What Is an Auto Loan and How Does It Work?

Purchasing a vehicle is often a significant financial decision, and many individuals rely on auto loans to help them make this purchase. Whether you’re buying your first car or upgrading to a newer model, an auto loan can make this process more manageable by allowing you to spread the cost over time.

In this article, we will break down what an auto loan is, how it works, and the key factors you should consider when applying for one. Additionally, we’ll address some common questions and provide helpful insights into the auto loan process.

Key Takeaways

- Auto loans help individuals finance the purchase of a vehicle by borrowing money and paying it back over time.

- Factors like credit score, income, and down payment play a significant role in determining your loan terms.

- Dealer financing and bank loans are common options, each with its pros and cons.

- Always shop around for the best interest rates and terms to save money over the life of the loan.

What Is an Auto Loan?

An auto loan is a financial product that helps you borrow money to purchase a car, truck, or another vehicle. When you take out an auto loan, you borrow a specific amount of money from a lender, typically a bank, credit union, or dealership. In exchange, you agree to repay the loan over a set period, usually between 24 and 72 months, along with interest.

The vehicle you purchase usually serves as collateral for the loan, meaning that if you fail to make payments, the lender has the right to repossess the car. Auto loans can either be secured (with the vehicle as collateral) or unsecured, though most auto loans are secured.

How Does an Auto Loan Work?

Here’s a breakdown of the auto loan process:

- Loan Application:

- The first step is applying for the loan. You will need to provide personal and financial information to the lender, such as your credit score, income, employment status, and other details. This information helps the lender assess your ability to repay the loan.

- Loan Approval:

- If the lender approves your application, they will offer you loan terms, including the loan amount, interest rate, repayment schedule, and any fees involved. A credit check will usually be conducted to determine your eligibility for a loan and the interest rate you qualify for.

- Down Payment:

- A down payment is the amount of money you pay upfront toward the vehicle’s purchase price. While some loans may not require a down payment, many lenders prefer one, as it reduces the loan amount and lowers the lender’s risk. A down payment can range from 5% to 20% of the vehicle’s price.

- Interest Rates and Loan Terms:

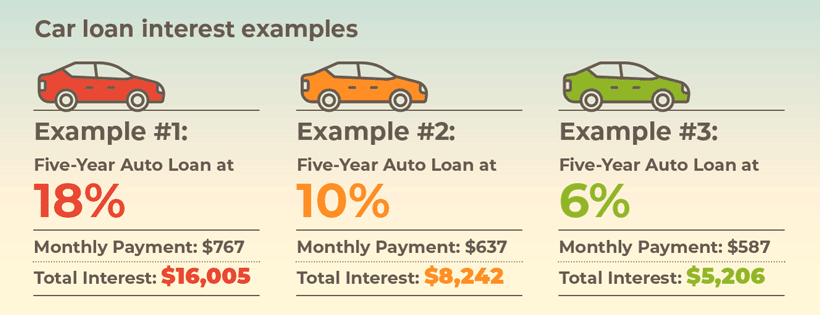

- Interest rate: This is the cost of borrowing the money, expressed as a percentage of the loan. A lower interest rate means you’ll pay less over the life of the loan.

- Loan term: The length of time you have to repay the loan. Loan terms typically range from 36 to 72 months. Shorter terms generally have higher monthly payments but cost less in interest, while longer terms have lower monthly payments but accrue more interest over time.

- Monthly Payments:

- After securing the loan, you’ll make monthly payments based on the loan’s terms. Your payment includes both the principal (the amount you borrowed) and interest. Typically, the monthly payment stays the same throughout the loan term.

- Repayment and Completion:

- Once the loan is fully paid off, the vehicle is entirely yours, and you own it free and clear. However, if you default on the loan (miss several payments), the lender may repossess the vehicle to recover the outstanding debt.

Types of Auto Loans

Auto loans can come in various forms, depending on where you get the loan and the specific terms of the loan agreement. The main types include:

1. Dealer Financing

Dealer financing refers to taking out a loan directly from the dealership when purchasing a vehicle. Many dealerships partner with banks or financial institutions to offer financing options to their customers.

- Advantages: Convenient and quick. It’s possible to finalize the loan and car purchase in one visit.

- Disadvantages: Often comes with higher interest rates than other sources, especially if you don’t have a good credit score.

2. Bank or Credit Union Loans

These loans are offered by traditional banks and credit unions. You can either apply in person or online, and they may offer lower interest rates compared to dealer financing.

- Advantages: Lower interest rates, especially if you have good credit, and more flexible terms.

- Disadvantages: The approval process may take longer, and you must have a solid credit history to qualify for the best rates.

3. Online Auto LoansOnline Auto Loans: A Comprehensive Guide

The world of finance has become increasingly digital, and online auto loans are a major part of this shift. In today’s fast-paced world, the convenience of applying for an auto loan from the comfort of your home, and often getting approved in a matter of minutes, is highly appealing. But what exactly are online auto loans, how do they work, and how can you benefit from them? Let’s dive into the details.

What Are Online Auto Loans?

An online auto loan is a loan that you apply for, secure, and manage entirely over the internet. These loans are typically offered by online lenders, banks, or credit unions, and sometimes through digital platforms or marketplaces that connect borrowers with multiple lenders. Unlike traditional methods where you might need to visit a bank, credit union, or dealership in person, online auto loans allow you to complete the entire process remotely, from application to approval to finalizing the loan.

How Do Online Auto Loans Work?

The process for securing an online auto loan is similar to applying for a loan through a traditional lender, but it’s far more convenient. Here’s how it works:

- Application Process:

- You begin by filling out an online application, which typically requires information such as your name, address, income, employment status, Social Security number, and any other information needed for a credit check. Many online lenders use automated systems to quickly assess your application and decide whether to approve or deny the loan.

- Loan Approval:

- Once your application is submitted, the online lender will evaluate your creditworthiness. This evaluation includes your credit score, income, debt-to-income ratio, and sometimes other factors. If you meet the lender’s criteria, you will receive a loan offer detailing the amount you can borrow, the interest rate, and the loan terms (such as the repayment schedule and the loan term length).

- Loan Agreement:

- If you accept the loan offer, you will sign a digital loan agreement. This agreement outlines the terms of the loan, including the loan amount, interest rate, monthly payment, and repayment term.

- Receiving Funds:

- Once the agreement is signed, the lender will transfer the funds directly into your bank account or, in some cases, directly to the dealership where you are purchasing the vehicle. Some online lenders also offer the option to receive the funds via a check.

- Repayment:

- You will begin making monthly payments according to the terms of the loan agreement. Online lenders often provide multiple options for repayment, such as direct bank transfers or payments via the lender’s online portal.

Advantages of Online Auto Loans

1. Convenience and Speed

- One of the biggest advantages of online auto loans is the ease and speed with which you can apply and receive approval. Many lenders offer pre-approval within minutes, and the entire application process can often be completed within an hour or two. This is much faster than traditional methods where you may need to visit a bank or dealership and wait days or even weeks for approval.

2. Competitive Interest Rates

- Online lenders often have lower overhead costs than brick-and-mortar financial institutions, which allows them to offer lower interest rates. In some cases, you may even be able to secure a loan with rates that are lower than what you would find at a dealership or traditional bank.

3. Wide Range of Lenders

- The online lending marketplace is vast, meaning you can easily compare multiple lenders to find the best deal for your needs. This competition helps drive down rates and gives you more options for loan terms.

4. Easy Comparison of Loan Offers

- Online platforms allow you to compare various loan offers side by side. This includes interest rates, terms, and fees, so you can make a well-informed decision. Many online platforms have calculators that let you see how different rates and loan terms impact your monthly payment and overall loan cost.

5. Access to Special Offers and Promotions

- Some online lenders offer special promotions or discounts, such as a reduced interest rate for borrowers with excellent credit or those who agree to set up automatic payments. These offers can make a significant difference in the overall cost of your loan.

6. No Need to Visit a Dealership

- While many people choose to finance their vehicle purchase through a dealership, working directly with an online lender means you don’t have to haggle with salespeople or worry about upselling. This streamlines the process and can save you both time and stress.

7. Transparency

- Many online lenders are transparent about their fees, terms, and conditions. This helps reduce the risk of hidden fees and ensures you understand what you’re agreeing to before you sign the loan agreement.

Disadvantages of Online Auto Loans

| Disadvantage | Description |

|---|---|

| Limited Customer Support | Online lenders may not offer the same level of personalized, in-person support as traditional banks or credit unions. |

| Requires Good to Excellent Credit | Online lenders often require a strong credit score to qualify for competitive interest rates, limiting access for borrowers with poor credit. |

| Possibility of Higher Rates for Subprime Borrowers | Borrowers with bad credit may face higher interest rates, increasing the total cost of the loan. |

| Limited Loan Terms for Used Cars | Some online lenders offer better terms for new cars, potentially limiting favorable loan options for used vehicles. |

| No Physical Location | The absence of physical branches can make it harder for some borrowers to resolve issues or discuss loan terms in person. |

| Risk of Scams or Unreliable Lenders | The lack of a physical presence increases the risk of encountering unreliable lenders or scams. |

| Dependence on Technology | Borrowers must have access to the internet and be comfortable using online platforms, which may be challenging for some. |

1. Limited Customer Support

- While most online lenders have customer service teams available, you may not get the same personalized attention that you would at a physical bank or credit union. If you encounter issues or need advice, you might have to rely on online chat or phone support, which may not always be as effective as in-person guidance.

2. Requires Good to Excellent Credit

- To secure the best interest rates, many online lenders require a good or excellent credit score. If your credit score is less than stellar, you may end up with a higher interest rate or limited loan options.

3. Possibility of Higher Rates for Subprime Borrowers

- While online lenders often offer competitive rates, borrowers with bad credit may face higher interest rates, similar to what they would get at traditional lenders or dealerships. Subprime auto loans, often marketed toward borrowers with poor credit, can come with significantly higher interest rates, which increases the overall cost of the vehicle.

4. Limited Loan Terms for Used Cars

- Some online lenders may only offer favorable loan terms for new cars, limiting their loan options for used vehicle purchases. If you are buying a used car, you may have to shop around more to find a lender willing to finance it under the terms you want.

5. No Physical Location

- For some borrowers, the lack of a physical branch or office might feel less secure. There’s no place to visit in person to discuss issues, and if you have technical problems accessing your online account, you might find it harder to resolve things quickly.

How to Apply for an Online Auto Loan

Applying for an online auto loan is a straightforward process, but to ensure the best outcome, follow these steps:

Once you’ve chosen your loan terms, sign the digital agreement. Afterward, you’

Check Your Credit Score:

Before applying, know your credit score. If your score is low, you may want to work on improving it before applying for an auto loan to increase your chances of getting a better interest rate.

Research Lenders:

Look for reputable online lenders with positive reviews and competitive rates. Compare loan terms, interest rates, and fees before making your decision.

Get Pre-Approved:

Many online lenders offer pre-approval, which gives you an idea of how much you can borrow and the interest rate you’ll pay without affecting your credit score. Pre-approval is a good way to shop for vehicles within your budget.

Provide Necessary Documentation:

✅ 1. Personal Identification

- Government-issued ID (Driver’s license, passport, or state ID)

- Social Security number (SSN) or Tax Identification Number (TIN)

✅ 2. Proof of Income

To confirm you have the financial ability to repay the loan:

- Recent pay stubs (usually last 2–3)

- Tax returns (last 1–2 years, especially for self-employed borrowers)

- W-2 or 1099 forms

- Bank statements (typically last 2–3 months)

- Proof of additional income (alimony, child support, rental income, etc., if applicable)

✅ 3. Employment Verification

- Employer contact information

- Employment letter or contract (sometimes required for new jobs or to confirm position and salary)

✅ 4. Credit History

- Lenders will pull your credit report directly, but you may be asked to:

- Provide written authorization for a credit check

- Explain any credit issues or discrepancies (e.g., past defaults or late payments)

✅ 5. Residence Verification

- Utility bill, lease agreement, or mortgage statement (to confirm your address)

- Driver’s license with current address (can double as ID and address proof)

✅ 6. Vehicle Information (for Auto Loans)

If applying for an auto loan:

- Purchase agreement or bill of sale

- Vehicle Identification Number (VIN)

- Car insurance information

- Registration or title (for used vehicles)

✅ 7. Down Payment Proof (if applicable)

- Bank statement or proof of funds for the down payment

- Gift letter (if down payment is a gift from a family member)

Choose the Loan Terms:

Once you are approved, select the loan amount and terms that fit your budget. Review the interest rate, monthly payments, and length of the loan carefully before committing.

Sign the Agreement:

4. Subprime Auto Loans

If you have bad credit or a limited credit history, you may qualify for a subprime auto loan. These loans come with higher interest rates due to the higher risk posed by the borrower.

- Advantages: Accessible to people with poor credit.

- Disadvantages: Higher interest rates and a greater overall cost.

Factors Affecting Auto Loan Approval

When applying for an auto loan, several factors come into play in determining whether you’ll be approved and what terms you’ll receive. These include:

- Credit Score:

- Your credit score plays a huge role in your ability to qualify for an auto loan. A higher score (typically above 700) often results in better interest rates and loan terms. A lower score (below 600) may mean higher interest rates or difficulty in getting approved.

- Income:

- Lenders want to ensure you have the means to repay the loan, so they’ll assess your income level. If your income is stable and sufficient to cover monthly payments, you’re more likely to be approved.

- Debt-to-Income Ratio (DTI):

- This ratio compares your total monthly debt payments to your gross monthly income. A lower DTI indicates you have a manageable amount of debt relative to your income.

- Down Payment:

- The size of your down payment affects both your loan approval and terms. A larger down payment reduces the lender’s risk and may lead to better loan terms.

- Vehicle Age and Condition:

- Lenders may place restrictions on the age of the car being financed. Newer cars often come with better financing terms, while older vehicles may have higher interest rates.

Also Read :-What Is a Personal Loan And How Does It Work?

Conclusion

An auto loan is a useful financial tool that allows individuals to purchase a vehicle without paying the full price upfront. It works by borrowing money from a lender and repaying it over time with interest. Whether you choose to finance through a bank, credit union, or dealership, understanding the terms of the loan, including interest rates, loan periods, and down payments, is essential to making an informed decision.

Auto loans come with various types, rates, and conditions that may suit different needs. To get the best deal, it’s crucial to shop around, maintain a good credit score, and choose a loan term that fits your budget.

7 Frequently Asked Questions About Auto Loans

1. Can I get an auto loan with bad credit?

Yes, it’s possible to get an auto loan with bad credit, but you may face higher interest rates and stricter terms. Some lenders specialize in subprime loans for individuals with poor credit.

2. What is the ideal loan term for an auto loan?

The ideal loan term depends on your financial situation. Shorter loan terms (36 or 48 months) generally result in higher monthly payments but cost less in interest, while longer terms (60 or 72 months) reduce monthly payments but may lead to higher overall costs due to interest.

3. Should I choose a secured or unsecured auto loan?

Most auto loans are secured loans, meaning the car serves as collateral. This makes it easier to qualify and often comes with lower interest rates. Unsecured loans, while rare for auto purchases, do not require collateral but usually come with higher interest rates.

4. Can I pay off my auto loan early?

Yes, you can pay off your auto loan early, but it’s essential to check with your lender about prepayment penalties. Some lenders charge fees for paying off loans early, while others allow it without penalty.

5. What happens if I default on my auto loan?

If you default on your auto loan, the lender may repossess your vehicle to recover the unpaid amount. This can significantly impact your credit score and make it harder to get future loans.

6. How does my credit score affect my auto loan rate?

A higher credit score typically results in lower interest rates because you are considered less risky to lenders. A lower score means higher rates due to the higher risk of default.

7. Is it better to get an auto loan through a bank or dealership?

It depends on your situation. Dealerships may offer special promotions, but bank loans often have better interest rates, especially for borrowers with good credit. It’s essential to compare both options before decidin