What Is The Best Travel Insurance For Visiting The USA In 2025?

Travel

Traveling to the United States in 2025? Whether you’re visiting for leisure, business, or study, securing the right travel insurance is crucial. The U.S. healthcare system can be expensive, and unexpected events can disrupt your plans. This comprehensive guide will help you navigate the best travel insurance options available for visitors to the USA.

Key Takeaways

- Comprehensive Coverage: Opt for plans that offer extensive medical and trip protection.

- Specialized Plans: Adventure travelers should consider providers like World Nomads for activity-specific coverage.

- Pre-existing Conditions: Ensure your plan addresses any existing health issues.

- Early Purchase: Secure insurance before your trip to maximize benefits.

- Provider Reputation: Choose reputable providers with positive customer reviews and reliable support.

Why Is Travel Insurance Essential for Visiting the USA?

The United States is known for its advanced medical facilities, but healthcare costs can be prohibitively high for visitors. Without adequate insurance, a single medical emergency can lead to substantial out-of-pocket expenses. Travel insurance provides:

- Emergency Medical Coverage: Protection against unforeseen medical expenses.

- Trip Cancellation/Interruption: Reimbursement for non-refundable trip costs if plans are altered due to unforeseen events.

- Baggage Loss/Theft: Compensation for lost or stolen belongings.

- Emergency Evacuation: Coverage for transportation to the nearest medical facility in case of an emergency.

Top Travel Insurance Providers for 2025

Based on coverage, customer reviews, and industry recognition, here are some of the leading travel insurance providers for visitors to the USA in 2025:

1. Travel Insured International – FlexiPAX

- Best For: Comprehensive coverage across various trip types.

- Highlights:

- $100,000 Trip Cancellation coverage.

- $100,000 Emergency Medical coverage.

- $500,000 Medical Evacuation.

- Options to add Cancel For Any Reason (CFAR) and Interruption For Any Reason (IFAR).

- Why Choose It: Offers flexibility and extensive coverage, making it suitable for international travelers, families, and luxury trips.

2. Allianz Travel Insurance

- Best For: Comprehensive coverage and frequent travelers.

- Highlights:

- Covers trip cancellations, medical emergencies, lost baggage, and rental car damage.

- 24/7 travel assistance with a global network of hospitals.

- Why Choose It: Trusted provider with customizable plans and robust customer support.

3. World Nomads

- Best For: Adventure travelers and digital nomads.

- Highlights:

- Covers over 200 adventure sports and activities.

- Provides emergency medical coverage, evacuation, and trip protection.

- Flexible policies that can be extended while traveling.

- Why Choose It: Ideal for thrill-seekers looking for specialized coverage.

4. AXA Assistance USA

- Best For: International travelers and families.

- Highlights:

- Affordable plans with generous medical expense limits.

- Coverage for trip cancellation, delays, and lost baggage.

- Family-friendly policies with discounts for children.

- Why Choose It: Provides excellent value for families and frequent international travelers.

5. Seven Corners – Trip Protection Choice

🌟 Seven Corners Trip Protection Choice: Comprehensive Travel Insurance for 2025

Traveling to the United States in 2025? Whether you’re visiting for leisure, business, or study, securing the right travel insurance is crucial. The Seven Corners Trip Protection Choice plan offers extensive coverage to ensure peace of mind during your travels.

✅ Key Benefits of the Trip Protection Choice Plan

1. Trip Cancellation & Interruption

- Trip Cancellation: Reimburses up to 100% of non-refundable trip costs if you need to cancel due to a covered reason.

- Trip Interruption: Provides up to 150% reimbursement for unused trip costs and additional transportation expenses if your trip is interrupted.

2. Emergency Medical Coverage

- Emergency Medical Expenses: Covers up to $500,000 for medical emergencies during your trip.

- Emergency Medical Evacuation: Provides up to $1,000,000 for evacuation to the nearest medical facility if necessary.

3. Baggage & Personal Effects

- Baggage Loss: Reimburses up to $2,500 for lost, stolen, or damaged baggage.

- Baggage Delay: Offers up to $500 for essential items if your baggage is delayed for more than 6 hours.

4. Travel Delay & Missed Connection

- Travel Delay: Provides up to $2,000 for additional expenses if your trip is delayed for more than 6 hours.

- Missed Connection: Reimburses up to $1,500 for additional transportation costs if you miss a connection due to a covered reason.

5. Optional Add-ons

- Cancel For Any Reason (CFAR): Reimburses up to 75% of non-refundable trip costs if you cancel for a reason not covered by the policy.

- Interruption For Any Reason (IFAR): Reimburses up to 75% of non-refundable trip costs if you interrupt your trip for a reason not covered by the policy.

📋 Coverage Summary

| Benefit | Coverage Amount |

|---|---|

| Trip Cancellation | Up to 100% of trip cost |

| Trip Interruption | Up to 150% of trip cost |

| Emergency Medical Expenses | Up to $500,000 |

| Emergency Medical Evacuation | Up to $1,000,000 |

| Baggage Loss | Up to $2,500 |

| Baggage Delay | Up to $500 |

| Travel Delay | Up to $2,000 |

| Missed Connection | Up to $1,500 |

| CFAR | Up to 75% of non-refundable trip cost |

| IFAR | Up to 75% of non-refundable trip cost |

📌 Why Choose Seven Corners Trip Protection Choice?

- Comprehensive Coverage: Offers a wide range of benefits to protect against unforeseen events.

- Flexible Add-ons: Optional CFAR and IFAR add-ons provide additional flexibility.

- High Coverage Limits: Generous coverage amounts for medical expenses and trip interruptions.

- Reputable Provider: Seven Corners is a trusted name in the travel insurance industry.

Factors to Consider When Choosing Travel Insurance

When selecting a travel insurance plan, consider the following factors:

- Trip Duration: Short-term vs. long-term travel may require different coverage.

- Activities Planned: Engaging in adventure sports may necessitate specialized coverage.

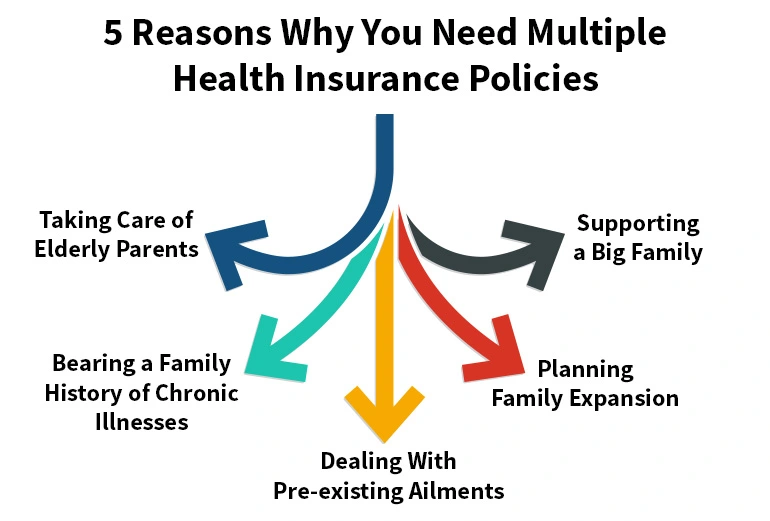

- Pre-existing Conditions: Ensure the plan covers any existing health issues.

- Destination: Some plans offer coverage tailored to specific regions or countries.

- Budget: Balance between premium costs and the extent of coverage.

Also Read :-What Is the Best Life Insurance Policy for Your Needs in 2025?

Conclusion

Selecting the best travel insurance for your visit to the USA in 2025 depends on your specific needs and circumstances. Providers like Travel Insured International, Allianz, World Nomads, AXA Assistance USA, and Seven Corners offer a range of plans catering to different traveler profiles. Carefully assess your trip details, health considerations, and budget to choose the most suitable coverage.

7 Frequently Asked Questions (FAQs)

1. Is travel insurance mandatory for visiting the USA?

While not mandatory, travel insurance is highly recommended due to the high cost of healthcare in the U.S. Some visa types may require proof of insurance.

2. Can I purchase travel insurance after arriving in the USA?

Yes, many providers offer the option to purchase insurance after arrival, but it’s advisable to secure coverage before your trip begins.

3. Does travel insurance cover COVID-19-related issues?

Coverage for COVID-19 varies by provider. Some plans offer coverage for trip cancellations or medical expenses related to COVID-19.

4. Are pre-existing medical conditions covered?

Some plans offer coverage for pre-existing conditions if certain requirements are met, such as purchasing insurance within a specified time frame after booking your trip.

5. What is Cancel For Any Reason (CFAR) coverage?

CFAR allows you to cancel your trip for reasons not typically covered by standard policies and receive partial reimbursement.

6. How do I file a claim?

Claims can typically be filed online through the insurance provider’s website or by contacting their customer service.

7. Can I extend my coverage while in the USA?

Some providers offer the option to extend your coverage while traveling, but it’s essential to confirm this before purchasing the policy.