What Are the Hidden Costs of a Car Loan?

Purchasing a car is a significant financial commitment, and while the advertised interest rates and monthly payments may seem manageable, the true cost of a car loan often extends beyond these figures. Understanding the hidden costs associated with car loans can help you make informed decisions and avoid unexpected financial burdens.

Key Takeaways

- Comprehensive Cost Assessment: Always consider processing fees, insurance, and potential penalties when evaluating a car loan.

- Negotiate Terms: Don’t hesitate to discuss charges and terms with lenders to secure the best deal.

- Consider Alternatives: Explore options like shorter loan tenures or higher down payments to reduce overall costs.

- Stay Informed: Regularly review your loan agreement and stay updated on any changes in terms or fees.

- Plan for the Future: Factor in the opportunity cost and potential depreciation to make a financially

1. Processing and Documentation Fees

Most lenders charge a processing fee to cover the administrative costs of evaluating and disbursing the loan. In India, this fee typically ranges from 0.5% to 2% of the loan amount. Additionally, documentation charges, stamp duty, and registration certificate collection fees can add to the upfront costs. For instance, banks like ICICI and HDFC impose documentation charges of ₹500–₹650, along with stamp duty and registration fees, which vary by state and loan amount.

2. Prepayment and Foreclosure Charges

| Country/Region | Prepayment Charges | Foreclosure Charges | Notes |

|---|---|---|---|

| India | Typically 2% to 6% of the outstanding principal amount. | Similar to prepayment charges, usually 2% to 5%. | Charges are higher in the initial years of the loan, decreasing over time. |

| United States | Generally 0% to 3%, some loans offer no prepayment fees. | Similar to prepayment, with no fee for most lenders. | Prepayment fees are relatively rare, especially for loans backed by government agencies (e.g., FHA). |

| United Kingdom | Usually no prepayment charges for most car loans. | No foreclosure charges, except for some special contracts. | The UK tends to have more consumer-friendly loan structures, with fewer penalties. |

| Germany | No prepayment penalties, but some fees for early closure. | No foreclosure charges; loans can be repaid early without extra fees. | Highly consumer-protective, with few to no additional charges. |

| Canada | Typically 2% to 3% of the remaining loan balance. | Foreclosure charges can be 2% to 4%, depending on the lender. | Prepayment penalties are common in the initial years, similar to India. |

| Australia | 1% to 2% of the loan balance, or a flat fee in some cases. | Typically 2% of the outstanding principal if paid early. | Some lenders offer early repayment without penalties if done after a certain period. |

| Japan | Around 2% to 3% of the principal amount remaining. | Similar to prepayment charges, about 2% of the outstanding balance. | Early repayment is not common due to the higher availability of longer loan terms in Japan. |

| South Africa | Prepayment penalties range from 3% to 5% of the outstanding loan amount. | Foreclosure penalties are similar to prepayment charges. | Some lenders offer fee waivers if the loan is closed after a certain number of years. |

| France | No prepayment charges for most loans. | No foreclosure penalties. | French banks generally avoid imposing penalties to encourage faster loan repayment. |

| Middle East | Prepayment charges range from 2% to 5%, depending on the lender and loan terms. | Similar to prepayment charges, 2% to 5% of the outstanding loan balance. | Penalties are typically higher in the initial years of the loan, and lenders are less flexible. |

While paying off your loan early can save on interest, many lenders impose prepayment or foreclosure charges. These fees can range from 2% to 6% of the outstanding principal, depending on the loan tenure and lender policies. For example, HDFC Bank charges 6% for preclosures within one year, 5% between 13–24 months, and 3% after 24 months from the first EMI.

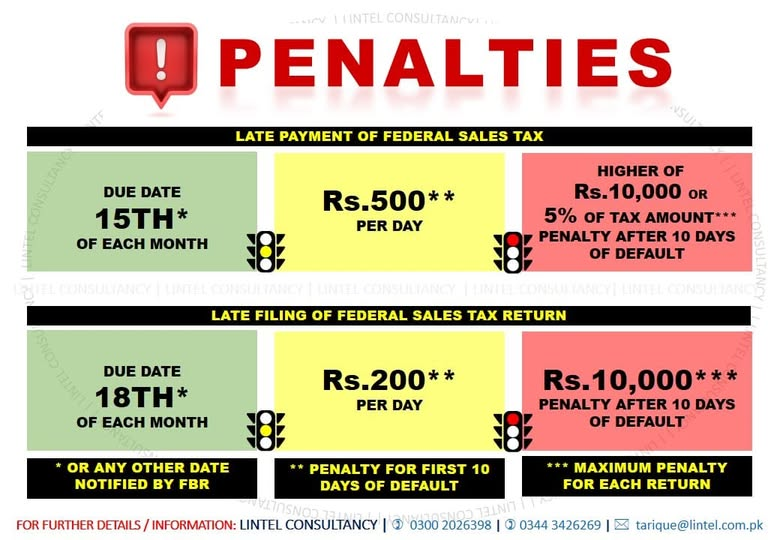

3. Late Payment Penalties

Missing an EMI payment can lead to significant penalties. Banks like ICICI impose a penal charge of 5% per annum on overdue EMIs, which can accumulate quickly and increase the total cost of the loan.

4. Insurance Costs

Comprehensive car insurance is mandatory and can be a substantial annual expense. The premium varies based on the car’s make, model, and value. Additionally, some lenders may offer add-on products like Guaranteed Asset Protection (GAP) insurance, which covers the difference between the car’s value and the loan balance in case of total loss. While optional, these add-ons can increase the overall loan cost if included in the financing package.

5. Extended Warranties and Add-Ons

Dealerships often offer extended warranties, service packages, and other add-ons. While these can provide value, they are frequently marked up and added to the loan amount, increasing both the loan balance and the interest paid over time. It’s advisable to evaluate the necessity and cost-effectiveness of these add-ons before agreeing to them.

6. Opportunity Costs

The funds allocated towards monthly car loan payments could otherwise be invested or saved for future needs. This opportunity cost represents potential earnings or savings foregone due to the financial commitment of the car loan.

7. Negative Equity

If the car’s value depreciates faster than the loan balance decreases, you may find yourself owing more than the car is worth—a situation known as negative equity. This can be problematic if you need to sell or trade in the vehicle before the loan is paid off.

Also Read :- Can Student Loans Open Doors Or Create Debt Traps?

Conclusion

While car loans provide the opportunity to own a vehicle, it’s crucial to be aware of the hidden costs that can significantly increase the total expenditure. By understanding these costs and planning accordingly, you can make more informed decisions and manage your finances effectively.

FAQs

- What is the typical processing fee for a car loan in India?

- Processing fees generally range from 0.5% to 2% of the loan amount, depending on the lender.

- Are prepayment penalties common in car loans?

- Yes, many lenders charge prepayment penalties, especially within the first few years of the loan.

- How can I avoid late payment penalties?

- Setting up automatic payments or reminders can help ensure timely EMI payments.

- Is GAP insurance necessary?

- GAP insurance is optional but can be beneficial if you have a low down payment or the car depreciates quickly.

- Can I negotiate documentation charges?

- Some lenders may waive or reduce documentation charges, especially during promotional periods.

- What is the impact of negative equity?

- Negative equity can make it difficult to sell or trade in your car, as you may owe more than its market value.

- Are extended warranties worth the cost?

- Evaluate the warranty terms and compare them with potential repair costs to determine if it’s a worthwhile investment.

1 Comment