What Makes a Car Insurance Policy the Best?

When it comes to car insurance, finding the best policy is crucial for ensuring peace of mind on the road. A well-structured policy not only provides financial protection in case of accidents or damage but also caters to the specific needs of the driver and their vehicle. But with so many options available in the market, it can be overwhelming to identify what makes a car insurance policy truly the best.

A car insurance policy should balance comprehensive coverage, affordability, flexibility, and customer service. In this article, we will explore the essential features of an excellent car insurance policy and how you can choose the best one for you.

Key Takeaways

- The best car insurance policy should offer comprehensive and customizable coverage.

- Look for affordable premiums but never compromise on coverage quality.

- Consider customer service, financial stability, and ease of filing claims when choosing an insurer.

- Take advantage of discounts and flexible add-ons to enhance your policy.

- Always assess your unique needs and compare different options before deciding on a policy.

Understanding Car Insurance Types

To find the best car insurance policy, it’s essential to understand the different types of coverage available. Below is a breakdown of the most common types of car insurance:

Liability Insurance

Liability insurance is mandatory in most places, as it helps cover the costs of damages or injuries you cause to others in an accident. This type of coverage doesn’t pay for your vehicle’s damages but protects your financial interests if you are held responsible for an accident.

Collision Insurance

Collision insurance covers repairs to your vehicle in case of an accident, regardless of who is at fault. This type of coverage ensures that you aren’t left with hefty repair bills after an accident.

Comprehensive Insurance

Comprehensive insurance provides coverage for non-collision-related incidents, such as theft, vandalism, fire, or damage caused by natural disasters. If your car is damaged in a way that isn’t related to a collision, comprehensive insurance steps in.

Personal Injury Protection (PIP)

PIP insurance covers medical expenses for you and your passengers, regardless of who is at fault. In some states, this coverage is mandatory, while in others, it is optional.

Uninsured/Underinsured Motorist Coverage

If you’re in an accident where the other driver is at fault but doesn’t have sufficient insurance or is uninsured, this coverage protects you. It helps pay for medical bills, lost wages, and damage repairs.

Factors That Make a Car Insurance Policy the Best

Coverage Options

One of the most important aspects of the best car insurance policy is the variety of coverage options it offers. A good policy should provide comprehensive and collision coverage, along with liability, personal injury protection, and uninsured motorist protection. Depending on your vehicle’s value and the risks you face, you may also need additional coverage like roadside assistance, rental car reimbursement, or gap insurance.

A policy that offers customizable coverage options allows you to choose what’s essential for you while excluding unnecessary extras. For example, if you have an older car with a low value, collision coverage may be unnecessary, while comprehensive coverage might still be valuable in case of theft or damage from natural disasters.

Affordability and Premiums

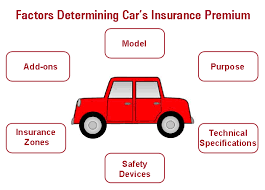

The price of a car insurance policy is a critical factor for many drivers. The best car insurance policy is one that provides robust coverage at a reasonable premium. Insurance companies calculate premiums based on several factors, such as your age, driving history, type of car, and the state in which you live.

However, an ideal policy balances cost with the quality of coverage. In other words, it’s not just about finding the cheapest option but about obtaining value for your money. Sometimes, paying a little more for added protection can be worth it in the long run.

Customer Service and Claims Process

The best car insurance providers pride themselves on offering excellent customer service. This includes a smooth and hassle-free claims process, where you can easily report an accident and get the compensation you need quickly.

Insurance companies with good customer service typically offer 24/7 customer support, straightforward claims processes, and helpful representatives who guide you through each step. Read reviews and research the reputation of the insurance company for customer service and claims satisfaction before purchasing a policy.

Discounts and Add-Ons

The best car insurance policies provide opportunities for discounts, which can help lower premiums. These discounts could be based on factors such as safe driving, bundling policies (home, life, and car insurance), or using certain safety features in your car. Some companies also offer discounts for students, seniors, and military members.

In addition to discounts, an ideal car insurance policy offers useful add-ons, such as roadside assistance, car rental coverage, and gap insurance, allowing you to personalize your coverage further.

Financial Strength of the Insurer

It’s important to choose an insurance provider that has strong financial stability. Insurance companies need to have enough funds to cover claims, especially in the event of large-scale accidents or disasters. To check a company’s financial health, look at independent ratings from agencies such as A.M. Best, Moody’s, and Standard & Poor’s.

Flexibility in Policy Terms

A top-notch car insurance policy is flexible and allows you to adjust coverage levels based on your changing needs. Whether you buy a new car, move to a new state, or experience life changes, you should be able to modify your policy without complications.

Digital Tools and Resources

In today’s digital age, the best car insurance policies come with robust digital tools and resources. This can include mobile apps that allow you to file claims, check your policy details, and track your car’s status in case of an accident. Some providers even offer telematics devices that monitor your driving habits to help adjust your premiums based on how safely you drive.

Ease of Understanding the Terms

The best car insurance policy should be transparent and easy to understand. Avoid policies with confusing jargon or hidden clauses that may affect your coverage in the event of a claim. A clear, straightforward policy ensures that you are aware of what’s covered, what isn’t, and what your deductible is.

Key Aspects of a Great Car Insurance Policy:

- Comprehensive and Customizable Coverage: The best policy offers a range of coverage options (liability, collision, comprehensive, PIP, uninsured motorist) to ensure that you’re protected in a variety of situations. Customizing your policy to suit your needs is also important.

- Affordability vs. Coverage Quality: While affordability is crucial, it should never come at the expense of comprehensive coverage. A good policy balances both to provide maximum protection without draining your finances.

- Customer Service and Claims Process: A reliable insurer will have exceptional customer service, offering straightforward claims processing, helpful support, and 24/7 accessibility. This makes the experience of filing claims stress-free.

- Discounts and Add-Ons: Look for opportunities to reduce premiums through discounts (e.g., safe driver, bundling, vehicle safety features) and additional coverage like roadside assistance or rental car reimbursement.

- Financial Stability: The insurer should have a strong financial rating, indicating that they can pay out claims when needed.

- Flexibility: A good policy allows you to make adjustments as your needs evolve, such as adding coverage or changing your deductible.

- Digital Tools: Insurance companies with strong digital tools, such as apps for managing your policy or submitting claims, can provide a smoother customer experience.

- Transparency: The best car insurance policies are clear and understandable. Avoid policies with vague terms or confusing language that could leave you with unwanted surprises.

Steps to Choose the Best Policy:

- Assess Your Needs: Understand what coverage is essential for you based on where you live, your driving habits, and your car’s value.

- Compare Providers: Use comparison tools to check premiums, coverage options, and customer reviews.

- Know Your Deductibles: Understand how changing your deductible will impact both your premiums and out-of-pocket costs.

- Legal Requirements: Ensure the policy meets or exceeds the minimum legal requirements in your state.

- Customer Reviews: Look for feedback on how well the company handles claims and customer service.

Key Aspects in More Detail:

1. Comprehensive and Customizable Coverage

Having a range of coverage options ensures that you’re not only protected in typical accidents but also in scenarios like theft, vandalism, or damage from natural disasters (hail, floods, etc.). Some of the more specialized coverage types include:

- Roadside Assistance: If you get a flat tire, need a jump start, or run out of gas, roadside assistance can come in handy.

- Gap Insurance: If you owe more on your car loan than the vehicle is worth, gap insurance can cover the difference if the car is totaled.

- Rental Car Reimbursement: If your car is in the shop due to an accident, this coverage can help cover the cost of a rental car.

- New Car Replacement: This ensures that if your new car is totaled, you receive a brand-new model rather than the depreciated value of your vehicle.

2. Affordability and Premiums

While finding an affordable premium is important, it’s crucial to understand how your premium is calculated. Factors such as:

- Your Driving History: A clean record means lower premiums. Insurers reward safe drivers with discounts.

- Type of Vehicle: Sports cars or luxury cars typically come with higher premiums due to their higher repair costs or higher likelihood of being stolen.

- Location: Living in a city with a higher rate of accidents or theft can raise premiums. Similarly, some areas are more prone to natural disasters, which could influence the cost of comprehensive insurance.

You should consider whether increasing your deductible (the amount you pay out of pocket before your insurance kicks in) will lower your monthly premium while still leaving you with manageable costs in case of a claim.

3. Customer Service and Claims Process

The claims process is often when you realize the true value of your insurance company. An easy, transparent claims process can reduce the stress of dealing with an accident. Some features to look for:

- 24/7 Availability: An insurance company that offers round-the-clock customer service ensures that you have support whenever you need it, whether it’s filing a claim, asking about coverage, or getting a roadside assist.

- Digital Claims Submission: Many insurers now offer the ability to submit claims via a mobile app or website, track their status, and communicate with representatives all online.

- Efficiency: Insurers that are known for quick claim resolutions are valuable, as a fast payout can help you get back on your feet quickly.

4. Discounts and Add-Ons

In addition to standard discounts, insurers often provide various ways to save money:

- Bundling Policies: If you have other types of insurance (home, life, etc.) with the same insurer, bundling them can lead to significant discounts.

- Good Driver Discount: If you maintain a clean driving record, many companies offer a “good driver” discount.

- Safety Features: Cars with advanced safety features such as automatic emergency braking or anti-theft devices often qualify for discounts.

- Low Mileage Discount: If you drive fewer miles annually, some insurers offer lower premiums, as you’re statistically less likely to be in an accident.

5. Financial Strength of the Insurer

The insurer’s financial strength is key to ensuring that they can cover the claims of their policyholders. Look at ratings from agencies like:

- A.M. Best: A global rating agency that evaluates the financial strength of insurance companies.

- Moody’s: Provides credit ratings, which give you an indication of how reliable an insurer is in terms of paying out claims.

- Standard & Poor’s: Another credit rating agency that evaluates the financial strength of insurance companies.

These agencies evaluate an insurer’s ability to pay out claims, and a strong rating ensures that your provider will be able to handle your claims when needed.

6. Flexibility in Policy Terms

A flexible car insurance policy allows you to modify your coverage as your life changes. For example:

- New Car Purchases: If you purchase a new car, you may need to adjust your coverage to reflect the new value.

- Moving to a New Area: If you move to a different state, your insurance requirements may change. A flexible provider will make it easy to update your policy to meet new legal requirements or to adjust coverage based on the risks in the new area.

- Changes in Driving Habits: If you start using your vehicle for ridesharing (like Uber or Lyft), your insurer should be able to provide coverage for that activity.

7. Digital Tools and Resources

In the digital age, car insurance companies are increasingly offering tools to improve your experience:

- Mobile Apps: Many companies have apps that let you manage your policy, file claims, and contact customer service from your phone.

- Telematics: Some insurers offer programs where they monitor your driving habits through a device or mobile app. This can be used to adjust your premium based on how safely you drive, potentially leading to lower rates for cautious drivers.

- Online Quote Tools: Use these tools to get instant quotes and compare rates from different insurers.

8. Transparency and Easy-to-Understand Terms

A good car insurance policy should clearly explain its terms, limits, exclusions, and conditions. Policies with confusing jargon or hidden clauses could lead to misunderstandings when you need to file a claim. Always make sure you understand:

- What’s Covered and What’s Not: Ensure you know what incidents and damages are covered (such as fire, vandalism, or theft) and the exclusions (such as driving under the influence of alcohol).

- Your Deductible: Understand the amount you’ll need to pay out of pocket in the event of a claim and how it affects your premiums.

- Limits on Coverage: Know the maximum amount your insurer will pay for specific types of claims, such as medical expenses or car repairs.

Additional Tips for Choosing the Best Car Insurance:

- Take Advantage of Free Reviews and Quotes: Many insurers offer free online tools that allow you to review your current policy, get quotes, and evaluate coverage options without any obligation. Use this to compare various providers and find the best deal.

- Reevaluate Your Insurance Periodically: Life changes, so your insurance needs may change as well. Whether you’ve paid off your car loan, upgraded your vehicle, or moved to a new state, it’s a good idea to review your policy annually to ensure it still meets your needs.

- Read the Fine Print: Always read the policy carefully before signing up, even if the agent provides you with a verbal explanation. This ensures you won’t miss any important details or exclusions.

How to Choose the Best Car Insurance Policy for You

Assessing Your Needs

Before buying a car insurance policy, assess your needs based on your vehicle type, location, and driving habits. For example, if you live in an area with high crime rates, comprehensive coverage may be essential. If you drive frequently, consider higher liability limits to protect against accidents.

Comparing Different Providers

Take the time to compare multiple insurance providers. Check the range of coverage options, premiums, customer reviews, and any additional services or discounts they offer. Many online comparison tools can simplify this process.

Understanding Your Deductibles

The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. A lower deductible means higher premiums but less out-of-pocket cost in case of a claim. A higher deductible means lower premiums but more financial responsibility if you need to file a claim.

Knowing the Legal Requirements in Your Area

Car insurance requirements vary from state to state. Make sure you know the minimum requirements in your area and build a policy that meets or exceeds those standards. Some states require no-fault insurance, while others mandate liability coverage.

Considering Customer Reviews and Ratings

Customer feedback is valuable when assessing an insurance provider. Look at online reviews and ratings to get a sense of a company’s reputation for handling claims, customer service, and overall satisfaction.

Also Read:-What Does Travel Insurance Typically Cover?

Conclusion

Choosing the best car insurance policy is a critical decision that ensures financial security in case of accidents, theft, or other incidents. A well-rounded policy offers a balance of comprehensive coverage, affordability, excellent customer service, and flexibility. When looking for the best policy, consider your needs, compare providers, and look for discounts and additional coverage options that suit your lifestyle.

FAQs

1. What is the difference between comprehensive and collision car insurance?

Comprehensive insurance covers non-collision-related damages, such as theft, vandalism, and natural disasters. Collision insurance covers damage to your vehicle after a collision, regardless of fault.

2. How can I lower my car insurance premium?

You can lower your premium by maintaining a clean driving record, increasing your deductible, taking advantage of discounts, bundling policies, and driving a safer car with anti-theft features.

3. Is full coverage car insurance necessary?

Full coverage, which includes both comprehensive and collision insurance, may be necessary if you own a new or high-value car. It provides more protection than basic liability coverage, but for older cars, it might not be cost-effective.

4. What factors affect my car insurance rate?

Several factors affect your rate, including your age, driving history, vehicle type, location, and the amount of coverage you select. Younger drivers and those with traffic violations typically pay higher premiums.

5. Can I switch my car insurance provider anytime?

Yes, you can switch your provider at any time, but it’s important to consider the timing of your switch to avoid lapses in coverage.

6. How does my driving record impact my insurance premium?

A clean driving record with no accidents or violations typically results in lower premiums, while a history of accidents or traffic tickets can raise your rates.

7. What is the best car insurance company for young drivers?

The best insurer for young drivers depends on various factors like discounts, policy options, and customer service. Companies like Geico, State Farm, and Progressive offer competitive rates for young drivers.