Which Investment Strategies Work Best in a Recession?

Recessions are a natural part of the economic cycle, but they can be unsettling, especially for investors. The uncertainty, market volatility, and declining consumer confidence can wreak havoc on portfolios. However, with the right investment strategies, investors can weather the storm and even find opportunities to grow their wealth.

In this article, we’ll explore:

- What happens during a recession,

- Which investment strategies perform best during downturns,

- How to protect your portfolio, and

- How to make smart, risk-adjusted decisions.

Key Takeaways

✅ Defensive and dividend stocks provide stability and income during downturns

✅ Dollar-cost averaging minimizes the impact of volatility

✅ Bonds and precious metals act as safe havens in recessions

✅ Holding cash and cash equivalents gives you flexibility

✅ Avoid panic selling; recessions often precede market recoveries

✅ Use downturns to re-evaluate financial goals and investment strategy

✅ Consider investing in your own skills and development

Understanding a Recession

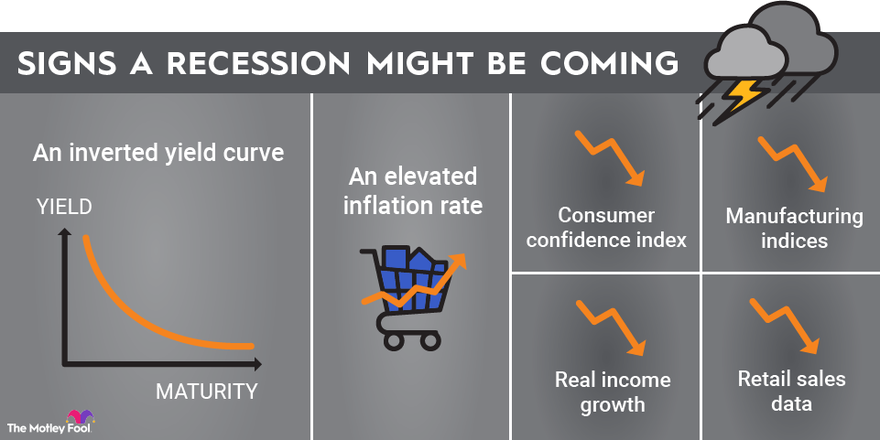

A recession is typically defined as a significant decline in economic activity across the economy, lasting more than a few months. It is visible in GDP, real income, employment, industrial production, and wholesale-retail sales.

Common Causes of a Recession:

- High inflation or deflation

- Interest rate hikes

- Financial crises

- Global economic shocks

- Geopolitical tensions

While the word “recession” often triggers fear, it’s worth noting that recessions can create buying opportunities and act as a test of financial discipline and strategic investing.

Core Principles of Investing During a Recession

1. Preserve Capital Before Seeking Growth

During a recession, focus shifts from aggressive growth to capital preservation. It’s essential to protect what you already have.

- Avoid high-risk speculative assets.

- Prioritize low-volatility, stable investments.

2. Diversify Your Portfolio

Diversification reduces your exposure to any single asset or market.

- Invest across different asset classes: stocks, bonds, real estate, commodities, and cash.

- Diversify within sectors—tech, healthcare, utilities, etc.

“Don’t put all your eggs in one basket” is never more true than in a recession.

3. Prioritize Quality Investments

Look for companies or assets with:

- Strong balance sheets

- Consistent cash flow

- Low debt levels

- History of weathering past downturns

These are more likely to survive—and thrive—after a recession.

4. Think Long-Term

Short-term volatility is inevitable. Successful investors see beyond the current turmoil.

- Stick to your long-term goals and investment plan.

- Remember: historically, markets recover and grow after recessions.

5. Use Dollar-Cost Averaging (DCA

DCA is a powerful strategy during volatile times.

- Invest a fixed amount regularly, regardless of market conditions.

- It reduces emotional decision-making and avoids trying to time the market.

6. Maintain Liquidity

Keep a portion of your portfolio in cash or cash equivalents.

- Emergency funds should cover 3–6 months of expenses.

- Liquidity allows you to buy discounted assets or cover expenses without selling at a loss.

7. Avoid Emotional Decisions

Panic selling and fear-based decisions can destroy long-term wealth.

- Stay informed, not influenced by headlines.

- Make investment choices based on data, not emotion.

8. Rebalance When Necessary

Markets shift quickly during recessions.

- Review and adjust your portfolio to maintain your desired risk profile.

- Rebalancing can lock in gains and capitalize on undervalued assets.

9. Continue Investing in Yourself

In times of economic uncertainty, the best investment might be you.

- Learn new skills.

- Improve financial literacy.

- Explore new income streams or side businesses.

Top Investment Strategies That Work Best in a Recession

1. Defensive Stocks Investing

Defensive stocks belong to industries that provide essential services—think healthcare, utilities, and consumer staples. These companies typically remain stable even during downturns.

Examples:

- Procter & Gamble (Consumer Staples)

- Johnson & Johnson (Healthcare)

- Duke Energy (Utilities)

Why it works: These businesses continue generating revenue because people still need their products, even during hard times.

2. Dividend-Paying Stocks

Dividend stocks provide a regular income stream and often come from financially sound companies. Reinvesting dividends can also help compound returns over time.

Key Benefits:

- Passive income during downturns

- Sign of corporate financial health

- Helps offset market losses

Look for: Companies with a long dividend-paying history, even during past recessions (Dividend Aristocrats).

3. Dollar-Cost Averaging (DCA)

Instead of trying to time the market, DCA involves investing a fixed amount of money at regular intervals, regardless of the market conditions.

Why it works in a recession:

- Reduces emotional investing

- Buys more shares when prices are low

- Smooths out volatility over time

Example: Investing $500/month into an index fund like the S&P 500 ETF (e.g., SPY or VOO).

4. Investing in Bonds and Bond Funds

Bonds—especially U.S. Treasury bonds—are considered safer investments. They offer more stability and can even outperform equities during recessions.

Best types during recessions:

- U.S. Treasury Bonds

- Investment-grade corporate bonds

- Municipal bonds

Pro tip: Avoid junk bonds, as they carry higher default risk during downturns.

5. Investing in Precious Metals (Gold, Silver)

Precious metals often act as a hedge against market downturns, currency devaluation, and inflation.

Why gold works:

- Seen as a safe-haven asset

- Tends to rise when markets fall

- Globally valued and liquid

You can invest via ETFs like GLD (SPDR Gold Trust) or buy physical metals.

6. Real Estate Investment Trusts (REITs)

REITs can be recession-resistant, especially those in sectors like healthcare, residential, and data centers.

Example REITs:

- Realty Income Corp (O)

- Public Storage (PSA)

- Digital Realty (DLR)

Watch out for: Retail and office REITs, which may underperform due to reduced consumer spending and remote work trends.

7. Cash and Cash Equivalents

Holding some cash isn’t a waste—it provides liquidity, flexibility, and buying power when assets are discounted.

Cash equivalents:

- Money market funds

- High-yield savings accounts

- Treasury bills (T-Bills)

Important: Don’t go overboard—cash loses value over time due to inflation.

8. Invest in Yourself

A recession is also a good time to invest in education, skills, or even start a side business.

Examples:

- Enroll in online courses (finance, tech, marketing)

- Start freelance or consulting work

- Build an emergency fund or budget plan

The return on personal development can outperform traditional investments.

Risk Management During Recessions

Regardless of strategy, risk management is critical:

- Diversify across asset classes

- Rebalance your portfolio regularly

- Cut losses quickly when necessary

- Avoid margin trading and high-leverage positions

- Have an emergency fund (3–6 months of expenses)

Historical Insights: What Worked in Past Recessions

Understanding past recessions offers valuable lessons for current and future investing. While no two downturns are exactly alike, certain strategies and asset classes have consistently helped investors preserve and grow wealth during economic contractions.

📉 1. The Great Depression (1929–1939)

- Economic Context: Massive stock market crash, widespread unemployment, deflation.

- What Worked:

- Gold: Maintained purchasing power as currencies devalued.

- Cash & Cash Equivalents: Liquidity was king during a time of deep uncertainty.

- Lesson: In extreme downturns, safety and liquidity matter more than returns.

💥 2. 1973–1975 Oil Crisis Recession

- Economic Context: Oil embargo, inflation spike, stock market down nearly 50%.

- What Worked:

- Energy stocks (e.g., Exxon): Profited from high oil prices.

- Commodities: Benefited from inflation hedging.

- Lesson: Sector-specific investing (energy, commodities) can outperform during inflationary recessions.

🖥️ 3. Dot-Com Bust (2000–2002)

- Economic Context: Internet bubble burst, massive tech stock losses.

- What Worked:

- Dividend-paying value stocks: Outperformed high-growth, non-profitable tech.

- Bonds: Offered stability and income.

- Lesson: Profitability and fundamentals matter when speculative bubbles burst.

🏦 4. Global Financial Crisis (2007–2009)

- Economic Context: Housing bubble collapse, bank failures, global credit freeze.

- What Worked:

- U.S. Treasury Bonds: Considered ultra-safe, yielded consistent returns.

- Gold: Surged amid fear and currency debasement concerns.

- Dollar-Cost Averaging (DCA): Helped investors buy equities at bargain prices during recovery.

- Lesson: Safe-haven assets and disciplined investing (DCA) help weather severe downturns.

🦠 5. COVID-19 Crash (Feb–Mar 2020)

- Economic Context: Global pandemic, lockdowns, massive GDP contraction.

- What Worked:

- Tech and healthcare stocks: Remote work and health sector demand surged.

- Gold and cryptocurrencies: Attracted risk-off investors.

- DCA into index funds: Those who continued investing during the crash saw strong gains post-recovery.

- Lesson: Stay invested and adapt—crises can accelerate innovation and new sector leadership.

📊 Comparative Table: Past Recessions vs. Winning Strategies

| Recession Period | Winning Assets/Strategies | Key Takeaway |

|---|---|---|

| Great Depression | Gold, Cash | Prioritize safety and liquidity |

| 1973–75 Oil Crisis | Energy stocks, Commodities | Inflation hedges matter |

| 2000–2002 Dot-Com Bust | Dividend stocks, Bonds | Focus on value and profitability |

| 2008 Financial Crisis | Treasuries, Gold, Dollar-Cost Averaging | Seek safety and buy quality on dips |

| 2020 COVID-19 Crash | Tech, Healthcare, Index Funds (DCA), Gold | Innovation sectors and disciplined investing |

Also Read :-What Are Alternative Investments And How Can They Diversify Your Portfolio?

Conclusion

Recessions test more than just the economy—they test investor psychology, patience, and preparation. The good news? With sound strategy, diversified assets, and a long-term view, recessions can become opportunities rather than obstacles.

Whether it’s leaning into defensive stocks, accumulating dividend income, or simply staying invested through dollar-cost averaging, the key is to stay calm, stay informed, and stay invested.

7 Frequently Asked Questions (FAQs)

1. Should I stop investing during a recession?

No. In fact, recessions can be the best time to invest—assets are often undervalued. Consistent investing via DCA is often the best approach.

2. What’s the safest investment during a recession?

U.S. Treasury Bonds and high-quality dividend stocks are considered among the safest options. Precious metals like gold are also stable.

3. Are index funds safe during a recession?

While index funds can drop in value short-term, they are a low-cost and diversified way to invest for the long term—even through recessions.

4. Should I hold cash in a recession?

Yes, but in moderation. Holding 10–20% of your portfolio in cash or equivalents gives you flexibility to take advantage of buying opportunities.

5. Is real estate a good investment during a recession

It depends. REITs or rental properties in strong markets can perform well, but speculative real estate can be risky due to lower demand.

6. How do I rebalance my portfolio in a recession?

Rebalance by trimming winners and adding to underperformers to maintain your desired allocation (e.g., 60% stocks / 40% bonds).

7. What mistakes should I avoid during a recession?

- Panic selling

- Chasing hot stocks or trends

- Timing the bottom of the market

- Taking on high-interest debt

- Ignoring your investment goals