The Ultimate Cryptocurrency Investment Guide: How To Get Started In 2025

Cryptocurrency has undoubtedly revolutionized the world of finance, presenting new opportunities for investors. Since Bitcoin’s inception in 2009, the digital currency market has expanded significantly, with thousands of cryptocurrencies available for trading today. If you’re considering diving into this market in 2025, this comprehensive guide will walk you through everything you need to know—from the basics of cryptocurrencies to advanced investment strategies, common pitfalls, and how to minimize risk.

Key Takeaways

- Cryptocurrencies offer high return potential but are highly volatile and risky.

- Education is crucial—understand blockchain technology, wallets, and exchanges before investing.

- Security is paramount—use hardware wallets, enable 2FA, and safeguard your private keys.

- Develop a strategy: HODL, day trade, stake, or dollar-cost average depending on your risk tolerance.

- Always start with an amount you can afford to lose and diversify your portfolio to reduce risks.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments (such as the dollar or euro), cryptocurrencies operate on decentralized networks based on blockchain technology. Blockchain is a distributed ledger that records all transactions across a network of computers, ensuring transparency, security, and immutability.

Bitcoin, the first cryptocurrency, paved the way for thousands of other digital coins, including Ethereum, Binance Coin, Ripple, and Litecoin. Each cryptocurrency operates on its own unique blockchain or platform, making the world of crypto both diverse and complex.

Why Invest in Cryptocurrency?

There are several compelling reasons why people choose to invest in cryptocurrencies:

- High Return Potential: Cryptocurrencies have delivered massive returns over the past decade. For instance, Bitcoin, which was worth less than $1 in 2010, reached an all-time high of over $60,000 in 2021. Many investors see digital currencies as a way to generate significant profits.

- Diversification: Adding cryptocurrency to a traditional portfolio of stocks and bonds can provide diversification, reducing overall portfolio risk. Crypto can perform differently from traditional assets, especially during periods of economic uncertainty.

- Decentralization: Unlike traditional fiat currencies, cryptocurrencies are not controlled by any central authority, such as a government or financial institution. This decentralization can provide more financial freedom, especially in countries with unstable economies.

- Blockchain Technology: The blockchain technology that underpins cryptocurrencies is highly secure and has multiple uses, including in supply chain management, healthcare, and financial services.

- Long-Term Potential: Despite the volatility, many experts believe that cryptocurrencies represent the future of finance and could revolutionize industries worldwide. As more people and institutions adopt crypto, its long-term potential could be enormous.

How to Get Started with Cryptocurrency Investment

If you’re ready to explore the world of cryptocurrency investment in 2025, here are the steps you should follow:

Understand the Basics

Before you invest a single penny, it’s important to educate yourself about cryptocurrencies and the underlying technology. Here are some key concepts to get you started:

- Blockchain: A decentralized, transparent digital ledger that records all transactions across a network.

- Wallets: Digital wallets are used to store your cryptocurrencies securely. There are two types: hot wallets (internet-connected) and cold wallets (offline storage).

- Exchanges: These are online platforms where you can buy, sell, and trade cryptocurrencies. Examples include Coinbase, Binance, and Kraken.

- Altcoins: Cryptocurrencies other than Bitcoin are known as altcoins. Some popular altcoins include Ethereum, Ripple (XRP), and Cardano.

- Private and Public Keys: Your public key is like your email address, while your private key is akin to your password. It’s essential to keep your private key safe, as it grants access to your cryptocurrencies.

Choose Your Cryptocurrencies

There are thousands of cryptocurrencies available, but not all of them are worth investing in. The most popular and established cryptocurrencies include:

- Bitcoin (BTC): The first and most widely recognized cryptocurrency. Known as “digital gold,” it’s often considered a store of value.

- Ethereum (ETH): A decentralized platform that enables the creation of smart contracts and decentralized applications (dApps).

- Binance Coin (BNB): A token associated with Binance, one of the largest cryptocurrency exchanges in the world.

- Cardano (ADA): A blockchain platform focused on scalability and sustainability, with a strong emphasis on academic research.

- Solana (SOL): A high-performance blockchain network designed for decentralized applications and crypto projects.

While Bitcoin and Ethereum are the most well-known, it’s wise to diversify your investments by exploring other altcoins. However, you should always conduct thorough research before investing in any cryptocurrency.

Choose the Right Crypto Exchange

A cryptocurrency exchange is where you’ll buy, sell, and trade your coins. Here are some popular exchanges to consider:

- Coinbase: One of the most beginner-friendly platforms, Coinbase allows you to buy, sell, and store a variety of cryptocurrencies. It also offers educational content to help new users understand the market.

- Binance: Known for its low fees and wide variety of cryptocurrencies, Binance is ideal for more advanced investors. It also offers a staking feature, where you can earn passive income.

- Kraken: A trusted exchange that provides a secure trading environment and offers a wide range of cryptocurrencies.

- Gemini: A regulated exchange in the U.S. that is known for its strong security measures and user-friendly interface.

Make sure the exchange you choose supports the cryptocurrencies you want to invest in and offers strong security features like two-factor authentication (2FA).

Secure Your Investments

Security should be a top priority when dealing with cryptocurrencies. There are several ways to keep your digital assets safe:

- Use a Hardware Wallet: A hardware wallet is an offline device that stores your private keys. Examples include Trezor and Ledger.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security by requiring you to verify your identity through your phone or email when logging in.

- Avoid Phishing Scams: Be wary of unsolicited emails or messages asking for your private keys or login information. Always verify the source before clicking on any links.

- Backup Your Private Keys: Store your private keys in a secure place, such as a password manager or offline storage, to prevent losing access to your investments.

Develop a Strategy

Like any investment, cryptocurrency requires a well-thought-out strategy. Here are a few common approaches:

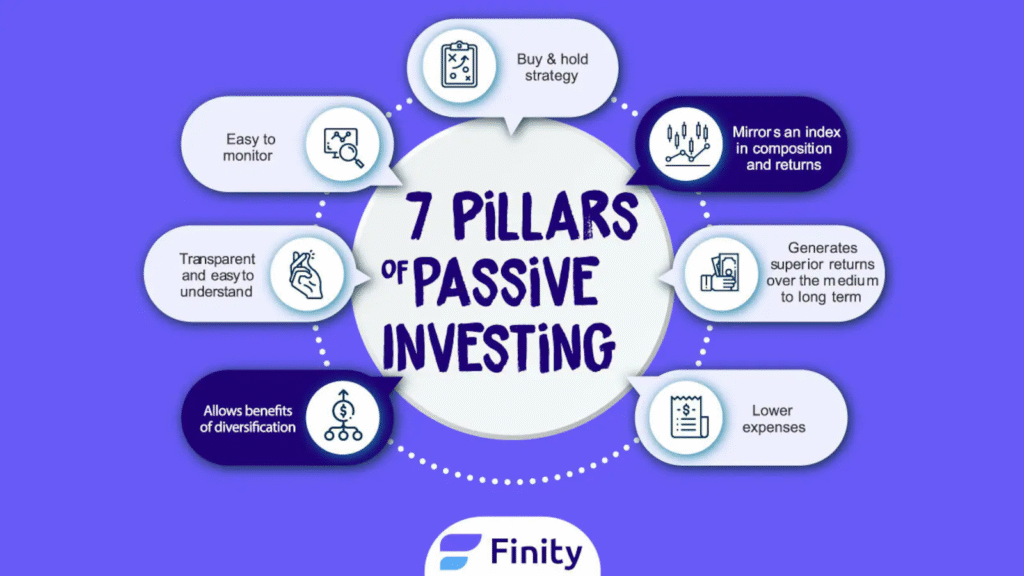

- Buy and Hold (HODL): This strategy involves buying cryptocurrencies and holding them for an extended period, hoping their value will increase over time. It’s a passive approach that requires patience and confidence in the technology.

- Day Trading: For more active investors, day trading involves buying and selling cryptocurrencies within short time frames to capitalize on price fluctuations. This strategy requires a good understanding of market trends and can be highly risky.

- Staking: Some cryptocurrencies, like Ethereum 2.0 and Cardano, allow investors to stake their coins to earn passive income. Staking involves locking your coins in a network to help validate transactions and secure the blockchain.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount in cryptocurrency regularly, regardless of price fluctuations. Over time, this helps reduce the impact of volatility.

Risks of Cryptocurrency Investment

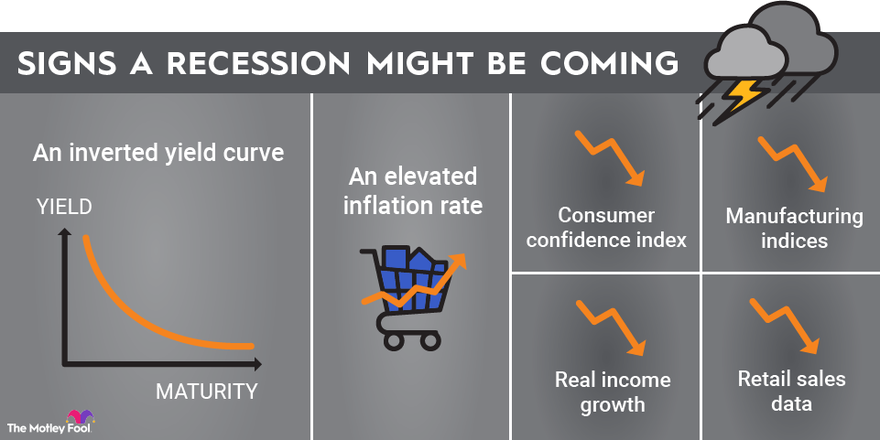

Cryptocurrencies are notoriously volatile, and while they can offer huge returns, they also come with substantial risks. Here are some key risks to consider:

- Volatility: Cryptocurrency prices can swing wildly, sometimes within hours. While this volatility can create opportunities for massive gains, it also exposes you to the risk of significant losses.

- Regulatory Uncertainty: Governments worldwide are still figuring out how to regulate cryptocurrencies. New regulations could impact the market, and some countries may even ban crypto trading.

- Security Risks: Cyberattacks, hacking, and scams are prevalent in the crypto world. It’s crucial to follow best practices for securing your investments.

- Market Manipulation: The relatively young and unregulated nature of the crypto market leaves it vulnerable to market manipulation, such as pump-and-dump schemes.

The Future of Cryptocurrency Investment in 2025 and Beyond

As we move further into 2025, the world of cryptocurrency continues to evolve rapidly. While the fundamental technology behind cryptocurrencies—blockchain—has already revolutionized the way we think about finance, there are several emerging trends and future opportunities in the crypto market that investors should be aware of. Whether you’re an experienced investor or just getting started, understanding these trends could give you a competitive edge.

1. Decentralized Finance (DeFi)

Decentralized Finance, or DeFi, is a rapidly growing segment of the cryptocurrency market. It refers to financial services that operate without the need for traditional financial institutions like banks. Instead, these services use smart contracts on blockchain networks like Ethereum to enable peer-to-peer transactions and services.

For example, in the DeFi space, you can borrow and lend cryptocurrencies, earn interest, and trade assets without relying on banks. The potential for growth in DeFi is enormous, as it promises to democratize access to financial services and increase financial inclusion globally.

As a cryptocurrency investor, paying attention to DeFi protocols and platforms could provide a new avenue for investment and passive income. Platforms like Uniswap, Aave, and Compound have emerged as key players in this space, offering users ways to earn returns by providing liquidity or lending their assets.

2. NFTs and the Metaverse

Non-fungible tokens (NFTs) have exploded in popularity over the past few years, and their role in the digital economy continues to expand. NFTs represent unique digital assets that can be bought, sold, and traded, often related to art, gaming, and collectibles. In 2025, we expect NFTs to be more integrated into everyday life, particularly in areas like gaming, virtual real estate, and even fashion.

NFTs could be a valuable part of your crypto investment strategy, not just as speculative assets but as an opportunity to participate in the burgeoning metaverse. The metaverse refers to virtual environments where users can interact, socialize, work, and play in immersive digital worlds. Many virtual worlds and games are starting to tokenize real estate, digital goods, and other assets through NFTs.

To capitalize on this trend, it’s important to understand the platforms that are shaping the NFT ecosystem, such as OpenSea, Rarible, and Decentraland. By investing in NFTs or metaverse-related assets, investors may open themselves up to a whole new world of opportunities.

3. Institutional Adoption and Regulation

As cryptocurrencies continue to grow in popularity, institutional adoption is becoming increasingly important. Big players like Tesla, MicroStrategy, and Square have already made significant investments in Bitcoin, and other traditional financial institutions, such as JPMorgan and Fidelity, have started offering crypto-related services to their clients.

The entry of institutional investors is often seen as a sign of the maturation of the market, which can bring more stability and legitimacy to cryptocurrencies. However, institutional involvement also means greater scrutiny from regulators. In 2025, governments and regulatory bodies are likely to introduce clearer and more robust regulations surrounding cryptocurrency trading, taxation, and security.

For investors, this could mean both challenges and opportunities. Clearer regulations may help to protect investors from fraud and manipulation, but it could also lead to stricter rules around cryptocurrency use and tax reporting. Keeping an eye on global regulatory developments will be crucial for any cryptocurrency investor in the coming years.

4. Scalability Solutions

One of the biggest challenges facing cryptocurrencies today is scalability. As more people and businesses adopt digital currencies, blockchain networks can become congested, resulting in slower transaction speeds and higher fees. This issue is particularly relevant for platforms like Ethereum, which has faced congestion issues due to its popularity.

In 2025, scalability solutions are expected to become more important than ever. Ethereum 2.0, for example, aims to address this problem by transitioning to a proof-of-stake consensus mechanism, which promises to improve scalability, reduce energy consumption, and lower transaction fees.

Other projects, such as Polkadot and Solana, are also focused on scalability and interoperability between different blockchain networks. As scalability improves, cryptocurrencies could become more practical for everyday transactions, opening the door for broader adoption.

5. Environmental Considerations

The environmental impact of cryptocurrency mining, particularly Bitcoin mining, has been a topic of growing concern. The energy-intensive process of mining Bitcoin and other cryptocurrencies that use proof-of-work consensus mechanisms has come under criticism due to its carbon footprint.

As we move into 2025, there’s a growing focus on making cryptocurrency mining more sustainable. Some projects, like Ethereum’s transition to proof-of-stake, are expected to drastically reduce energy consumption. Additionally, some cryptocurrencies, like Chia, use environmentally friendly mining techniques.

Investors may want to consider the environmental impact of the cryptocurrencies they are investing in, especially as governments and institutions become more focused on sustainability. Coins with lower carbon footprints or those committed to environmental responsibility may gain favor as the public becomes more aware of sustainability issues.

Advanced Cryptocurrency Investment Strategies

If you’re an experienced investor or looking to take your crypto investments to the next level, here are a few advanced strategies to consider in 2025:

1. Yield Farming and Staking

Both yield farming and staking are ways to earn passive income on your cryptocurrency holdings. While these strategies come with risks, they can provide significant rewards if done correctly.

- Yield farming involves providing liquidity to decentralized exchanges (DEXs) or lending platforms in exchange for interest or rewards in the form of tokens. This method can offer high returns, but it comes with the risk of impermanent loss (the risk that your holdings may decrease in value if the price of the assets you provided liquidity for fluctuates).

- Staking involves locking your cryptocurrency in a network to help validate transactions and secure the blockchain. In return, you can earn staking rewards. It’s considered a lower-risk method compared to yield farming, but the returns tend to be lower as well.

2. Leveraged Trading

Leveraged trading allows you to borrow funds to amplify your cryptocurrency positions. While it can increase your potential profits, it also significantly increases your risk. Leveraged trading is a complex strategy suitable for advanced traders who understand market dynamics and have a high tolerance for risk.

Leveraged products are available on many crypto exchanges, including Binance and Kraken, allowing investors to trade with leverage on both rising and falling markets. However, be aware that leveraged positions can quickly turn against you, leading to significant losses.

3. Hedging with Derivatives

Crypto derivatives, like futures and options, allow investors to hedge against market volatility or speculate on price movements. With futures contracts, you can agree to buy or sell a cryptocurrency at a set price in the future. This can help protect your portfolio from price drops.

Options give you the right, but not the obligation, to buy or sell crypto at a specific price. Both derivatives can be used to hedge against risk, but they require a solid understanding of how they work.

4. ICO and IEO Investments

Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) allow investors to purchase tokens of a new cryptocurrency project before they are listed on exchanges. While these investments can offer huge returns if the project is successful, they are highly speculative and come with significant risk. You should conduct thorough research and only invest in ICOs or IEOs from trusted and reputable projects.

Also Read :-What Are The Best Investment Opportunities Right Now?

Conclusion

Cryptocurrency investing in 2025 presents an exciting opportunity, but it requires careful planning, research, and an understanding of the inherent risks. As with any investment, diversification, security, and a well-thought-out strategy are key to navigating this volatile market successfully. Whether you’re interested in Bitcoin, Ethereum, or altcoins, educating yourself and keeping up with market trends will help you make informed decisions.

FAQs

- Is cryptocurrency a good investment in 2025?

- While cryptocurrency remains highly volatile, many believe it has strong long-term potential, especially as blockchain technology becomes more widely adopted.

- What’s the best cryptocurrency to invest in?

- Bitcoin and Ethereum are considered relatively stable and established, but other altcoins like Solana and Cardano offer potential for growth. Always conduct thorough research before investing.

- How much should I invest in cryptocurrency?

- As a general rule, only invest what you can afford to lose. Cryptocurrency is a high-risk asset, so start small and gradually increase your investment as you gain experience.

- How do I secure my cryptocurrency investments?

- Use a hardware wallet for offline storage, enable two-factor authentication, and avoid phishing scams to protect your assets.

- Can I lose all my money in cryptocurrency?

- Yes. The volatile nature of cryptocurrency means that prices can fluctuate wildly, and there’s always a risk of losing your entire investment.

- What are the tax implications of investing in cryptocurrency?

- Cryptocurrency is taxable in many countries. The tax treatment of gains or losses will depend on local regulations, so it’s essential to consult with a tax professional.

- Can I earn passive income with cryptocurrencies?

- Yes, through methods like staking, yield farming, or lending your crypto assets on various platforms.