How Can You Successfully Navigate Stock Market Investments?

Navigating the stock market can seem daunting, especially for those who are new to investing. However, with the right knowledge, strategies, and a disciplined approach, you can achieve long-term success in the stock market. Stock market investments can offer tremendous opportunities to grow wealth, but they also come with risk. Therefore, it’s essential to understand the dynamics of the market and how to make informed decisions.

In this article, we’ll explore how you can successfully navigate stock market investments, providing practical advice on strategies, tips, and common pitfalls to avoid. Whether you’re a beginner or have some experience with the stock market, this guide will help you on your path to becoming a confident investor.

Key Takeaways

- Set clear, specific financial goals to guide your investment decisions.

- Educate yourself about the stock market and different investment strategies.

- Diversify your portfolio to manage risk and reduce the impact of losses in any one investment.

- Understand your risk tolerance and invest in line with your comfort level.

- Adopt a long-term mindset to ride out market fluctuations and achieve sustainable growth.

- Review your portfolio regularly and adjust it to keep it aligned with your goals.

- Avoid making emotional decisions based on market volatility. Stick to your plan and stay patient.

Understanding the Stock Market

Before diving into strategies and tips, it’s important to have a clear understanding of what the stock market is. The stock market is a platform where buyers and sellers come together to exchange shares of publicly traded companies. These exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, provide investors with the opportunity to buy shares of companies and potentially profit from their performance over time.

When you invest in stocks, you essentially own a small portion of the company you invest in. Stock prices fluctuate based on various factors, including company performance, market trends, economic conditions, and investor sentiment.

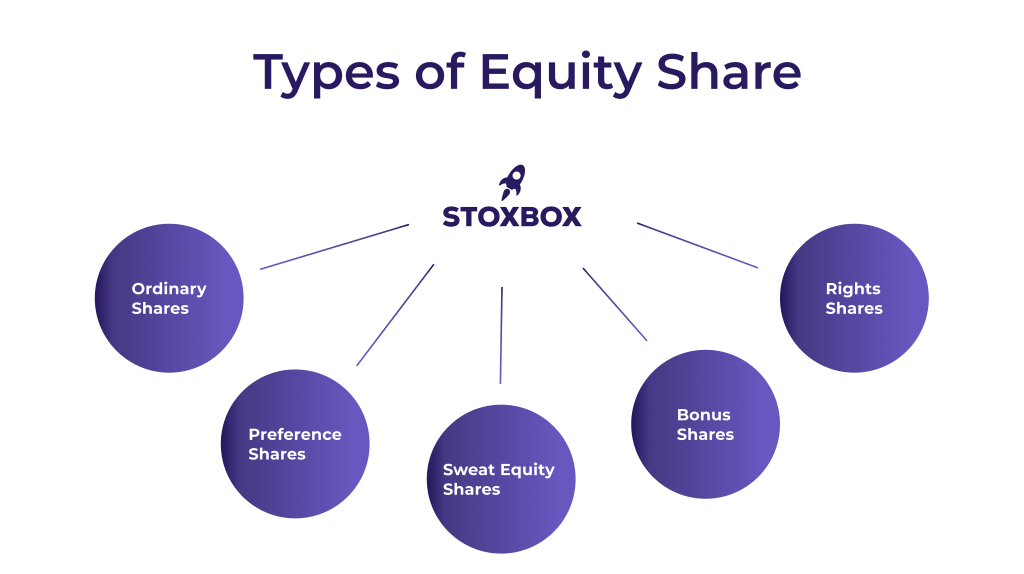

There are two main types of stock market investments:

- Individual Stocks: Investing in individual companies’ stocks means buying shares of specific companies. This type of investment is riskier but has the potential for higher rewards.

- Exchange-Traded Funds (ETFs) and Mutual Funds: These funds pool money from many investors to purchase a diversified portfolio of stocks. They are generally less risky than investing in individual stocks and can provide exposure to various sectors of the economy.

Steps to Navigate Stock Market Investments Successfully

- Set Clear Investment Goals

Before jumping into the stock market, it’s crucial to set clear investment goals. Do you want to build wealth for retirement? Save for a major purchase? Or perhaps you’re looking to generate passive income? Your goals will determine the types of investments you should consider.

For example, if your goal is long-term growth (e.g., retirement), you might focus on stocks with growth potential, such as tech companies or blue-chip stocks. On the other hand, if you’re seeking regular income, you might look into dividend-paying stocks or ETFs that focus on income-generating assets.

By setting specific, measurable, and time-bound goals, you’ll have a clear direction and avoid making emotional decisions based on short-term market fluctuations.

- Educate Yourself About the Market

Successful investing requires a solid understanding of how the stock market works. This involves learning about market fundamentals, investment strategies, and how to read financial statements. You should also understand key terms, such as:

- Bulls and Bears: A bull market refers to rising prices, while a bear market refers to falling prices.

- Dividends: Some companies pay dividends to shareholders as a portion of their profits.

- P/E Ratio: The price-to-earnings ratio measures the price of a stock relative to its earnings. A high P/E ratio could indicate overvaluation, while a low P/E ratio may indicate undervaluation.

You don’t need to become an expert, but having a strong foundational knowledge will give you confidence in your decisions and help you evaluate investment opportunities.

- Diversify Your Portfolio

One of the most important strategies for successful stock market investing is diversification. This means spreading your investments across different sectors, industries, and asset classes to reduce risk.

By diversifying, you’re less likely to experience significant losses if one particular stock or sector performs poorly. For example, if you invest only in technology stocks and the tech sector faces a downturn, your entire portfolio could be affected. However, if you also hold stocks in other sectors like healthcare, energy, or consumer goods, the overall impact on your portfolio may be reduced.

ETFs and mutual funds are excellent tools for diversification since they typically contain a basket of stocks from different sectors. Additionally, consider diversifying across asset classes by including bonds, real estate, or even international stocks in your portfolio.

- Understand Risk Tolerance

Every investor has a different level of risk tolerance, which refers to the amount of risk you’re willing to take on in pursuit of higher returns. It’s essential to assess your risk tolerance before investing, as this will guide your asset allocation decisions.

If you’re risk-averse, you may want to focus on more conservative investments, such as blue-chip stocks or bond funds. If you’re comfortable with risk and looking for higher returns, you might consider investing in growth stocks or emerging market funds.

Remember that risk tolerance can change over time. As you approach your financial goals or your investment horizon shortens (e.g., retirement), you may want to adjust your portfolio to reduce risk.

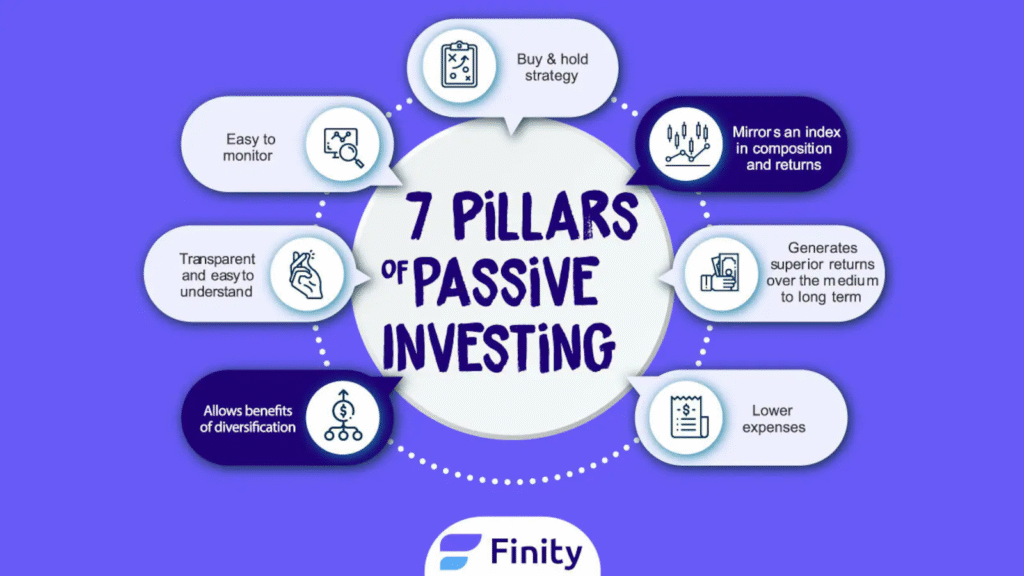

- Adopt a Long-Term Mindset

The stock market can be volatile in the short term, but historically, it has shown an upward trend over the long term. Successful investors understand that the market will have its ups and downs, but patience is key to achieving long-term gains.

When you invest in the stock market, focus on the long-term growth potential of your investments rather than short-term price movements. This mindset will help you avoid emotional decision-making during market fluctuations. Avoid the temptation to “time the market” by trying to predict short-term price movements—this strategy rarely works in the long run.

- Regularly Review Your Portfolio

Investing is not a one-time event; it’s an ongoing process. Regularly reviewing your portfolio ensures that you’re staying on track to meet your financial goals. You should check your portfolio’s performance and make adjustments as necessary, such as rebalancing it to maintain your desired asset allocation.

For example, if one stock or sector has performed well and now makes up a larger portion of your portfolio than you intended, it may be time to sell some shares and reinvest in other areas. Rebalancing helps manage risk and ensures that your portfolio remains aligned with your goals.

- Avoid Emotional Decision-Making

Emotional decision-making is one of the most common mistakes investors make in the stock market. Fear and greed can drive you to make impulsive decisions that may hurt your portfolio in the long run.

- Fear: During market downturns, it’s easy to panic and sell your investments at a loss. However, if you stick to your long-term strategy and avoid reacting to short-term market movements, you’ll likely fare better.

- Greed: Conversely, during bull markets, greed may tempt you to take on excessive risk or invest in “hot” stocks that are overvalued. While these investments may offer short-term gains, they also carry the potential for significant losses when the market corrects.

To avoid emotional decision-making, stick to your investment plan and regularly assess your goals. If you’re unsure about making a decision, consult a financial advisor who can offer objective advice.

Understanding Market Trends and Fundamentals

One of the critical elements to navigating the stock market successfully is understanding market trends and how to interpret fundamental data. Investors need to learn how to analyze the broader market conditions, as well as individual company metrics, to make informed decisions.

1. Market Trends

Stock markets move in cycles, and these cycles often consist of periods of expansion (bull markets) followed by periods of contraction (bear markets). By understanding these cycles, you can make better decisions about when to buy, hold, or sell.

- Bull Market: In a bull market, stock prices are generally rising, investor confidence is high, and economic conditions are positive. During these times, investors are more willing to take risks in hopes of earning higher returns.

- Bear Market: A bear market is characterized by falling stock prices, increased pessimism, and investor fear. These markets often result in significant losses for investors, but they can also present buying opportunities for long-term investors.

Understanding these phases can help you avoid panic during downturns and make strategic decisions about when to capitalize on buying opportunities.

2. Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health by studying its financial statements, earnings reports, management team, and overall business model. Key metrics you should pay attention to include:

- Earnings Per Share (EPS): This metric indicates how much profit a company makes for each share of stock. A rising EPS suggests that the company is becoming more profitable, while a declining EPS can signal trouble.

- Price-to-Earnings (P/E) Ratio: The P/E ratio compares a company’s stock price to its earnings. A high P/E ratio may indicate that the stock is overvalued, while a low P/E ratio could suggest undervaluation.

- Dividend Yield: For income-focused investors, dividend yield is important. This is the annual dividend payment expressed as a percentage of the stock’s price. A consistent or growing dividend yield can indicate financial stability.

- Debt-to-Equity Ratio: A high debt-to-equity ratio can be risky, as it indicates that the company is relying heavily on borrowed money to fund its operations.

By analyzing these metrics, investors can make decisions based on the fundamental strength or weakness of a company, helping to ensure that they’re not investing in companies with poor financial health.

3. Technical Analysis

While fundamental analysis focuses on a company’s financial health, technical analysis looks at historical market data—such as stock price movements, trading volume, and patterns—to predict future trends. By analyzing charts and indicators, technical analysts aim to identify short-term investment opportunities based on market behavior.

Some commonly used technical analysis tools include:

- Moving Averages: These help smooth out price fluctuations and identify the overall trend of a stock over a specified period (e.g., 50-day, 200-day).

- Support and Resistance Levels: These are price levels at which a stock tends to stop falling (support) or rising (resistance). They can help investors identify potential entry and exit points.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. An RSI above 70 suggests the stock may be overbought, while an RSI below 30 indicates it may be oversold.

For those comfortable with short-term trading, technical analysis can be an essential tool to identify trends and capitalize on market movements.

The Role of Behavioral Finance in Stock Market Investing

Behavioral finance examines how psychological factors and biases can influence investment decisions. While traditional financial theory assumes that investors act rationally, behavioral finance acknowledges that emotions, biases, and cognitive errors often play a significant role in market outcomes.

Here are some common behavioral biases that can negatively affect stock market investments:

- Overconfidence Bias: Investors may overestimate their ability to predict market movements, leading them to take on excessive risk or trade too frequently.

- Loss Aversion: This refers to the tendency to fear losses more than we value gains. Investors experiencing a loss may be reluctant to sell a losing position, hoping the stock will rebound—often to their detriment.

- Herd Behavior: During market rallies or crashes, many investors follow the crowd, buying into stocks that are trending upward or selling out of fear, even when it’s not in their best interest.

- Anchoring Bias: Investors may base their decisions on irrelevant information or past prices, ignoring more recent data or trends that would suggest a different course of action.

- Confirmation Bias: Investors tend to seek information that supports their existing beliefs and ignore data that contradicts their views. This can lead to poor decision-making and missed opportunities.

To mitigate these biases, it’s important to develop a disciplined investment strategy, regularly evaluate your decisions, and avoid making emotional or impulsive choices based on short-term market movements.

Tax Considerations in Stock Market Investing

Investing in the stock market comes with potential tax implications that can impact your returns. Understanding the basics of how taxes affect your investments is essential for maximizing your after-tax gains.

1. Capital Gains Tax

When you sell a stock for a profit, that profit is subject to capital gains tax. There are two types of capital gains tax:

- Short-Term Capital Gains: If you sell a stock that you’ve held for one year or less, the profit is taxed at your ordinary income tax rate.

- Long-Term Capital Gains: If you hold a stock for more than one year before selling, the profit is subject to a lower long-term capital gains tax rate. This rate varies depending on your income bracket, but it’s typically lower than the rate for short-term gains.

2. Dividends and Taxes

Dividend income is also taxable. However, qualified dividends (those paid by U.S. companies that meet certain criteria) are typically taxed at a lower rate than ordinary income. Non-qualified dividends, such as those from foreign companies, may be taxed at your ordinary income rate.

3. Tax-Advantaged Accounts

To minimize taxes, many investors use tax-advantaged accounts, such as:

- Individual Retirement Accounts (IRAs): Contributions to traditional IRAs may be tax-deductible, and the investments grow tax-deferred until withdrawal.

- Roth IRAs: Contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

- 401(k) Plans: Employer-sponsored retirement accounts that allow you to invest on a pre-tax basis, reducing your taxable income in the year you contribute.

By strategically investing through these accounts, you can reduce the overall tax burden on your stock market gains.

Risk Management and Hedging

Risk management is essential to navigate the stock market successfully. While it’s impossible to eliminate risk entirely, there are several strategies to mitigate potential losses:

- Stop-Loss Orders: A stop-loss order automatically sells a stock when its price falls to a certain level, helping to limit your losses.

- Hedging with Options: Investors can use options contracts (calls and puts) to hedge against potential losses in their stock holdings. Options allow you to buy or sell a stock at a predetermined price, providing some protection in volatile markets.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money into the market at regular intervals, regardless of market conditions. By doing so, you avoid trying to time the market and reduce the impact of short-term volatility.

- Rebalancing: Regularly rebalancing your portfolio ensures that you’re not overly exposed to any one asset class or sector. This helps manage risk by maintaining a well-diversified portfolio.

Also Read :-Which Investment Strategies Work Best in a Recession?

Conclusion

Successfully navigating the stock market requires patience, discipline, and a long-term approach. By setting clear goals, diversifying your investments, understanding your risk tolerance, and avoiding emotional decision-making, you can increase your chances of success in the stock market. Remember that investing is a journey, not a sprint, and staying focused on your objectives will help you ride out the inevitable ups and downs of the market.

Frequently Asked Questions (FAQs)

- What is the best way to start investing in the stock market? To start investing in the stock market, begin by setting clear financial goals, educating yourself about investing basics, and opening a brokerage account. Start small with diversified investments like ETFs or mutual funds, and gradually build your portfolio over time.

- How much money do I need to start investing in stocks? You don’t need a large amount to start investing. Many brokerage firms allow you to open an account with as little as $100, and some even offer fractional shares, which let you invest in expensive stocks with smaller amounts.

- How can I reduce the risk of losing money in the stock market? To reduce risk, diversify your portfolio across various asset classes and sectors, invest for the long term, and only invest money you can afford to lose. Additionally, regularly review your portfolio and make adjustments as needed.

- What is the best stock to invest in right now? There’s no one-size-fits-all answer to this question, as the best stocks depend on your financial goals, risk tolerance, and market conditions. Do thorough research or consult with a financial advisor before making investment decisions.

- What should I do if the stock market crashes? If the stock market crashes, avoid panic-selling. Stick to your long-term investment strategy, and use the downturn as an opportunity to buy quality stocks at a lower price. If you’re unsure, consult a financial advisor for guidance.

- Should I invest in individual stocks or mutual funds/ETFs? Both have pros and cons. Individual stocks offer the potential for higher returns but come with greater risk. Mutual funds and ETFs provide diversification, reducing risk but typically offering more moderate returns. Choose based on your risk tolerance and goals.

- How do I know when to sell my stocks? You should consider selling a stock if it no longer aligns with your investment goals, has reached an overvaluation, or if the company’s fundamentals have significantly deteriorated. However, avoid selling in response to short-term market fluctuations.