What Is a Credit Score?

A credit score is a numerical representation of your creditworthiness, usually ranging from 300 to 850. It is calculated based on your credit history, including your payment history, the amount of debt you owe, the length of your credit history, and the types of credit accounts you have. - The Role of Credit Score in Loan Approval

Lenders rely on your credit score to gauge whether you will repay the loan on time. Generally, scores above 700 are considered good, while scores below 600 may indicate a higher risk to lenders. A higher score typically translates to lower interest rates and more favorable loan terms. - How to Improve Your Credit Score

Improving your credit score involves paying off existing debt, making timely payments, reducing credit card balances, and addressing any discrepancies in your credit report. Keep in mind that the higher your score, the easier it will be to secure loans with better terms.

2. Income Level

Your income plays a significant role in determining your loan eligibility. Lenders want to ensure that you have enough income to repay the loan, so they will typically require you to provide proof of income when applying. This helps them assess whether your monthly earnings are sufficient to cover the loan’s repayment schedule.

- What Income Do Lenders Consider?

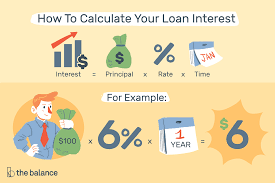

Lenders generally consider your salary, business income, investments, and other forms of regular income. If you’re self-employed, you may need to provide tax returns or financial statements to prove your income. - Debt-to-Income Ratio (DTI)

One of the key factors related to income is the Debt-to-Income (DTI) ratio. This is the percentage of your income that goes toward paying off debts. The lower your DTI, the better your chances of qualifying for a loan. Lenders typically prefer a DTI ratio of 36% or lower.

3. Employment History

Stability in your employment history shows lenders that you are financially reliable. A steady job with a consistent income reduces the risk for lenders, making you a more attractive borrower. Most lenders prefer applicants who have been employed in the same job for at least 2 years.

- Why Employment History Matters

Lenders want to know that you can sustain regular income over time. Frequent job changes or unemployment gaps might signal financial instability, which can lower your chances of loan approval.

4. Loan Amount and Type

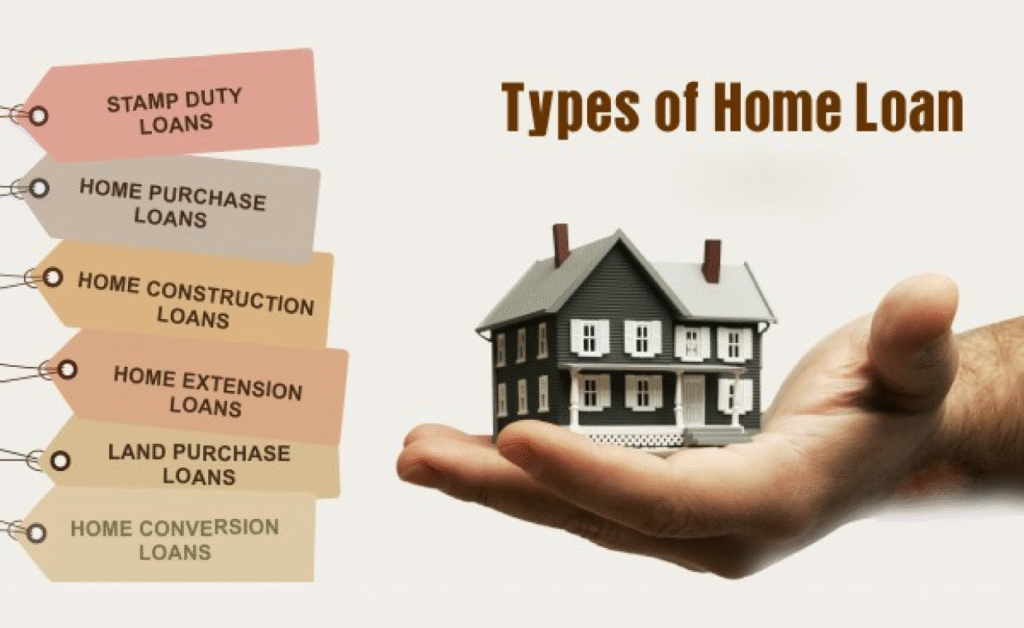

The type of loan you’re applying for, and the amount you need, will also influence your eligibility. Larger loan amounts may require more stringent eligibility criteria. For instance, mortgage loans typically have higher approval standards than smaller loans such as personal or auto loans.

- Secured vs. Unsecured Loans

Secured loans (such as mortgages or auto loans) are backed by collateral, which reduces the lender’s risk. Unsecured loans, such as personal loans, do not require collateral and often have stricter eligibility requirements. - Loan Term and Interest Rate

The term (how long you’ll be paying the loan) and the interest rate also factor into eligibility. Longer loan terms or higher interest rates can affect your monthly payment and debt burden, so lenders will assess whether you can afford the payments based on your financial situation.

5. Existing Debt

Lenders will also examine your existing debt when evaluating your loan eligibility. If you already have a significant amount of debt, such as credit card balances, student loans, or personal loans, it may affect your ability to repay new loans.

- Managing Debt Effectively

To improve your eligibility for new loans, it’s essential to manage your current debt responsibly. Avoid excessive borrowing, and aim to pay off high-interest debts first. A high level of existing debt can result in loan rejection or higher interest rates.

6. Collateral

For secured loans, collateral can be a determining factor. Collateral is an asset (e.g., a home or car) that the lender can seize if you fail to repay the loan. Offering valuable collateral can increase your chances of approval, especially if you have a less-than-ideal credit score.

- What Types of Collateral Can Be Used?

Common types of collateral include real estate, vehicles, jewelry, or savings accounts. The value of the collateral often needs to be equal to or greater than the loan amount.

7. Age and Citizenship Status

Your age and citizenship or residency status can affect your eligibility for certain types of loans. Most lenders require borrowers to be at least 18 years old, and some may only lend to citizens or permanent residents of a particular country.

- Loan Eligibility Based on Age

While 18 is typically the minimum age, some loans, such as student loans or specialized financial programs, may have different age requirements. - Residency or Citizenship Requirements

Lenders usually require you to be a legal resident of the country in which you’re applying. For example, a foreign national might face additional requirements or restrictions when applying for a mortgage in a new country.

Additional Insights on Loan Eligibility Factors

Let’s explore a few more intricate details on some of the factors mentioned, including how different scenarios can impact your eligibility and what you can do to mitigate challenges.

8. Financial History and Stability

While your credit score is a direct measure of your creditworthiness, lenders will also consider the broader context of your financial history. This includes your overall financial stability and your ability to manage various financial products over time.

- What Lenders Look For

Lenders are often interested in your savings history, consistency in payments, and how well you handle multiple financial obligations. For instance, if you have a history of regularly saving money in a bank account, this can be a positive signal. It demonstrates your ability to manage finances and create buffers for unexpected expenses, thus reducing the risk for lenders. - How to Improve Financial Stability

- Building a savings buffer can improve your financial history.

- Ensuring that you don’t rely heavily on credit cards and avoiding late payments or overdrafts can help stabilize your financial profile.

- Periodically checking your financial health and correcting errors on your credit report is another crucial step to ensure your records remain accurate.

9. Loan Purpose

The specific reason behind your loan application can influence its approval process. Certain loans, such as mortgages and auto loans, are generally easier to secure because they are backed by collateral. However, other loans, like personal loans or unsecured loans, depend more on your financial situation and less on the purpose for which you intend to use the funds.

- Specific Loan Purposes

For example, if you’re applying for a loan for home improvement or debt consolidation, lenders might treat it differently than a request for a personal vacation or luxury purchase. Lenders are often more inclined to approve loans that have clear, tangible benefits or improve your financial situation, as they view them as a safer investment. - Loans for Education

Student loans are a special category because they are often backed by the government or have unique repayment options that make them less risky for lenders. They may offer lower interest rates and more lenient repayment terms compared to other types of loans.

10. Lender-Specific Criteria

Each lender has its own set of criteria for loan eligibility, which means that one lender may approve your loan application, while another might reject it. Understanding the lender’s requirements is crucial when applying for a loan.

- Different Lenders, Different Standards

For instance, traditional banks may have stricter eligibility criteria, requiring higher credit scores and more robust income documentation. On the other hand, online lenders or peer-to-peer lenders may offer more flexibility, including lower credit score requirements or alternative ways to demonstrate income. Always research the specific eligibility standards of the lender you intend to approach. - Government-Backed Loans

Government loans (such as FHA or USDA loans) often have more lenient eligibility requirements, especially for first-time homebuyers. These programs may lower the bar for credit scores and offer lower down payments, making them an appealing option for borrowers with less-than-perfect financial histories.

The Loan Application Process

Now that we’ve explored the key factors that influence loan eligibility, it’s essential to understand the typical loan application process to further enhance your chances of success.

1. Pre-Qualification

Many lenders offer a pre-qualification process, where you can check whether you meet their basic eligibility requirements before officially applying for the loan. During pre-qualification, lenders will typically assess your credit score, income, and basic financial information to determine whether you could qualify for a loan.

- Why It Matters

Pre-qualification helps you get an idea of the loan terms you might be offered, as well as whether you have a good chance of approval. It’s a useful tool, especially for first-time borrowers, and it typically involves a soft credit check, meaning it won’t affect your credit score.

2. The Full Application Process

Once you’ve been pre-qualified and decided to move forward, the full application process will require more detailed documentation. This may include providing proof of identity, income, address, and your credit history.

- Documents Typically Required

- Proof of Identity (e.g., passport, driver’s license)

- Proof of Income (e.g., pay stubs, bank statements, tax returns)

- Proof of Address (e.g., utility bills)

- Credit Report (lenders may request this from credit bureaus)

- Employment Verification (recent pay slips or employer confirmation)

- Impact on Credit Score

A full loan application will usually involve a hard credit check, which may cause a slight dip in your credit score. However, the impact is typically temporary and minimal if you have a strong credit history.

3. Loan Underwriting and Approval

After submission, the lender will review your application, conduct a thorough credit evaluation, and verify all provided documents. This stage, called underwriting, determines the final decision on whether you’ll be approved or rejected for the loan.

- What Underwriters Look For

Underwriters assess your creditworthiness, income stability, debt level, and other eligibility factors discussed above. This is when the lender will closely examine all the key data to determine whether you present a low enough risk to be approved for the loan. - Conditional Approval

In some cases, lenders may issue conditional approval, which means your loan is tentatively approved but dependent on meeting certain conditions. These conditions might include providing additional documentation, paying off certain debts, or securing collateral for the loan.

4. Loan Closing or Disbursement

Once the loan is approved and all conditions are met, you’ll enter the closing phase (for secured loans, such as mortgages or car loans), where you’ll sign the final paperwork and receive the loan amount. In some cases, funds are transferred directly into your account, while in other cases, such as for home loans, the funds may go toward paying for the property itself.

Additional Strategies to Improve Loan Eligibility

While we’ve discussed various key factors in determining loan eligibility, let’s focus on actionable strategies you can apply to improve your chances of approval.

1. Maintain a Healthy Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you are using compared to your total available credit. Keeping this ratio below 30% is ideal for maintaining a good credit score. For example, if your credit card limit is $10,000, try to avoid carrying a balance over $3,000.

2. Pay Down High-Interest Debt First

If you have multiple debts, prioritize paying down high-interest debts such as credit card balances. This can improve both your credit score and your DTI ratio, making you more attractive to lenders.

3. Consider a Co-Signer

If your credit history or income doesn’t meet the lender’s requirements, consider asking someone with a stronger financial profile to co-sign the loan. This can increase your chances of approval, as the co-signer will be responsible for the loan if you fail to repay.

4. Save for a Larger Down Payment

For home loans, a larger down payment reduces the lender’s risk, and it can help you secure a loan even with a lower credit score. A larger down payment also shows the lender that you’re financially stable.

Also Read :-How Do I Apply for a Federal Student Loan in 2025?

Conclusion

Understanding the factors that determine your loan eligibility is crucial to improving your chances of getting approved. Your credit score, income level, employment history, debt load, and loan type all play a role in the decision-making process. By focusing on these key factors, you can better prepare yourself for the loan application process and increase the likelihood of approval.

FAQs

1. Can I apply for a loan with bad credit

Yes, you can apply for a loan with bad credit, but it may be more difficult to get approved. Lenders may offer higher interest rates or require a co-signer or collateral. Consider exploring specialized loans for people with poor credit, such as secured loans or payday loans.

2. How can I improve my chances of getting a loan?

To improve your chances of getting a loan, you should focus on increasing your credit score, reducing outstanding debts, providing proof of stable income, and maintaining a low DTI ratio. Having a good employment history and offering collateral for secured loans can also help.

3. How long does it take to get approved for a loan?

The time it takes to get approved for a loan depends on the type of loan and the lender. For instance, personal loans may be approved in as little as 24 hours, while mortgage loans can take weeks due to the complexity of the approval process.

4. What is the minimum credit score required for a loan?

The minimum credit score required varies depending on the type of loan and lender. Generally, a score above 600 is required for personal loans, while mortgages often require a score above 620.

5. Will my loan eligibility be affected if I have a bankruptcy on my record?

A bankruptcy can significantly impact your loan eligibility. However, if enough time has passed since your bankruptcy and you’ve taken steps to rebuild your credit, you may still be able to qualify for certain types of loans.

6. Can I get a loan if I am self-employed?

Yes, self-employed individuals can qualify for loans. However, they will need to provide additional documentation, such as tax returns, financial statements, or bank statements, to prove their income and financial stability.

7. What is the role of the Debt-to-Income (DTI) ratio in loan approval?

The DTI ratio helps lenders assess whether you can afford to repay a new loan based on your existing debts and income. A high DTI ratio may indicate that you are over-leveraged, which could reduce your chances of loan approval.