What Are the Best Strategies for Risk Management in Investments?

Introduction

In the dynamic world of investing, risk is an inherent companion. Whether you’re a seasoned investor or just starting, understanding and managing risk is crucial to achieving long-term financial success. This comprehensive guide delves into the best strategies for risk management in investments, providing you with the tools and knowledge to navigate the complexities of the financial markets.

Key Takeaways

- Diversification and asset allocation are fundamental strategies for managing investment risk.

- Regular portfolio rebalancing ensures that your investments remain aligned with your risk profile.

- Stop-loss orders and hedging can provide additional layers of protection against market volatility.

- Assessing your risk tolerance and seeking professional advice can enhance your risk management efforts.

- Continuous education and staying informed about market conditions are vital for effective risk management.

Top Risk Management Strategies for Investors

1. Diversify Your Portfolio

Spreading investments across various asset classes—such as stocks, bonds, real estate, and commodities—can reduce exposure to any single economic event. This approach helps balance potential losses in one area with gains in another, thereby lowering overall portfolio volatility.

2. Asset Allocation Based on Risk Tolerance

Allocate your investments according to your risk tolerance, investment horizon, and financial goals. For instance, younger investors with a longer time horizon might favor equities for growth, while those nearing retirement may prefer bonds for stability and income.

3. Regular Portfolio Rebalancing

Over time, market fluctuations can cause your portfolio to drift from its original asset allocation. Regular rebalancing—typically annually or after significant market movements—ensures that your investments remain aligned with your risk profile and objectives.

4. Implement Stop-Loss and Limit Orders

Utilize stop-loss orders to automatically sell a security when it reaches a predetermined price, limiting potential losses. Similarly, limit orders can help lock in profits by setting a target price for selling. These tools are particularly useful in volatile markets.

5. Hedging with Derivatives

Advanced investors may use financial instruments like options and futures to hedge against specific risks, such as adverse price movements in commodities or currencies. While these strategies can provide protection, they also introduce complexity and require a thorough understanding.

6. Maintain an Emergency Fund

Before investing, ensure you have an emergency fund covering 6–12 months of living expenses. This safety net allows you to avoid liquidating investments during market downturns to cover unexpected costs, thereby preserving your investment strategy.

7. Adopt Dollar-Cost Averaging

Investing a fixed amount at regular intervals, regardless of market conditions, can reduce the impact of market volatility. This strategy, known as dollar-cost averaging, helps avoid the pitfalls of market timing and can lower the average cost per share over time.

Understanding Investment Risk

Investment risk refers to the possibility of losing some or all of your original investment or not achieving the expected returns. It’s an inherent aspect of investing, influenced by various factors such as market fluctuations, economic conditions, and individual investment choices. Understanding these risks is crucial for making informed investment decisions and managing potential downsides effectively.

Types of Investment Risks

- Market Risk (Systematic Risk)

This is the risk of losses due to factors that affect the entire market, such as economic downturns, political instability, or natural disasters. It cannot be eliminated through diversification. - Credit Risk (Default Risk)

The risk that a borrower will default on their debt obligations, leading to potential losses for the lender or investor. This is particularly relevant for bondholders. - Liquidity Risk

The risk that an investor may not be able to buy or sell investments quickly enough to prevent or minimize a loss. This is especially pertinent in markets with fewer participants or for assets that are not frequently traded. - Interest Rate Risk

The risk that changes in interest rates will affect the value of investments, particularly bonds. When interest rates rise, bond prices typically fall, and vice versa. - Inflation Risk (Purchasing Power Risk)

The risk that the return on an investment will not keep up with inflation, eroding purchasing power over time. This is a significant concern for fixed-income investments. - Currency Risk (Exchange Rate Risk)

The risk of loss due to changes in exchange rates when investing in foreign assets. Fluctuations in currency values can impact the returns on international investments. - Reinvestment Risk

The risk that income from an investment, such as interest or dividends, will have to be reinvested at a lower rate than the original investment. - Concentration Risk

The risk of loss due to having a large portion of an investment portfolio in a single asset or sector. Diversification helps mitigate this risk. - Political Risk

The risk that political decisions or instability will affect the value of investments. This includes changes in tax laws, trade tariffs, or expropriation of assets. - Country Risk

The risk that a country will default on its debt obligations or experience economic instability, affecting investments in that country. - Model Risk

The risk of inaccuracy in financial models used to make investment decisions, potentially leading to incorrect valuations or strategies. - Event Risk

The risk of a significant event, such as a merger, acquisition, or natural disaster, negatively impacting an investment’s value.

Managing Investment Risk

Effective risk management involves understanding the various types of risks and implementing strategies to mitigate them. This includes:

Risk Assessment Tools: Employing metrics like Value at Risk to quantify potential losses and make informed decisions.

Diversification: Spreading investments across different asset classes, sectors, and geographical regions to reduce exposure to any single risk.

Asset Allocation: Determining the optimal mix of asset classes based on an investor’s risk tolerance, investment goals, and time horizon.

Regular Monitoring and Rebalancing: Continuously reviewing and adjusting the investment portfolio to maintain the desired risk profile.

Hedging: Using financial instruments like options or futures contracts to offset potential losses in investments.

Best Strategies for Risk Management in Investments

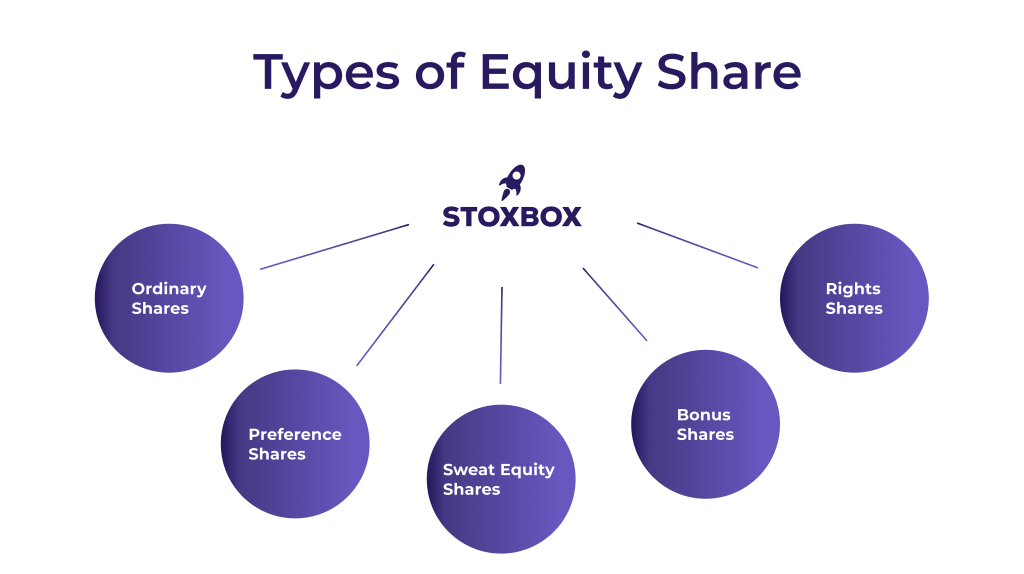

- Diversification

Diversification involves spreading your investments across various asset classes, sectors, and geographical regions to reduce exposure to any single risk. By holding a mix of investments, the overall risk of the portfolio is minimized because different assets often perform differently under various market conditions.

- Asset Allocation

Asset allocation is the process of determining the optimal mix of asset classes (such as equities, bonds, and cash) based on an investor’s risk tolerance, investment goals, and time horizon. Regularly reviewing and adjusting your asset allocation ensures that your portfolio remains aligned with your financial objectives and risk profile.

- Regular Portfolio Rebalancing

Portfolio rebalancing is the process of realigning the weightings of a portfolio’s assets to maintain a desired risk level and investment strategy. Over time, market fluctuations can cause the proportions of different assets to shift, potentially increasing risk or deviating from financial goals. Rebalancing helps restore the original asset allocation, ensuring the portfolio remains aligned with the investor’s objectives.

Why Is Portfolio Rebalancing Important?

- Maintains Desired Risk Profile: Asset values change over time, and without rebalancing, a portfolio may become more heavily weighted in higher-risk assets, increasing overall risk exposure.

- Aligns with Financial Goals: Regular rebalancing ensures that the portfolio continues to reflect the investor’s financial objectives, whether it’s retirement, education, or other goals.

- Enhances Long-Term Performance: By systematically buying underperforming assets and selling overperforming ones, rebalancing can help in “buying low and selling high,” potentially improving long-term returns.

How Often Should You Rebalance?

- Annually: A common approach is to review and adjust the portfolio once a year, which balances the need for alignment with the risk of incurring transaction costs.

- Semi-Annually or Quarterly: In volatile markets, more frequent rebalancing may be appropriate to maintain desired asset allocations.

- Threshold-Based: Some investors choose to rebalance when an asset class deviates from its target allocation by a certain percentage, such as 5%.

How to Rebalance Your Portfolio

- Assess Current Allocation: Determine the current value of each asset class in your portfolio.

- Compare with Target Allocation: Evaluate how the current allocation compares to your desired asset mix.

- Buy or Sell Assets: Adjust the portfolio by buying underrepresented assets and selling overrepresented ones to realign with the target allocation.

- Consider Costs and Taxes: Be mindful of transaction fees and potential capital gains taxes when making adjustments.

Considerations and Potential Drawbacks

- Transaction Costs: Frequent rebalancing can incur brokerage fees, which may erode returns.

- Tax Implications: Selling investments may trigger capital gains taxes, especially in taxable accounts.

- Emotional Decision-Making: Rebalancing based on short-term market movements can lead to reactive decisions rather than strategic ones.

Visual Example

Consider a portfolio with an initial allocation of 70% stocks and 30% bonds. After a period of market growth, the stock portion increases to 80%, raising the portfolio’s risk. Rebalancing would involve selling some stocks and purchasing bonds to return to the original 70/30 allocation.

Final Thoughts

Regular portfolio rebalancing is a fundamental aspect of investment management, helping to maintain a portfolio’s alignment with an investor’s risk tolerance and financial goals. By periodically reviewing and adjusting asset allocations, investors can navigate market fluctuations more effectively and work towards achieving their long-term objectives.

- Stop-Loss Orders

A stop-loss order is an instruction to sell a security when it reaches a certain price, limiting potential losses. This strategy is particularly useful in volatile markets, providing an automatic mechanism to exit a position before losses become significant.

- Hedging

Hedging involves using financial instruments or market strategies to offset potential losses in investments. Common hedging techniques include options, futures contracts, and inverse exchange-traded funds (ETFs).

- Risk Assessment and Profiling

Before making investment decisions, it’s vital to assess your risk tolerance, investment objectives, and time horizon. Risk profiling tools can help determine the level of risk you are comfortable with and guide the selection of appropriate investment strategies.

- Continuous Education and Awareness

Staying informed about market trends, economic indicators, and financial news is crucial for effective risk management. Regularly educating yourself and seeking advice from financial professionals can help you make informed decisions and adapt to changing market conditions.

Also Read :- What Are the Best Mutual Funds to Invest in 2025?

Conclusion

Investment risk is an inherent aspect of the financial markets, but it doesn’t have to be a deterrent. By understanding the various types of risks—such as market, credit, liquidity, and interest rate risks—investors can develop strategies to mitigate potential downsides.

Key strategies for managing investment risk include diversification, asset allocation, regular portfolio rebalancing, setting stop-loss orders, and employing hedging techniques. Additionally, assessing your risk tolerance and seeking professional financial advice can further enhance your risk management efforts.

It’s important to remember that while risk cannot be entirely eliminated, it can be effectively managed. By implementing these strategies and staying informed about market conditions, investors can navigate the complexities of the financial markets with greater confidence and achieve their long-term financial goals.

FAQs

- What is the most effective way to reduce investment risk? Diversification is widely regarded as one of the most effective methods to mitigate investment risk. By spreading investments across various asset classes and sectors, the impact of a poor-performing asset is minimized.

- How often should I rebalance my investment portfolio? The frequency of rebalancing depends on individual circumstances. Some investors rebalance quarterly, while others do so annually or when asset allocations deviate by a certain percentage from their targets.

- Are stop-loss orders foolproof in preventing losses? While stop-loss orders can help limit losses, they are not foolproof. In volatile markets, prices can gap down, causing the stop-loss order to execute at a lower price than expected.

- Can hedging strategies guarantee profits? No, hedging strategies do not guarantee profits. They are designed to reduce potential losses but can also limit potential gains.

- How can I assess my risk tolerance? Risk tolerance can be assessed through questionnaires provided by financial institutions or advisors, considering factors like financial goals, time horizon, and emotional comfort with market fluctuations.

- Is it necessary to consult a financial advisor for risk management? While not mandatory, consulting a financial advisor can provide personalized guidance and strategies tailored to your individual financial situation and goals.

- What role does asset allocation play in risk management? Asset allocation determines the distribution of investments across various asset classes, directly influencing the risk and return profile of a portfolio.