What’s the Safest Way to Trade Forex in 2025?

The foreign exchange (forex) market remains one of the most liquid and dynamic financial markets globally, attracting both seasoned professionals and retail traders. However, with its vast opportunities come significant risks. In 2025, ensuring safety in forex trading requires a combination of strategic planning, adherence to regulations, and leveraging technological advancements. This comprehensive guide delves into the safest approaches to forex trading in 2025, offering insights into risk management, regulatory compliance, and the utilization of modern trading tools.

Key Takeaways

- Regulatory Compliance: Ensure brokers are authorized by relevant authorities.

- Risk Management: Implement strategies like stop-loss orders and appropriate position sizing.

- Technological Utilization: Leverage tools like AI-driven platforms and demo accounts.

- Continuous Education: Engage in ongoing learning to adapt to market changes.

Understanding the Forex Market in 2025

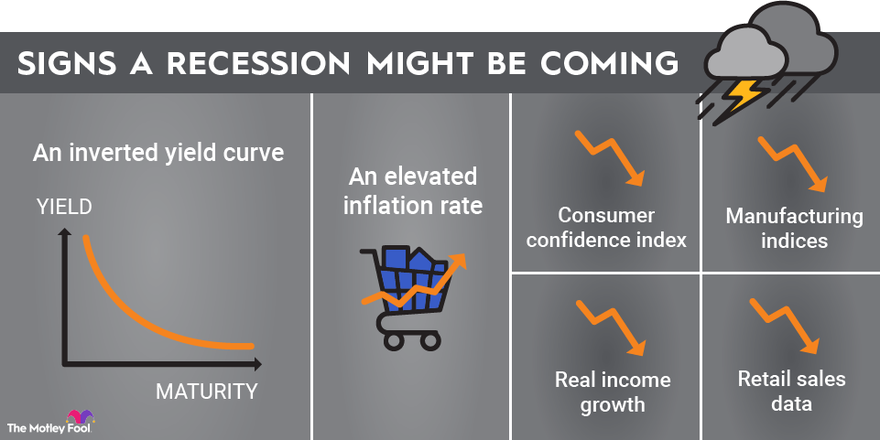

The forex market in 2025 is characterized by increased volatility, influenced by geopolitical events, economic policies, and technological advancements. Central banks’ monetary policies, such as interest rate changes and quantitative easing, play a pivotal role in currency valuation. Additionally, geopolitical tensions and trade agreements can lead to significant market fluctuations.

Traders must stay informed about global events and economic indicators to anticipate market movements. Utilizing economic calendars and subscribing to reputable financial news sources can aid in making informed trading decisions.

Regulatory Landscape and Compliance

Regulatory bodies worldwide have implemented measures to protect retail traders and ensure market integrity. In the United States, the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) have set leverage limits to mitigate excessive risk-taking. Similarly, the European Securities and Markets Authority (ESMA) enforces strict regulations on forex trading within the European Union.

In India, the Reserve Bank of India (RBI) oversees forex trading activities. Traders must ensure that their brokers are authorized by the RBI to operate within the country. Engaging with unauthorized platforms can lead to legal repercussions and financial losses.

Choosing the Right Forex Broker

Selecting a reputable forex broker is crucial for safe trading. Traders should consider the following factors when choosing a broker:

- Regulation: Ensure the broker is regulated by recognized authorities like the FCA, CFTC, or RBI.

- Trading Platform: The broker should offer a user-friendly and reliable trading platform, such as MetaTrader 5 or proprietary platforms with advanced charting tools.

- Leverage Options: Be cautious of brokers offering excessively high leverage, as it can amplify both gains and losses.

- Customer Support: Opt for brokers that provide responsive customer support and educational resources.

Risk Management Strategies

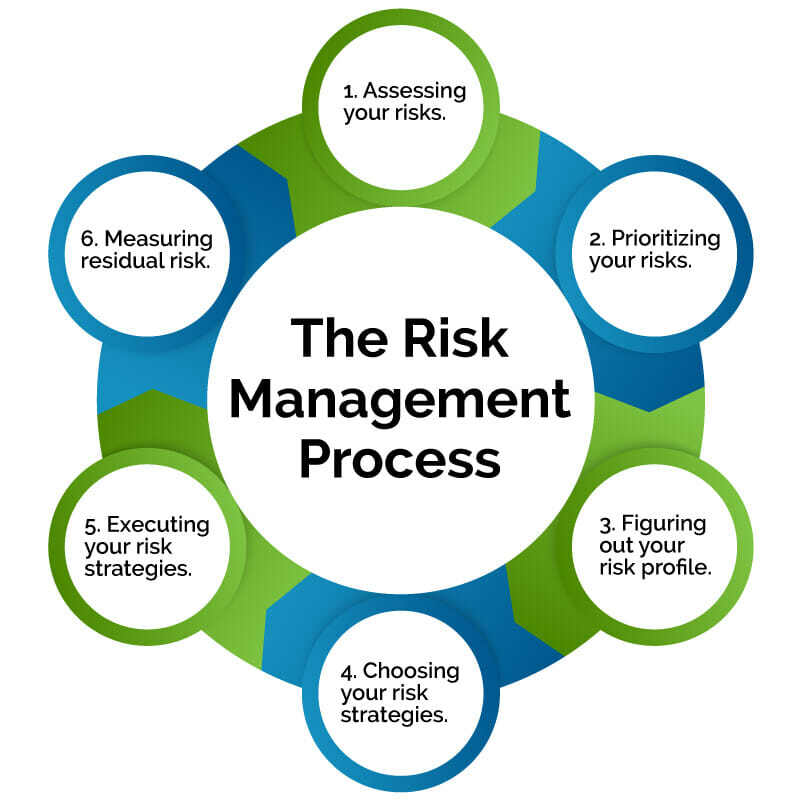

Effective risk management is the cornerstone of safe forex trading. Traders should implement the following strategies:

- Position Sizing: Determine the appropriate trade size based on account balance and risk tolerance.

- Stop-Loss Orders: Always set stop-loss orders to limit potential losses.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio, typically 1:2 or higher.

- Diversification: Avoid concentrating trades on a single currency pair; diversify to spread risk.

| Strategy | Description | Purpose |

|---|---|---|

| Position Sizing | Determine trade size based on account balance and risk tolerance. | To control potential loss and preserve capital. |

| Stop-Loss Orders | Set predefined exit points to automatically close losing trades. | To limit losses and avoid emotional decision-making. |

| Risk-Reward Ratio | Target a reward that outweighs the risk, typically aiming for 1:2 or higher. | To ensure long-term profitability. |

| Diversification | Spread trades across different currency pairs. | To reduce exposure to a single market movement. |

Technological Tools and Platforms

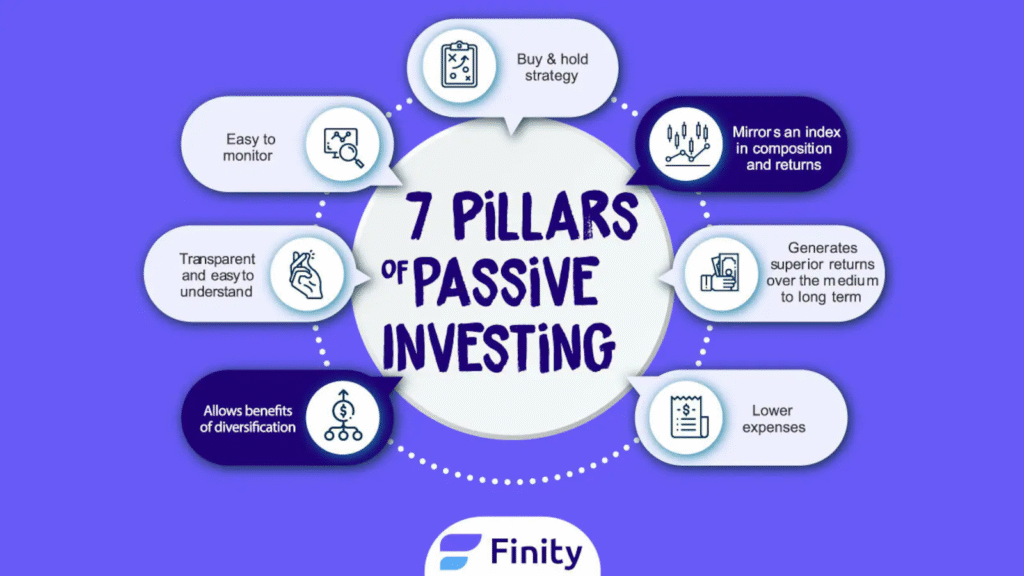

Advancements in technology have significantly enhanced the safety and efficiency of forex trading by providing traders with powerful tools and platforms. Automated trading systems, such as ZuluTrade and eToro, allow users to implement copy trading strategies by replicating the trades of experienced investors, reducing the influence of emotion and human error. Artificial Intelligence (AI) has further transformed trading by enabling platforms to analyze vast amounts of market data, identify patterns, generate predictive insights, and manage risks more effectively than manual methods. Demo accounts, offered by most major brokers, allow traders to practice and test strategies under real market conditions without risking real capital, making them invaluable for beginners and professionals alike. In addition, platforms equipped with risk management tools—such as stop-loss, take-profit, and margin alerts—help protect traders from significant losses and enforce disciplined trading practices. Technical analysis platforms, like TradingView and MetaTrader, offer advanced charting and indicators that support informed decision-making. Traders also benefit from economic calendar tools, which provide real-time schedules of major financial events, helping them anticipate market volatility. With mobile trading apps, users can monitor and execute trades from anywhere, ensuring constant access to markets. Furthermore, social trading platforms foster community learning by allowing users to share insights and follow other traders. Real-time information from news aggregators like Bloomberg and Reuters ensures traders stay updated on global financial developments. Finally, cloud-based platforms provide flexible access to accounts and tools from any device, enhancing security and convenience.

Advancements in technology have introduced various tools to enhance trading safety:

- Automated Trading Systems: Platforms like ZuluTrade and eToro offer copy trading features, allowing traders to mimic the strategies of experienced traders.

- Artificial Intelligence (AI): AI-driven platforms can analyze vast amounts of data to identify trading opportunities and manage risks.

- Demo Accounts: Utilize demo accounts to practice strategies without risking real capital.

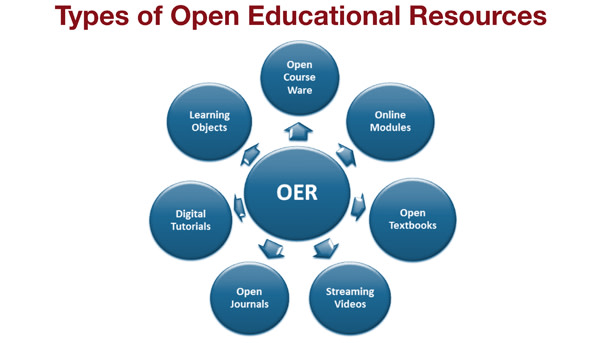

Educational Resources and Continuous Learning

Continuous education is essential for success in the dynamic and ever-evolving forex market. As trading strategies, tools, and market conditions change over time, staying updated through structured learning and community engagement can significantly enhance a trader’s performance. One of the most accessible ways to build foundational and advanced knowledge is through online courses, which cover topics such as fundamental and technical analysis, risk management, and trading psychology. Platforms like Coursera, Babypips, and Udemy offer structured learning paths created by industry professionals. In addition to courses, traders can benefit from webinars and live workshops hosted by experienced traders, brokerage firms, and financial institutions. These events often provide real-time market analysis, strategy breakdowns, and Q&A sessions that allow participants to gain practical insights. Trading communities—such as forums, social media groups, and platforms like Reddit or Discord—also play a crucial role by enabling traders to share experiences, exchange strategies, and stay informed about market trends. Furthermore, regularly reading financial news, subscribing to market analysis newsletters, and following reputable trading blogs or YouTube channels can keep traders informed of both macroeconomic developments and niche strategies. As forex trading requires both skill and adaptability, investing time in continuous learning not only sharpens decision-making but also helps build the confidence needed to navigate market uncertainties.

Continuous education is vital for adapting to the evolving forex market:

- Online Courses: Enroll in reputable online courses that cover fundamental and technical analysis.

- Webinars and Workshops: Participate in webinars and workshops conducted by experienced traders and financial institutions.

- Trading Communities: Join online trading communities to share insights and learn from peers.

Common Mistakes to Avoid

New and even experienced traders often fall into certain pitfalls:

- Overleveraging: Using high leverage can lead to significant losses.

- Ignoring Economic Indicators: Failing to consider economic reports can result in unexpected market movements.

- Emotional Trading: Letting emotions drive trading decisions can lead to impulsive actions and losses.

- Lack of a Trading Plan: Trading without a clear plan can result in inconsistent performance.

Understanding the Forex Market in 2025

The forex market in 2025 is far more sophisticated than it was a decade ago. Rapid advancements in technology, the rise of retail trading platforms, and evolving geopolitical dynamics have made it crucial for traders to understand the market’s underpinnings.

Volatility remains a hallmark of the forex market. Fluctuations in currency prices can happen quickly and dramatically due to geopolitical instability, natural disasters, monetary policy decisions, or even changes in international trade agreements. Events such as Brexit, the US-China trade war, and the COVID-19 pandemic have illustrated how external factors can have widespread impacts on currency values.

In 2025, the forex market is also shaped by global macroeconomic factors such as inflation, central bank interest rates, and employment data. These fundamentals serve as the bedrock of currency trading, and staying informed about these indicators is vital for traders aiming to avoid the dangers of sudden market shifts.

Regulatory Landscape and Compliance

To trade safely, understanding the regulatory environment is crucial. Forex trading operates under strict regulations in many regions to protect traders and ensure market integrity. It’s essential to stay updated with regulations that could impact the way you trade.

Global Regulatory Authorities

Several regulatory bodies oversee forex markets worldwide to protect traders. These include:

- U.S. (CFTC, NFA): The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate forex trading in the U.S. They ensure brokers adhere to strict risk management practices and that retail traders are protected.

- EU (ESMA): The European Securities and Markets Authority (ESMA) enforces guidelines across the EU, focusing on leverage restrictions and ensuring that brokers follow best practices. For example, they’ve imposed limits on leverage to safeguard traders from excessive risk.

- U.K. (FCA): The Financial Conduct Authority (FCA) is one of the most trusted regulatory bodies in the world. The FCA ensures that forex brokers operating in the UK follow strict guidelines to protect traders and uphold market transparency.

- India (RBI): In India, the Reserve Bank of India (RBI) has set strict rules regarding forex trading. While forex trading is legal, traders must ensure they deal with licensed and regulated brokers to avoid fraudulent activity.

To stay safe, ensure that your forex broker is licensed by these authoritative bodies. Regulatory compliance reduces the risk of fraud and guarantees that the broker is accountable to a higher standard of operation.

Choosing the Right Forex Broker

Selecting the right forex broker is paramount for ensuring a safe trading experience. Brokers act as intermediaries between traders and the forex market, and their role is critical in determining the quality of the trading experience. The wrong choice can result in hefty losses or exposure to market manipulation.

Key Considerations When Choosing a Broker

- Regulation: As mentioned, always opt for brokers that are regulated by reputable authorities like the FCA, CFTC, and ESMA. Ensure that their operations are transparent and they comply with the legal requirements of the countries in which they operate.

- Customer Support: A reputable broker should offer excellent customer service with a dedicated support team that can be contacted through multiple channels such as live chat, email, and phone. Accessibility to help ensures you can resolve issues promptly.

- Platform and Tools: Brokers should offer intuitive trading platforms such as MetaTrader 5, cTrader, or their proprietary platforms. Platforms should also provide advanced tools such as automated trading, backtesting, and algorithmic trading options.

- Leverage and Spreads: Excessive leverage is a common cause of significant losses in the forex market. It’s recommended to use brokers who offer moderate leverage options to minimize risk. Also, check the spreads, as lower spreads can help save on trading costs over time.

- Account Types: Ensure the broker offers a variety of account types, including demo accounts, so you can practice without risking real money. Additionally, ensure they offer competitive margin levels suited to your trading style.

Risk Management Strategies

In the fast-paced and highly leveraged forex market, managing risk is the single most important factor in ensuring long-term profitability and survival. Here are some effective risk management strategies to consider:

Position Sizing

Before executing a trade, determine the amount of capital you’re willing to risk on each trade. Position sizing ensures that a single losing trade won’t drain your entire trading account. It’s often recommended to risk only 1–2% of your account balance per trade.

Stop-Loss Orders

A stop-loss order is a tool that automatically closes a trade at a pre-set level of loss. This is essential for limiting potential losses when markets move unexpectedly. It’s important to set stop-loss orders according to the volatility of the currency pair you are trading.

Take-Profit Orders

Similarly, take-profit orders allow traders to lock in profits when a predetermined price target is reached. This prevents traders from being too greedy and ensures that they lock in profits before a market reversal occurs.

Risk-to-Reward Ratio

Every trade should have a favorable risk-to-reward ratio, typically 1:2 or higher. This means for every dollar you risk, you aim to make two dollars. This strategy can help ensure long-term profitability even if you don’t win every trade.

Technological Tools and Platforms

| Category | Tool/Platform Examples | Purpose | Usage Context |

|---|---|---|---|

| Communication Tools | Zoom, Microsoft Teams, Slack, Google Meet | Video conferencing, messaging, collaboration | Remote work, online meetings, team chat |

| Project Management | Trello, Asana, Jira, Monday.com | Task tracking, workflow organization, collaboration | Agile development, project tracking |

| Cloud Storage | Google Drive, Dropbox, OneDrive, iCloud | File storage, sharing, backup | File management, team access, remote storage |

| Learning Platforms | Coursera, Udemy, Khan Academy, Moodle | Online education, training | E-learning, professional development |

| Development Tools | GitHub, GitLab, Visual Studio Code, Docker | Software development, version control | Programming, DevOps, collaboration |

| Design Tools | Adobe Creative Cloud, Canva, Figma, Sketch | Graphic/UI/UX design | Creative design, web/app prototyping |

| Data & Analytics | Google Analytics, Tableau, Power BI, Excel | Data visualization, reporting, decision-making | Business analysis, marketing, finance |

| Marketing Platforms | Mailchimp, HubSpot, Hootsuite, SEMrush | Email campaigns, social media, SEO | Digital marketing, brand promotion |

| E-commerce Platforms | Shopify, WooCommerce, Magento, BigCommerce | Online selling, payment processing | Retail, small business, digital storefronts |

| Cybersecurity Tools | Norton, McAfee, Bitdefender, Cloudflare | Protection from malware, DDoS, data breaches | IT security, personal and enterprise use |

| AI & Automation Tools | ChatGPT, Zapier, UiPath, IBM Watson | Process automation, virtual assistants, AI tasks | Business automation, customer support, R&D |

Technology plays an increasingly significant role in forex trading in 2025. New tools and platforms can help enhance the safety and efficiency of trading. Here’s a look at some of the best tools available:

Automated Trading Systems

Automated trading systems, or Expert Advisors (EAs) on MetaTrader 4/5, allow traders to execute trades automatically based on pre-set conditions. This removes emotional decision-making from trading and can help traders stick to a consistent strategy.

Copy Trading Platforms

Platforms like eToro, ZuluTrade, and Covesting offer the ability to copy the trades of successful and experienced traders. This can help beginners learn trading strategies while benefiting from the expertise of seasoned professionals.

AI Trading Bots

AI-driven trading platforms, such as those offered by platforms like Tradestation, are equipped with machine learning algorithms that can process vast datasets to make informed trading decisions. These systems are capable of identifying patterns, trends, and anomalies that human traders may miss.

Mobile Trading Apps

Mobile trading apps are vital for traders who wish to stay connected to the market at all times. These apps offer real-time data, charting tools, and quick trade execution, making it easier to manage trades while on the go.

Educational Resources and Continuous Learning

No matter how experienced you are, continuous learning is essential for staying ahead in the forex market. The forex market evolves quickly, and staying informed about new trading strategies, regulations, and technology is key to maintaining safety.

Courses and Online Learning Platforms

Numerous online platforms offer comprehensive forex trading courses. Websites like BabyPips, Udemy, and Coursera offer tutorials on everything from the basics of forex trading to advanced strategies.

Webinars and Workshops

Many brokers and financial institutions host regular webinars and workshops where traders can learn directly from industry experts. These events are a great way to pick up new skills, ask questions, and gain practical knowledge.

Reading Trading Books

Books like “Trading in the Zone” by Mark Douglas and “The Little Book of Currency Trading” by Kathy Lien provide valuable insights into trading psychology and technical analysis. Educating yourself through reading is a great way to strengthen your trading knowledge.

Common Mistakes to Avoid

Even experienced traders can make mistakes that jeopardize their success. Here are some common pitfalls to avoid:

- Overleveraging: Using excessive leverage can amplify both gains and losses. Always understand the risks associated with leverage and use it wisely.

- Ignoring Risk Management: Failing to implement risk management tools like stop-loss orders or ignoring proper position sizing can result in large, uncontrollable losses.

- Chasing Losses: After a losing trade, some traders try to “chase” their losses by overtrading, which often results in bigger losses. Stick to your trading plan and avoid emotional decisions.

- Not Diversifying: Focusing too much on one currency pair can be risky. Diversify your trades across different assets to spread risk.

Also Read:- Mastering The Crypto Market: The Ultimate Investment Strategy

Conclusion

Trading forex in 2025 offers numerous opportunities but also presents significant risks. By adhering to regulatory guidelines, choosing reputable brokers, implementing robust risk management strategies, leveraging technological tools, and committing to continuous education, traders can navigate the forex market safely and effectively.

FAQs

1. What is the safest leverage to use in forex trading?

A leverage ratio of 10:1 or 20:1 is considered safe for most retail traders. It allows for potential profits while managing risk.

2. How can I verify if a forex broker is regulated?

Check the broker’s website for regulatory information and verify it with the relevant regulatory authority’s website.

3. Is it necessary to use a trading platform with AI capabilities?

While not mandatory, AI-driven platforms can provide advanced analytics and trading signals, enhancing decision-making.

4. Can I trade forex legally in India?

Yes, but ensure that the broker is authorized by the RBI to operate within India.

5. What is the role of economic indicators in forex trading?

Economic indicators provide insights into a country’s economic health, influencing currency values.

6. How can I manage risk effectively in forex trading?

Implement strategies like setting stop-loss orders, diversifying trades, and using appropriate position sizes.

7. Are demo accounts useful for beginners?

Yes, demo accounts allow beginners to practice trading without risking real money.